Market Overview:

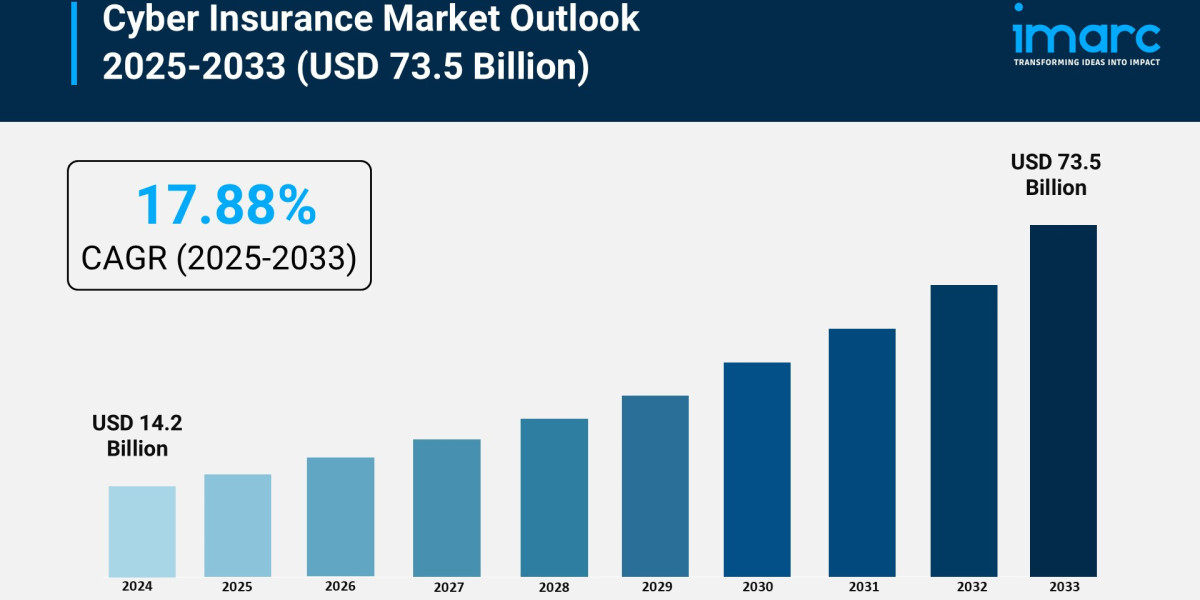

According to IMARC Group's latest research publication, "Cyber Insurance Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", offers a comprehensive analysis of the industry, which comprises insights on the global cyber insurance market share. the global market size reached USD 14.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 73.5 Billion by 2033, exhibiting a growth rate (CAGR) of 17.88% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

How AI and Advanced Technologies are Reshaping the Future of Cyber Insurance Market

- AI and advanced analytics enable insurers to assess cyber risks more accurately, with 63% of insurance companies either implementing or planning to implement AI in their operations soon.

- AI-powered risk assessment tools provide personalized and targeted insurance policies, making cyber coverage more accessible and affordable for small and medium-sized enterprises.

- Integration of cyber insurance with existing cybersecurity tools creates comprehensive protection ecosystems, attracting businesses to invest more heavily in cyber risk management.

- Machine learning algorithms help detect emerging threat patterns in real-time, enabling insurers to develop innovative products that adapt to evolving cyber threats and vulnerabilities.

- AI-driven automation improves policy claims processing and distribution management, reducing administrative costs by 15-20% while enhancing customer experience and operational efficiency.

Download a sample PDF of this report: https://www.imarcgroup.com/cyber-insurance-market/requestsample

Key Trends in the Cyber Insurance Market

- Escalating Cyber Threat Landscape: Global cybercrime damages reach $8 trillion annually, with ransomware incidents accounting for 59% of all attacks globally. Phishing and social engineering constituted 438 out of 2,365 documented cyberattacks in 2023, driving organizations to seek comprehensive insurance protection.

- Stringent Regulatory Mandates: Governments worldwide are enforcing strict data protection regulations including GDPR, California Consumer Privacy Act (CCPA), and China's Cybersecurity Law. These regulatory pressures are compelling businesses to adopt cyber insurance as a critical compliance and risk management tool.

- Rapid Digital Transformation and IoT Proliferation: The widespread adoption of cloud computing, IoT devices, and Industry 4.0 technologies has expanded the cyber threat surface. Australia leads in IoT adoption with 96% of companies utilizing IoT in their operations, amplifying the need for comprehensive cyber insurance coverage.

- Remote Work and E-Commerce Growth: The shift to remote work arrangements and accelerated e-commerce expansion have created new vulnerabilities and security gaps. Businesses now require cyber insurance to protect against data breaches involving sensitive customer information and operational disruptions.

- Stand-Alone Cyber Insurance Dominance: Stand-alone cyber insurance policies account for 68.3% of the market share in 2024, driven by the need for specialized, comprehensive coverage designed specifically for cyber risks. These policies provide immediate access to cybersecurity experts and legal assistance following breaches.

Growth Factors in the Cyber Insurance Market

- Rising Incidence of Data Breaches and Cyberattacks: The increasing complexity and frequency of cyberattacks, including ransomware and data breaches, compel organizations to prioritize financial protection. In 2023, 32% of UK companies experienced cyber incidents, jumping to 59% for medium enterprises and 69% for large enterprises.

- Heightened Regulatory Compliance Requirements: Stricter data protection regulations and heavier fines for breaches make cyber insurance essential for legal protection and risk mitigation. The regulatory landscape encourages organizations to allocate greater resources toward comprehensive cyber coverage.

