The Micro, Small, and Medium Enterprises (MSME) sector forms the backbone of India’s economy. To empower these businesses, the government introduced udyam registration, a simplified online process for MSME recognition. By registering, businesses not only gain formal status but also become eligible for a range of benefits including loans, subsidies, tax exemptions, and protection under law.

If you’re a small business owner aiming for sustainable growth, having a valid Udyam registration is no longer optional—it’s a strategic must.

What Role Does Udyam Aadhar Play in the Registration Process?

Udyam aadhar is the Aadhaar number used to verify the identity of the business owner or authorized representative during the Udyam registration process. It ensures legitimacy and helps link the business to an individual, thus preventing duplication or fraudulent entries.

Without a valid Aadhaar number, the registration cannot proceed. This linkage not only improves transparency but also allows easy access to a range of government schemes once registration is complete. It’s a vital requirement that ties your identity directly to your enterprise.

How to Complete Udyam Registration Online

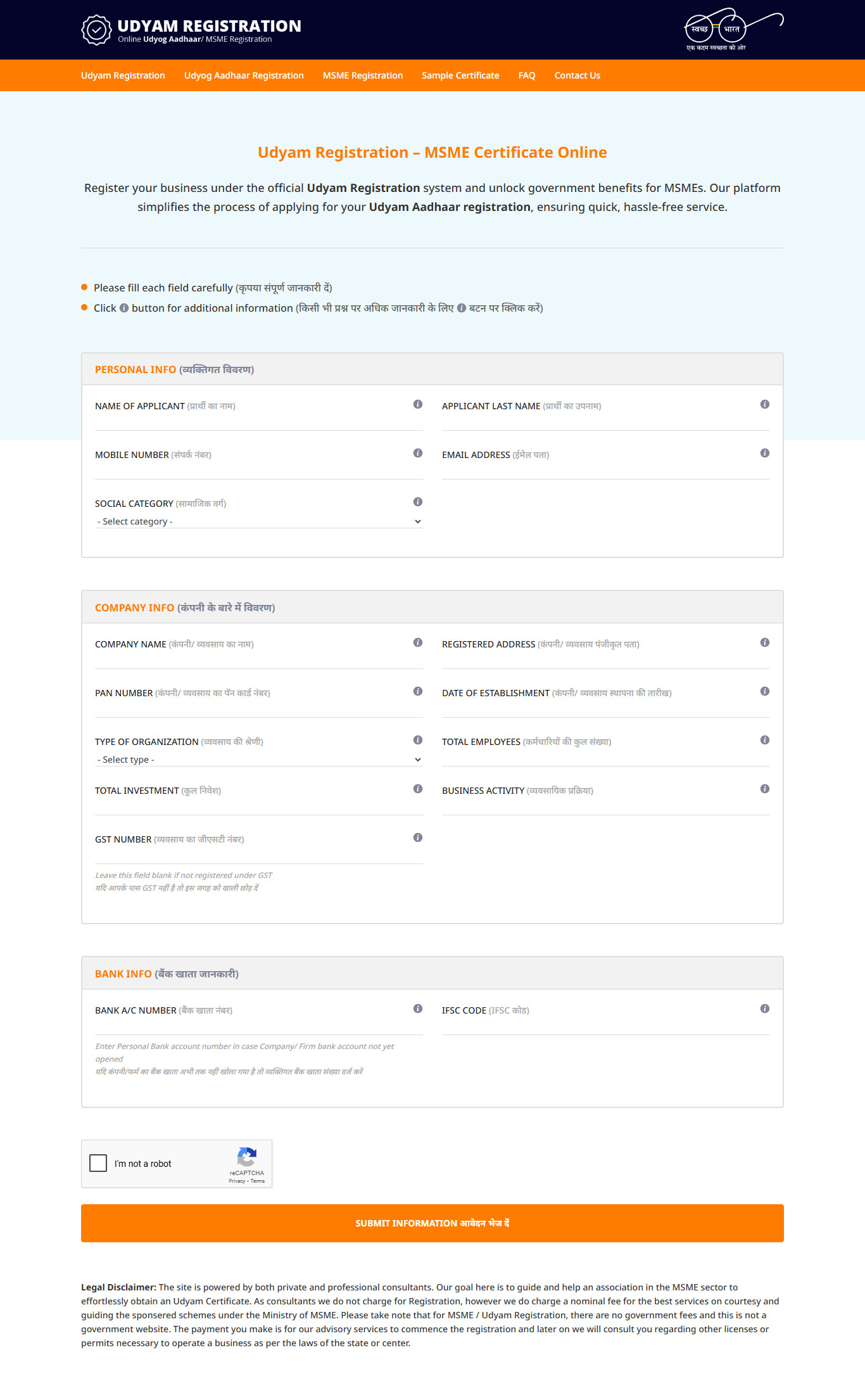

The most efficient way to register your MSME is through the udyam registration online process. The government’s Udyam portal is user-friendly, fully digital, and requires minimal documentation. You don’t need to upload lengthy forms or visit physical offices.

