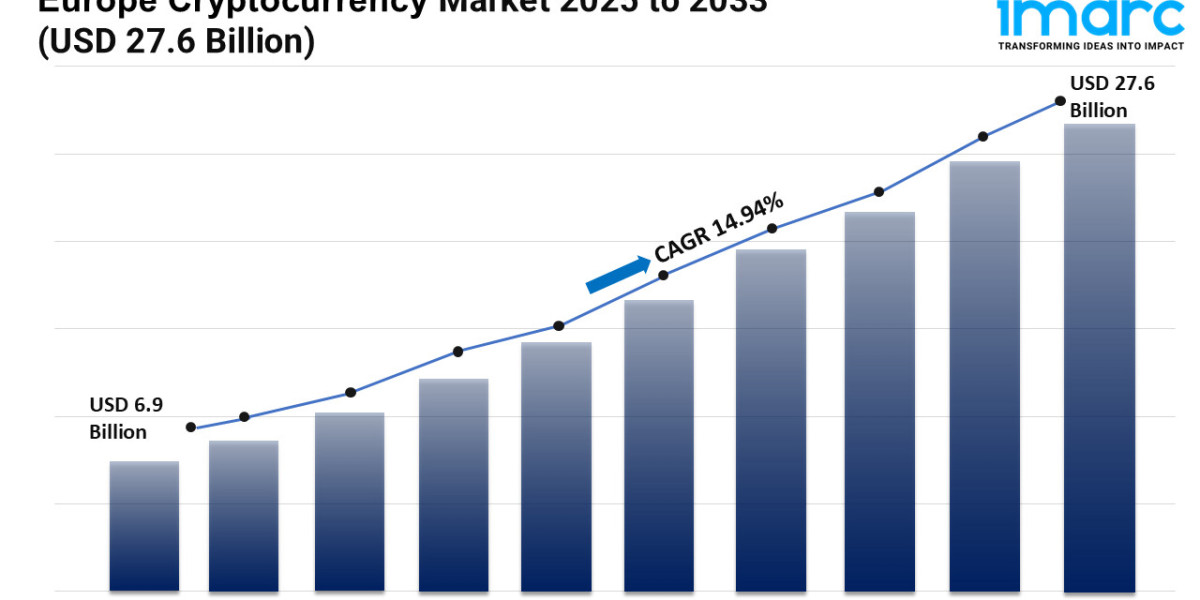

Europe Cryptocurrency Market Overview

Market Size in 2024: USD 6.9 Billion

Market Forecast in 2033: USD 27.6 Billion

Market Growth Rate: 14.94% (2025-2033)

According to the latest report by IMARC Group, the Europe cryptocurrency market size was valued at USD 6.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 27.6 Billion by 2033, exhibiting a CAGR of 14.94% from 2025-2033.

Europe Cryptocurrency Industry Trends and Drivers:

Driven by technological innovation, regulatory development, and growing adoption across several industries, the European cryptocurrency market is fast changing. Demand for crypto solutions that provide transparency, security, and efficiency is being driven by the growing integration of blockchain technology into financial services, supply chain management, and healthcare. Rising supportive rules in Europe are establishing more explicit standards encouraging both institutional investors and small players to participate boldly in the market. Governments investigating digital fiat currencies to improve payment systems are also increasing cryptocurrency acceptance, so fueling the adoption of central bank digital currencies (CBDCs). Decentralized finance (DeFi) systems are also transforming conventional financial models by offering simple lending, borrowing, and trading capabilities devoid of intermediaries. This change is drawing a broad user base and generating market growth outside of traditional crypto enthusiasts. The flexibility and scalability of bitcoin uses is being improved even more by innovation in tokenization, smart contracts, and interoperability between blockchain networks. Enhanced cybersecurity measures and user-friendly interface improvements are also lowering barriers to entry for newcomers, therefore expanding market involvement. These elements working together produce a perfect ground for development and put the European cryptocurrency market as a major actor in the worldwide digital economy.

