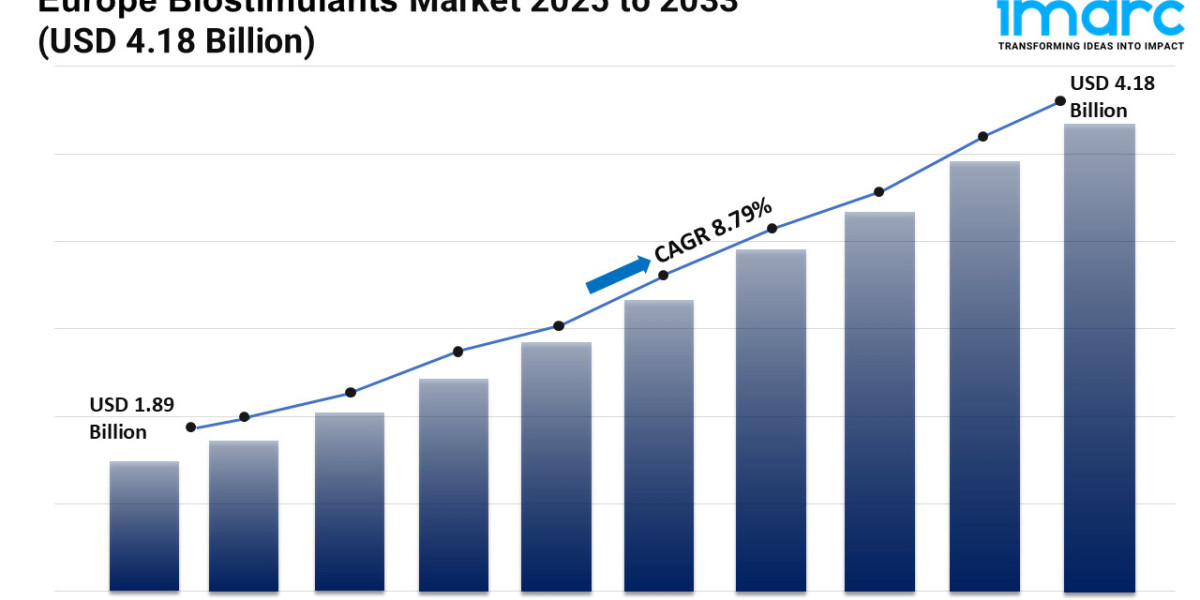

Europe Biostimulants Market Overview

Market Size in 2024: USD 1.89 Billion

Market Forecast in 2033: USD 4.18 Billion

Market Growth Rate: 8.79% (2025-2033)

According to the latest report by IMARC Group, the Europe biostimulants market size was valued at USD 1.89 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.18 Billion by 2033, exhibiting a CAGR of 8.79% from 2025-2033.

Europe Biostimulants Industry Trends and Drivers:

As sustainable farming methods take center stage in food production plans all over Europe, the market for biostimulants is booming. Farmers and agribusinesses are using biostimulants more and more to boost crop resistance, maximize soil health without the negative environmental effects of traditional agrochemicals, and increase nutritional efficiency. Demand for biological substitutes including seaweed extracts, humic compounds, and microbial treatments is soaring as regulatory agencies demand less chemical input and better ecological stewardship. To guarantee high compatibility with both conventional and organic agricultural systems, producers are investing in sophisticated formulations customized to different crop types, application techniques, and climatic circumstances. Furthermore, as end-users give top priority to long-term yield stability and environmental effect, biostimulants are becoming strategic inputs that fit with EU Green Deal goals and sustainable agriculture subsidies, hence enhancing market appeal across the continent.

Biostimulant adoption is growing fast in Germany, France, and the Netherlands as precision farming, smart irrigation, and climate-resilient crop techniques pick up speed. Germany is leading through its strong RandD ecosystem, technologically cutting-edge agricultural techniques, and tough policy frameworks that promote biological inputs. French and Dutch farmers are progressively using biostimulants into their grape, vegetable, and greenhouse crop cycles to improve plant vigour and lower dependency on artificial fertilizers. Cooperation among universities, biotech companies, and agricultural organizations in these areas is promoting innovation in biostimulant research, with an increasing focus on scientifically verified solutions. Furthermore guaranteeing access and technical assistance for various farming activities, distribution channels are growing via specialized agri-retailers and digital platforms. This regional synergy is assisting to change biostimulants from specialized supplements into main crop management techniques.

Market momentum is growing in Southern and Eastern Europe—including Spain, Italy, and Poland—as climate issues and changing regulatory norms force farmers toward sustainable crop improvement ideas. Spain and Italy are using their major fruit, vegetable, and vineyard industries to embrace biostimulants for stress tolerance and post-harvest quality maintenance; Poland is aggressively incorporating these products into its growing cereal and oilseed production. Supported by agriculture modernization projects and EU-funded innovation efforts, local producers are expanding production to satisfy domestic and export needs. Field tests, information-sharing initiatives, and technical seminars are raising farmer knowledge of biostimulant effectiveness and trust in it. Moreover spurring regional product innovation and application precision is the increasing participation of cooperatives and agritech companies. Driven by creativity, affordability, and long-term agricultural resilience, Southern and Eastern Europe are becoming important contributors to the continent's biostimulant scene as sustainable farming keeps gaining policy and consumer support.

Download sample copy of the Report: https://www.imarcgroup.com/europe-biostimulants-market/requestsample

Europe Biostimulants Industry Segmentation:

The report has segmented the market into the following categories:

Analysis by Product Type:

- Acid-based

- Humic Acid

- Fulvic Acid

- Amino Acid

- Extract-based

- Seaweed Extract

- Other Plant Extracts

- Others

- Microbial Soil Amendments

- Chitin and Chitosan

- Others

Analysis by Crop Type:

- Cereals and Grains

- Fruits and Vegetables

- Turf and Ornamentals

- Oilseeds and Pulses

- Others

Analysis by Form:

- Dry

- Liquid

Analysis by Origin:

- Natural

- Synthetic

Analysis by Distribution Channel:

- Direct

- Indirect

Analysis by Application:

- Foliar Treatment

- Soil Treatment

- Seed Treatment

Analysis by End-User:

- Farmers

- Research Organizations

- Others

Analysis by Country:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Latest News and Developments:

- February 2025: Belgium-based Fyteko raised EUR 13 Million in Series B funding to scale production, expand internationally, and advance research and development (R&D). Its enzymatic synthesis-based biostimulants help crops like corn and vines withstand water stress, supporting sustainable agriculture amid Europe’s growing drought concerns and increasingly severe climate-related challenges.

- October 2024: BASF and Elicit Plant announced that they would partner to advance EliSun-a and EliGrain-a biostimulants for sunflowers and cereals in France. Elicit Plant also secured USD 48 million in Series B funding to expand globally, targeting the U.S. Corn Belt with its phytosterol-based biosolutions and planning a 2025 launch.

- September 2024: Rovensa Next’s seaweed-based biostimulant Phylgreen earned CE marking under the EU Fertilizing Products Regulation. Now marketable across all 27 EU countries, Phylgreen enhances drought resistance in various crops and shows potential against other stresses like heat and cold, supporting sustainable agriculture through Rovensa’s Primactive Effect technology.

- March 2024: Helsinki-based UPM Biochemicals launched UPM Solargo, a new range of lignin-based, bio-based biostimulants for sustainable agriculture. Designed to augment crop yield, soil health, and reduce reliance on traditional fertilizers, Solargo marks UPM’s entry into the agrochemicals market following years of R&D and successful test marketing in Europe.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=4122&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145