- Growing Awareness of Financial and Reputational Risks: Organizations increasingly recognize the significant financial and reputational damage resulting from cyber incidents. This heightened awareness drives demand for cyber insurance policies that provide comprehensive protection and expert support.

- Technological Innovation and Affordable Solutions: Advanced technologies including AI, analytics, and automation are making cyber insurance more affordable and accessible to small and medium-sized enterprises. Insurers are providing educational resources and preventive tools alongside policies, creating attractive value propositions.

- Expanding Digital Infrastructure Dependency: The increasing reliance on digital platforms for business operations, coupled with the proliferation of connected devices and cloud services, has elevated cyber risk exposure. Organizations now view cyber insurance as a critical component of their enterprise risk management strategy.

- Large Enterprise Leadership: Large enterprises account for 73.8% of market share, driven by their international operations across multiple regulatory environments, prime status as cyberattack targets, and extensive reliance on advanced technologies requiring specialized cyber insurance coverage.

Leading Companies Operating in the Global Cyber Insurance Industry:

- Allianz Group

- American International Group Inc.

- AON Plc

- AXA XL

- Berkshire Hathaway Inc.

- Chubb Limited (ACE Limited)

- Lockton Companies Inc.

- Munich ReGroup (Munich Reinsurance Company)

- Lloyd's of London

- Zurich Insurance Company Limited

Cyber Insurance Market Report Segmentation:

Breakup By Component:

- Solution - Leads the market with comprehensive strategies including prevention, risk management, response planning, and recovery services.

- Services - Provides expert collaboration, technical assessments, monitoring, and ongoing support to organizations.

Solution represents the leading component segment, driven by the need for comprehensive, customized coverage aligned with organizational risks and compliance requirements.

Breakup By Insurance Type:

- Stand-alone - Accounts for 68.3% of market share; policies specifically designed to cover cyber risks with specialized industry coverage.

- Packaged - Combined with other insurance products; offers broader coverage alongside traditional business insurance.

Stand-alone dominates the market due to its specialized approach and comprehensive protection against diverse cyber threats.

Breakup By Organization Size:

- Large Enterprises - Account for 73.8% of market share; face greater regulatory requirements and sophisticated cyberattack risks.

- Small and Medium Enterprises (SMEs) - Growing segment; increasingly adopting affordable cyber insurance solutions for financial protection.

Large enterprises lead the market due to their complex regulatory environments, larger attack surface, and extensive operational dependence on digital infrastructure.

Breakup By End Use Industry:

- BFSI (Banking, Financial Services, Insurance) - Leads with 28.2% market share; handles vast sensitive customer data and faces sophisticated threats.

- Healthcare - Growing at 25% CAGR; expanding medical device vulnerabilities and digitization requirements drive vertical-specific coverage.

- IT and Telecom - Critical infrastructure sector with complex network vulnerabilities and regulatory compliance needs.

- Retail - Faces significant e-commerce-related cyber threats and customer data protection requirements.

- Others - Manufacturing, energy, and government sectors increasingly adopting cyber insurance.

BFSI dominates with 28.2% market share due to its role as a prime cyberattack target and the critical need to protect sensitive financial data and comply with stringent regulations.

Breakup By Region:

- North America - Accounts for 36.9% market share; leads globally with highest cyber insurance adoption and regulatory mandates.

- Europe - Growing market driven by GDPR compliance and increasing cyber incidents; 32-69% of UK companies experience cyber events.

- Asia Pacific - Fast-growing region with rapid digitization, high IoT adoption (96% in Australia), and emerging cyber threats.

- Latin America - Gaining momentum; increasing cybercrime and digital transformation driving adoption in Brazil and other major economies.

- Middle East and Africa - Rapidly growing; 82% of organizations in the Middle East and Turkey experienced at least one cybersecurity incident between 2022-2024.

Geographic Breakdown:

- United States - Accounts for 87.60% of North America market share; prime cyberattack target with ransomware accounting for 59% of global attacks in Q2 2024.

North America enjoys the leading position owing to its status as a major cyberattack target, strict regulatory compliance requirements, and the presence of large technology corporations and financial institutions requiring comprehensive cyber protection.

Recent News and Developments in Cyber Insurance Market

- December 2024: CyberCube announced a strategic partnership with St. Andrews Insurance Brokers to deploy its platform for Broking Manager, improving cyber insurance portfolio assessment and cyber loss evaluation for customers.

- February 2022: StrikeForce Technologies partnered with Zentek Corporation to integrate GuardedID and MobileTrust personal cyber insurance policies, targeting Brazil's banking and financial sectors with enhanced security solutions.

- Industry Growth: Vertical-specific products address unique risks such as medical device vulnerabilities, with healthcare cyber insurance growing at 25% CAGR due to accelerated digitization and increasing healthcare sector cybersecurity incidents.

Market Drivers Summary

The cyber insurance market is experiencing robust growth driven by:

- Rising Cyber Threats: Increasing complexity and frequency of cyberattacks globally

- Regulatory Requirements: Stringent data protection laws and compliance mandates

- Digital Infrastructure Growth: Expanding reliance on cloud computing, IoT, and digital systems

- Awareness Building: Growing recognition of financial and reputational risks from cyber incidents

- Technological Innovation: AI-powered solutions enabling better risk assessment and affordable coverage

- Organizational Vulnerability: Large enterprises facing sophisticated threats across multiple jurisdictions

Note:

If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About IMARC Group:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact IMARC Group:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302