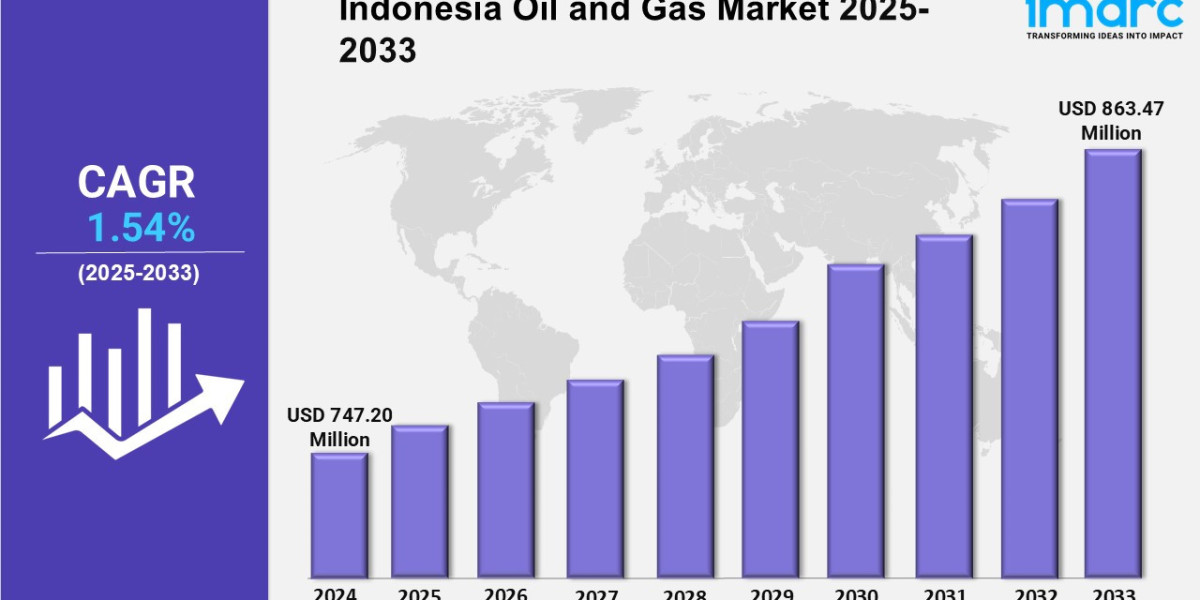

Indonesia Oil and Gas Market 2025-2033

As indicated in the latest market research report published by IMARC Group, titled “Indonesia Oil and Gas Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, and Region, 2025-2033,” this report provides an in-depth analysis of the industry, featuring insights into the market. It encompasses competitor and regional analyses, as well as recent advancements in the market.

How Big is Indonesia Oil and Gas Market ?

The Indonesia meat market size reached USD 18.47 Billion in 2024. The market is projected to reach USD 21.96 Billion by 2033, exhibiting a growth rate (CAGR) of 1.94% during 2025-2033.

Indonesia Oil and Gas Market Trends:

The Indonesian oil and gas markets remain an important engine of the economy, providing energy resources within Indonesia as well as opportunities to trade internationally. A mix of stakeholders operate in this market, predominantly state-owned companies along with international oil companies and local companies, and operate within a regulatory environment supporting both national interests and foreign investments. The Indonesian archipelago has vast hydrocarbon reserves, there has been exploration and production to the north in the Natuna and in the southern basins of Sumatra and from east on Borneo (Kalimantan) to the Papua basin. If we look at a map of oil and gas location on such an archipelago the combination of old infrastructure to compete with established production fields with old equipment continually declining and under perhaps difficulties to access through current ownership and time or even difficulties in attracting the investment needed to improve upon timelines moving into more difficult to access fields.

The government's focus remains encouraging to revisit and refresh the sectors outlook with new exploration blocks to allow for more fiscal adjustments to bring in economic justifications or investment. This will not contradict the growth in importance of the transition into cleaner energy moving forward, and there could be established contemporary discussions about the future potential role of oil and gas in Indonesia's energy supply and boom economy engaging future growth not just taking advantage of the previous growth potential. With the remaining issues - this sector is very important, creating or maintaining jobs, national revenue at the local, provincial, national level and for the whole of Indonesia a significant energy security level.

Download sample copy of the Report: https://www.imarcgroup.com/indonesia-oil-gas-market/requestsample

Indonesia Oil and Gas Market Scope and Growth Analysis:

While the Indonesian Government has focused on building new refineries to alleviate the government's dependence on imported fuels, progress in the downstream hydrocarbons market has come slowly, partly due to limited financing and partly due to sustained opposition by refineries and inconsistencies in fuel distribution logistics. While Natural gas - especially liquefied natural gas (LNG) - is increasingly viewed as a cleaner option to oil, Indonesia is establishing itself as significant player in regional LNG markets, particularly with regards to supply and consumption. The mechanics of determining pricing and subsidy related policies for LNG also remain a source of contention and market distortions.

Environmental and social issues continue to plague the sector as communities and coalitions of activists are demanding more stringent regulations relating to exploration and production. As the downstream and upstream and entire industrial sector in Indonesia continues to evolve, it is uncertain whether the sector can weather the level of substantive complexities implied from these market conditions, including but not limited to the realities of peak oil and global transitioning energy industry significantly present in the realities of domestic policy conditions.

By the IMARC Group, the Top Competitive Landscapes Operating in the Industry:

- BP p.l.c.

- Chevron Corporation

- China National Offshore Oil Corporation

- ExxonMobil Corporation

- Petroliam Nasional Berhad (PETRONAS)

- PT Pertamina (Persero)

- PT. Connusa Energindo

- PT. Perusahaan Gas Negara Tbk

- Shell plc

Indonesia Oil and Gas Market Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the Indonesia oil and gas market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Analysis by Sector:

- Upstream

- Midstream

- Downstream

Regional Analysis:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Key highlights of the Report:

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• COVID-19 Impact on the Market

• Porter's Five Forces Analysis

• Strategic Recommendations

• Historical, Current and Future Market Trends

• Market Drivers and Success Factors

• SWOT Analysis

• Structure of the Market

• Value Chain Analysis

• Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145