The global EV powertrain market is on the cusp of a transformative decade. Valued at USD 20 billion in 2025, the market is projected to soar to USD 159.8 billion by 2035, growing at an impressive CAGR of 23.1%. As the automotive industry pivots toward electrification, powertrain technologies—comprising motors, inverters, transmissions, and battery packs—are set to define the efficiency, performance, and sustainability of the vehicles of tomorrow.

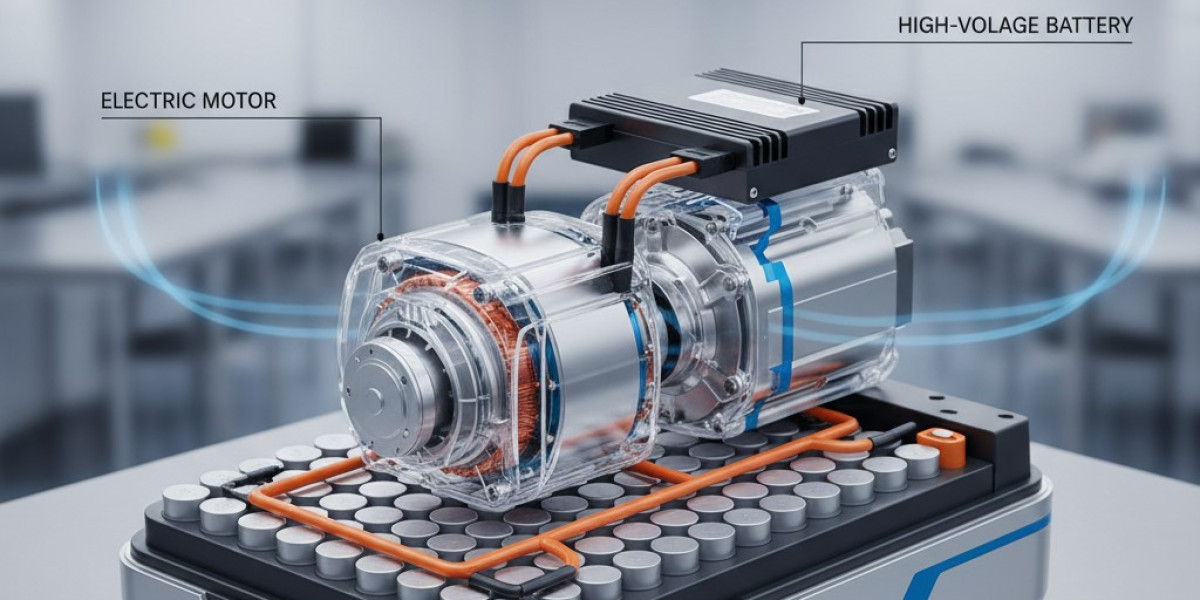

Electric vehicle (EV) powertrains are the backbone of modern mobility. Driven by rising consumer expectations for longer range, quicker charging, and enhanced driving dynamics, automakers and technology providers are racing to innovate. The period through 2035 will mark the shift from costly, complex systems toward more affordable, modular, and scalable solutions.

Full Market Report available for delivery. For purchase or customization, please request here – https://www.futuremarketinsights.com/reports/sample/rep-gb-16607

Yet, challenges remain. The high cost of advanced motors and battery technologies continues to weigh on manufacturers, especially in emerging markets. Supply chain volatility surrounding lithium, cobalt, and rare earths adds further complexity. These pressures are pushing both established giants and new entrants to rethink strategies, diversify material sourcing, and accelerate R&D in alternative chemistries and rare-earth-free motors.

Innovation Driving New Opportunities

Advancements in electric motor design, high-efficiency inverters, and solid-state battery technology are ushering in new growth opportunities. Commercial applications, from electric buses to delivery fleets, are emerging as particularly strong growth segments, with cities worldwide investing heavily in green public transport systems. Manufacturers who deliver lightweight, integrated, and high-durability powertrains stand to capture significant market share.

The period 2025–2035 will also see the introduction of AI-based energy management, modular battery packs, hydrogen fuel cells for heavy-duty trucks, and wireless charging infrastructure. These innovations will redefine how EVs are powered and maintained, setting the stage for global adoption.