Here’s what you’ll need:

Aadhaar number of the business owner

PAN number linked to the enterprise

Basic business details (activity, turnover, investment)

Steps:

Visit the Udyam registration portal

Enter Aadhaar and validate with OTP

Fill in business details and submit PAN

Receive your Udyam Registration Number (URN)

Once approved, your MSME will be officially recognized by the government.

Udyam Aadhar Registration for Existing Businesses

For businesses that previously registered under the Udyog Aadhaar system, udyam aadhar registration offers a way to transition to the new platform. This ensures that legacy businesses are not left out of current benefits and schemes.

Why re-register?

Udyog Aadhaar is no longer valid post-2021

Migrating to Udyam updates your classification

Ensures you’re eligible for new incentives and protections

Keeps your MSME profile accurate and compliant

Simply use your Aadhaar and PAN to update your records and secure your place in the new MSME database.

Why the Spelling Error 'Udhyam Registration' Could Be Costly

A small typo like udhyam registration instead of “udyam registration” might seem trivial but can lead to major confusion. Many fake websites use this common misspelling to lure unsuspecting users into providing sensitive information or charging hidden fees.

Avoid this mistake by:

Always double-checking the spelling

Using only government-authorized sites or verified sources

Being wary of sites that ask for payment upfront for registration

A simple spelling error can expose your business to fraud. Stay vigilant and use the correct term every time.

Understanding the Udyam Registration Certificate

Once your application is approved, you’ll receive an official udyam registration certificate via email. This digital document serves as proof that your business is legally recognized as an MSME in India.

The certificate includes:

Your Udyam Registration Number (URN)

Name and type of your enterprise

Classification (Micro, Small, or Medium)

QR code for instant verification

This certificate is essential when applying for tenders, loans, government incentives, and when seeking business partnerships. It acts as your enterprise’s official identity.

Advantages of Having Udyam Registration

Being a registered MSME under the Udyam system brings a host of advantages that can significantly boost your growth and reduce operational stress.

Top benefits include:

Access to low-interest collateral-free loans

Priority allocation in government procurement tenders

Protection against delayed payments from buyers

Exemption from certain taxes and statutory audits

Eligibility for subsidies on patent and trademark registration

These benefits not only improve your business finances but also give you a competitive edge in the market.

Who Can Apply for Udyam Registration?

The following types of business entities are eligible for Udyam registration:

Proprietorships

Partnership firms

Limited Liability Partnerships (LLPs)

Private Limited Companies

Co-operative societies

Trusts and others engaged in manufacturing or services

Classification depends on two key factors:

Investment in plant and machinery or equipment

Annual turnover of the business

Enterprise Categories:

Micro Enterprise: Investment ≤ ₹1 crore and Turnover ≤ ₹5 crore

Small Enterprise: Investment ≤ ₹10 crore and Turnover ≤ ₹50 crore

Medium Enterprise: Investment ≤ ₹50 crore and Turnover ≤ ₹250 crore

Make sure your business fits within these limits to qualify as an MSME.

Keep Your Udyam Details Up-To-Date

After registration, it's crucial to keep your information updated on the portal. Any changes in turnover, address, or business activity must be reflected in your profile to maintain compliance.

Why updates matter:

Maintains eligibility for government schemes

Prevents penalties or suspension of benefits

Ensures your MSME classification is accurate

Helps you access loans and tenders smoothly

A proactive approach to maintaining your MSME profile can help you stay competitive and compliant.

Conclusion

Whether you're starting fresh or updating an old Udyog Aadhaar, completing your udyam aadhar registration gives your business a formal identity and access to powerful government support. With a valid udyam registration certificate, you unlock financial tools, legal protections, and growth opportunities that only registered MSMEs can enjoy. In today’s evolving economy, this is one decision every entrepreneur should make with confidence.