Europe Jewelry Market Overview

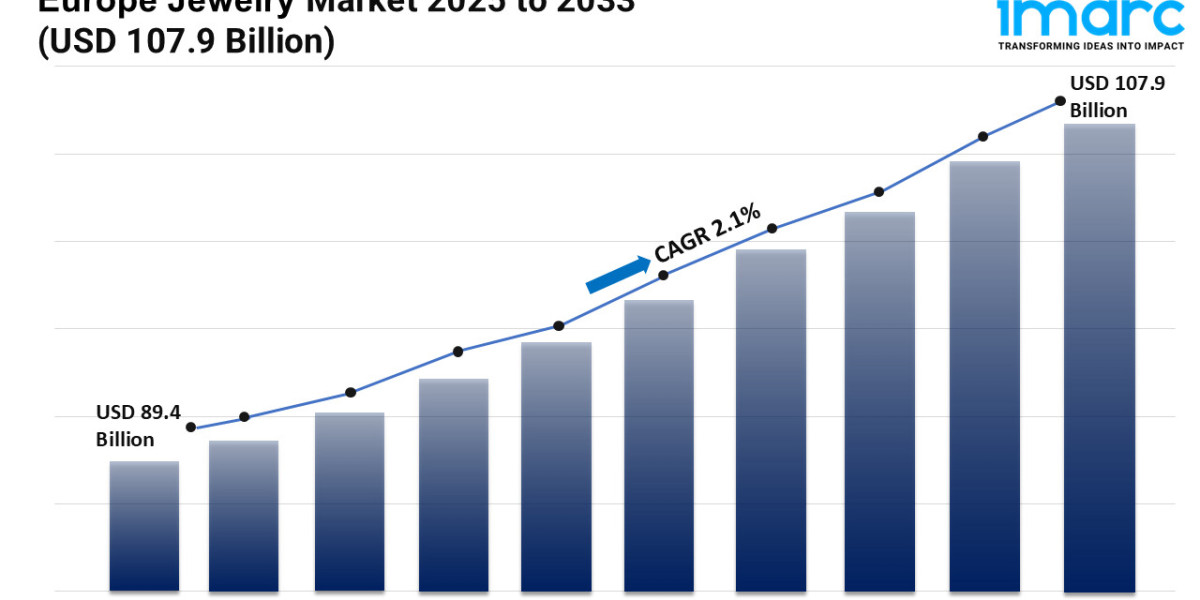

Market Size in 2024: USD 89.4 Billion

Market Forecast in 2033: USD 107.9 Billion

Market Growth Rate: 2.1% (2025-2033)

According to the latest report by IMARC Group, the Europe jewelry market size was valued at USD 89.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 107.9 Billion by 2033, exhibiting a CAGR of 2.1% from 2025-2033.

Europe Jewelry Industry Trends and Drivers:

As changing consumer preferences, material invention, and digital change transform how individuals interact with personal adornment, the Europe jewelry market is seeing a consistent evolution. Particularly among millennials and Gen Z customers who are connecting premium purchases with environmental and social principles, demand for morally sourced materials and lab-grown diamonds is growing. Offering more accessibility in pricing, these solutions are matching the visual and chemical integrity of natural gemstones and therefore increasing market reach across demographic segments. Furthermore supporting companies to provide customizable goods that capture individuality and personal stories, current design trends favor customized and minimalist aesthetics. Rising smart jewelry combines fashion and technology by including health monitoring and connection. Heritage and premium brands, meanwhile, are adding lines to connect traditional elegance with modern appeal, therefore addressing both those seeking daily luxury and those driven by events. These processes are helping the European jewelry industry to stay pertinent while also promoting diversity, creativity, and customer happiness.

Distinct contributions to the general growth of the jewelry business from regional markets throughout Europe reflect cultural influences, lifestyle changes, and the maturity of retail infrastructure. Backed by a deep-seated respect for artisan methods and premium materials, nations in Western Europe such France, Italy, and Germany are consolidating their position as hubs of luxury jewelry and craft. Strong performance in both luxury fashion lines and vintage and heirloom-inspired items is seen in these countries. With Scandinavian countries preferring sleek, functional designs created from recycled metals and conflict-free stones, Northern Europe is pushing for sustainable and simple jewelry choices. Through purchases driven by tourism and local store expansions offering regionally inspired designs, southern European markets including Portugal and Spain are growing. Growing riches and digital penetration in Eastern Europe are propelling social media-led discovery and e-commerce sites, hence creating a lively combination of local and foreign products. Together, these regional trends are bolstering Europe's role as a complex jewelry hub, addressing both tradition and innovation equally.

With omnichannel approaches at the center of consumer access and interaction, the European jewelry market is still expanding its digital presence. With virtual try-ons, AR-enhanced shopping experiences, and customized recommendation engines that reflect browsing behavior and style preferences, brands are improving their online visibility. Direct-to-consumer services provided by e-commerce platforms help smaller designers to reach wider audiences and are bridging geographical gaps. Flagship locations and experimental retail concepts are promoting face-to–face interaction and brand immersion especially in important cities parallel. Ethical certifications and narrative are becoming strong distinguishing elements as customers look for transparency in sourcing. While younger generations are drawn to inclusion, customization, and digital ease, luxury customers are appreciating origin and workmanship. Material trends are changing too; mixed-metal items, modular designs, and vivid jewels are becoming increasingly well-known. Increasingly, jewelry is seen as more than just a style accessory but also as a means of self-expression, investment, and technology integration. These complex consumer habits are keeping market momentum going, setting Europe's jewelry industry for long-term, flexible expansion.

Download sample copy of the Report: https://www.imarcgroup.com/europe-jewelry-market/requestsample

Europe Jewelry Industry Segmentation:

The report has segmented the market into the following categories:

Analysis by Product:

- Necklace

- Ring

- Earrings

- Bracelet

- Others

Analysis by Material:

- Gold

- Platinum

- Diamond

- Others

Analysis by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Latest News and Developments:

- December 2024: The Vicenzaoro Jewelry Show 2025 is set to launch and aims to welcome 1,300 top brands, displaying the newest in luxury jewelry, gemstones, and advanced technology in Italy. It is considered the biggest event in Europe for the gold, jewelry, and watch sectors.

- May 2024: SKYlink, a top travel retail distributor, teamed up with Eurotrade to introduce its new jewelry collection, Marlay, at Munich Airport Terminal 2, Germany. The new Marlay launch represents the brand's largest travel retail debut featuring a selection of 67 stock keeping units (SKUs).

- May 2024: Luxury jeweler Bulgari introduced its latest high-end collection Aeterna in Rome, celebrating its 140th anniversary. The collection features an exquisite selection of more than 500 pieces, including high jewelry, high jewelry watches, premium bags, and ultra-luxurious fragrances.

- September 2023: Cartier, a luxury goods conglomerate based in France, intended to launch its Jewelry Institute and make it accessible to the public during the European Heritage Days. On September 16th and 17th, around 200 attendees were expected to explore the realm of jewelry crafting and Cartier's exclusive skills.

- June 2023: Malabar Gold & Diamonds (MGD), a prominent jewelry brand, opened its new showroom in London, UK. This signified the brand's growth into its 11th operational country and its entry into the European region. The London showroom features an extensive range of gold, diamond, and precious gemstone jewelry, along with exclusive brands and collections thoughtfully selected by the company from more than 15 countries.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=9733&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145