Regional Outlook: Powertrain Growth Across the Globe

- North America: The U.S. leads regional adoption, backed by federal incentives, investments in charging infrastructure, and strong domestic manufacturing. Companies like Tesla, GM, and Ford are at the forefront, developing high-efficiency motors, silicon carbide inverters, and next-gen battery management systems.

- Europe: Aggressive EU emission reduction targets, combined with investments in charging networks and gigafactories, are pushing automakers like Volkswagen, BMW, and Renault toward AI-optimized powertrains and vehicle-to-grid (V2G) technologies.

- Asia-Pacific: China dominates the EV ecosystem, supported by massive production incentives, while Japan and South Korea are innovating in solid-state batteries, modular e-drives, and wireless charging. This region remains the largest and fastest-growing hub for EV powertrains.

- Rest of the World: Emerging opportunities in Latin America, the Middle East, and Africa are being shaped by urban pollution concerns and government-led green initiatives. Nations such as Brazil, South Africa, and the UAE are gradually expanding EV fleets and supporting charging infrastructure.

Market Evolution: 2020–2024 vs. 2025–2035

From 2020 to 2024, the EV powertrain sector matured with lithium-ion battery enhancements, 800V fast charging systems, and regenerative braking adoption. Moving forward, 2025 to 2035 will introduce transformative changes:

- Solid-state batteries delivering 600+ miles of range.

- Wireless dynamic charging to combat range anxiety.

- AI-driven powertrain optimization and predictive maintenance.

- Rare-earth-free motors and recyclable battery materials to lower environmental impact.

This shift reflects not just an industry evolution, but a systemic transformation in global mobility.

Supply Chain Developments: From Constraints to Solutions

Supply chain pressures remain a key challenge. With China controlling over 90% of rare earth refining, automakers are diversifying into ferrite magnet motors and lithium iron phosphate (LFP) batteries. Western nations are ramping up mining in Australia, Canada, and Vietnam, while recycling initiatives and low-rare-earth technologies are gaining traction.

ASEAN nations are also making strategic plays:

- Thailand is mandating localized powertrain component production.

- Indonesia is leveraging its nickel reserves to build battery plants.

- Vietnam is pushing vertical integration via VinFast.

- Malaysia is strengthening its role in semiconductors and EV electronics.

Segment Insights: Passenger & Commercial Vehicles

Passenger EVs remain the largest market, with Tesla, BYD, Volkswagen, BMW, and Mercedes-Benz setting benchmarks in performance and efficiency. Dual-motor architectures and AI-driven torque management are redefining driving dynamics.

Meanwhile, electric buses and coaches are seeing rapid adoption, especially in Asia-Pacific and Europe. Industry leaders such as BYD, Proterra, and Volvo are building long-range, fast-charging fleets to electrify public transport.

Component Innovation: Motors, Electronics & Batteries

- Electric Motors: Advancements in axial flux and induction motors, paired with lightweight materials, are reducing reliance on rare earths.

- Power Electronics: Silicon carbide (SiC) and gallium nitride (GaN) inverters are enabling faster charging and longer ranges. Leaders like Infineon and STMicroelectronics are spearheading these innovations.

- Battery Systems: Solid-state, lithium iron phosphate, and modular battery technologies are set to dominate the next decade.

Competitive Landscape: Established Leaders & Emerging Innovators

The EV powertrain market is highly competitive, with both established leaders and emerging players contributing to growth:

- Tesla Inc. (20–25%): Pioneer in integrated motor and battery systems, setting performance standards.

- BYD Co. Ltd. (15–20%): Leading in vertically integrated solutions, combining battery and motor expertise.

- Bosch (12–16%): Innovator in e-axle systems and silicon carbide inverter technologies.

- Magna International (10–14%): Known for modular e-powertrain solutions integrating motors, inverters, and gearboxes.

- Nidec Corporation (6–10%): Specialist in lightweight, high-efficiency e-motors for improved driving performance.

- Other Stakeholders (30–40%): Firms like Continental, Mitsubishi Electric, ZF Friedrichshafen, BorgWarner, Valeo, and Dana are intensifying competition with new propulsion and energy management solutions.

Stay Ahead – Grab the Report: https://www.futuremarketinsights.com/reports/brochure/rep-gb-16607

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware – 19713, USA

T: +1-347-918-3531

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

LinkedIn| Twitter| Blogs | YouTube