Financial institutions, hedge funds, and venture capital firms are increasing putting capital into cryptocurrency assets and blockchain companies, making institutional adoption a major driver. While encouraging technical developments and ecosystem expansion, this surge of institutional capital is driving market liquidity and stabilizing values. Concurrently, authority such the European Securities and Markets Authority (ESMA) and national regulators' regulatory clarity is building confidence and obedience, therefore motivating businesses to integrate digital assets into their operating systems. The growth of centralized exchanges together with new decentralized exchange methods is enabling smooth trading and custody solutions, therefore improving accessibility for seasoned investors as well as retail participants. Moreover, growing interest in non-fungible tokens (NFTs) and tokenized actual assets is broadening market options, generating new income sources and applications. Additionally speeding ecosystem maturity are collaborative projects including blockchain creators, fintech companies, and government agencies that guarantee strong security standards and consumer protections. By providing people with information on the advantages and risks of cryptocurrencies, education and awareness efforts throughout Europe are helping to create a sensible and informed society. These forces support consistent expansion and help to strengthen market trust.

Using distinct economic, technical, and legislative features, regional differences inside Europe are influencing the direction of the bitcoin market. Promoting fintech innovation, assisting blockchain businesses, and enacting investor-friendly policies that draw capital inflows, Germany is positioning itself as a cryptocurrency powerhouse. Through collaborations between conventional banks and bitcoin companies, as well as creative legislative strategies that drive innovation, the financial services industry of the United Kingdom is embracing digital assets. France is highlighting digital sovereignty initiatives and promoting blockchain research to help sustainable market growth, while countries like Switzerland keep using their reputation for privacy, stability, and fintech leadership. Driven by rising internet penetration and younger populations, Eastern European countries are quickly embracing cryptocurrencies as alternative financial solutions. Cross-border initiatives inside the European Union are also unifying legislative standards, hence promoting easier market activities and more widespread adoption. Investments in infrastructure for blockchain networks, payment systems, and cybersecurity are increasing regional capacity, therefore enabling various uses across retail, corporate, and government industries. This regional mosaic of invention, rules, and adoption is guaranteeing that the Europe cryptocurrency market is maturing in complexity as well as in size, laying a firm basis for future developments and integration into the more general digital economy.

Download sample copy of the Report: https://www.imarcgroup.com/europe-cryptocurrency-market/requestsample

Europe Cryptocurrency Industry Segmentation:

The report has segmented the market into the following categories:

Analysis by Type:

- Bitcoin

- Ethereum

- Bitcoin Cash

- Ripple

- Litecoin

- Dashcoin

- Others

Analysis by Component:

- Hardware

- Software

Analysis by Process:

- Mining

- Transaction

Analysis by Application:

- Trading

- Remittance

- Payment

- Others

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Competitive Landscape:

The European cryptocurrency market is characterized by intense competition among global and regional players, alongside emerging platforms. Financial institutions are entering the space with custody and trading services, while blockchain startups drive innovation in decentralized finance (DeFi) and tokenization. The market’s growth is fueled by regulatory clarity and strategic investments, positioning Europe as a leader in the global cryptocurrency ecosystem. For instance, according to industry data, in 2024, Binance led in Bitcoin deposits, with a daily average increase of 2.77 BTC, outpacing Kraken (0.56 BTC) and Coinbase (0.41 BTC). Overall, Bitcoin deposits rose from 0.36 BTC in 2023 to 1.65 BTC, while Tether (USDT) deposits surged from $19,600 to $230,000. Binance set a record of 6.85 BTC ($465,000) the same year and a peak of $303,000 in USDT deposits. Binance's corporate clients grew by 40% in 2024.

The report provides a comprehensive analysis of the competitive landscape in the Europe cryptocurrency market with detailed profiles of all major companies.

Latest News and Developments:

- In 2024, Bitstamp, a European cryptocurrency exchange, and LTP partnered to enhance institutional trading, offering LTP clients simplified access to Bitstamp's liquidity pools, lending solutions, and advanced trading infrastructure for improved crypto market accessibility and efficiency.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=9080&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145