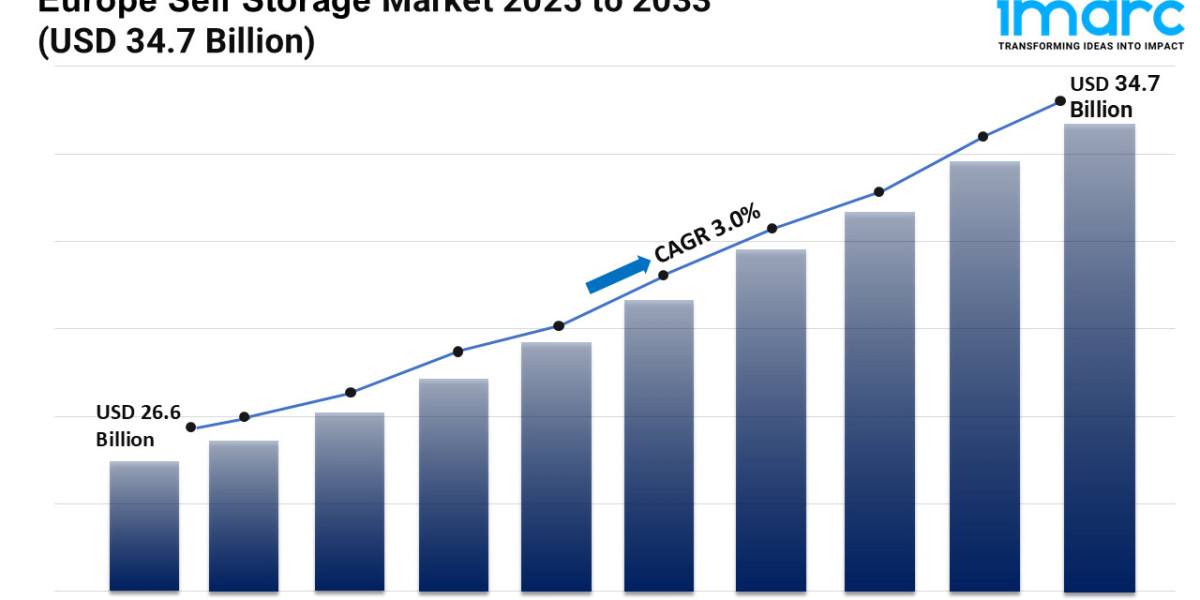

Europe Self Storage Market Overview

Market Size in 2024: USD 26.6 Billion

Market Forecast in 2033: USD 34.7 Billion

Market Growth Rate: 3.0% (2025-2033)

According to the latest report by IMARC Group, the Europe self storage market size was valued at USD 26.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 34.7 Billion by 2033, exhibiting a CAGR of 3.0% from 2025-2033.

Europe Self Storage Industry Trends and Drivers:

As individuals and companies look for flexible, safe, and easily accessible storage solutions in response to urban densification and evolving lifestyle trends, the Europe self storage sector is changing quickly. People are downsizing, traveling more often, and adopting simple living more and so producing constant need for storage containers in a range of sizes. The growth of hybrid office models and remote work is forcing people to repurpose home spaces, therefore producing a need for offsite storage of furniture, equipment, and seasonal goods. Companies—in particular small companies and e-commerce retailers—are using self storage facilities to control excess inventory, simplify fulfillment, and enable micro-warehousing operations. By providing tech-enabled services including digital bookings, 24/7 monitoring, and app-based access, operators are adding value and so creating a seamless user experience. The sector is moving toward integrated security systems and contactless activities, which are increasing operational efficiency and building end-user trust.

Constricted living quarters in significant European cities and rising urbanization are both supporting the need for local storage networks. Underused commercial and industrial areas are being turned into contemporary storage centers with drive-up accessibility, scaled unit setups, and temperature regulation by developers. Concurrently, customers are showing increasing knowledge of self- storage options via electronic channels; comparison sites and internet stores are making pricing transparency easier. Many businesses are investing in energy-efficient lighting, solar systems, and green building certifications to draw in environmentally aware consumers as sustainability becomes a market differentiator. Rising demand, especially in university towns, heavily visited areas, and high-mobility metropolitan areas, is also supported by the hospitality, education, and relocation industries. These changes in structure and behavior are facilitating the segmentation of end-users, hence building the resilience of the market and its long-run growth trajectory.

With its mature storage ecosystem, high urban density, and great e-commerce and flexible housing penetration, the United Kingdom is holding a prominent position among region-specific trends that are transforming market dynamics. Through urbanization in cities like Berlin, Hamburg, and Munich, where affordability pressures are driving the use of tiny residential designs backed by storage systems, Germany is seeing rising adoption. France is incorporating storage into mixed-use projects, combining comfort with lifestyle amenities. While Eastern Europe is growing by means of real estate diversification and infrastructure improvement, Southern European nations like Spain and Italy are using tourism-driven seasonal demand. New Nordic facility projects are being shaped by digital transformation and environmentally motivated design. These country-level dynamics are motivating operators to change their tactics locally—from micro-unit products to premium smart storage hubs—to match local tastes, demographics, and legal requirements. The resulting ecosystem is increasingly viewing Europe's self storage sector as a crucial part of the contemporary urban and business environment.

Download sample copy of the Report: https://www.imarcgroup.com/europe-self-storage-market/requestsample

Europe Self Storage Industry Segmentation:

The report has segmented the market into the following categories:

Analysis by Storage Unit Size:

- Small Storage Unit

- Medium Storage Unit

- Large Storage Unit

Analysis by End Use:

- Personal

- Business

Regional Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

- Shurgard Self Storage SA

- Safestore Holdings PLC

- Self Storage Group ASA

- WP Carey Inc.

- SureStore Ltd

- Big Yellow Group PLC

- Access Self Storage

- Lok'nStore Limited

- Lagerboks

- 24Storage

- Casaforte

- Pelican Self Storage

Latest News and Developments:

- April 2025: Shurgard opened its first self-storage facility in Stuttgart, with 1,000 units ranging from 1.5 to 22.5 sqm. The EUR 17.1 million facility addressed the growing demand for premium storage. Shurgard also expanded its German presence, with several new projects reportedly planned in major cities.

- February 2025: Heitman acquired a majority stake in Servistore, a Swedish self-storage operator, which operates 31 sites across 14 cities. The acquisition aimed to enhance Servistore's technology-led, unmanned operations and expand its market leadership. Heitman manages over 600 self-storage assets globally.

- December 2024: PGIM Real Estate and Pithos Capital launched a joint venture in France to acquire and reposition self-storage assets. The venture, operating under the Zebrabox brand, aimed to develop and convert properties, and secured six assets as of December 2024.

- April 2024: SpaceGenie, a German self-storage company, opened its first facility in Hassloch, Germany. The company planned to expand with six more locations in the near-term and acquire 11 additional sites.

- April 2024: Shurgard acquired a UK-based Lok'nStore in a GBP 378 million deal, effectively doubling its presence in the UK. Lok'nStore operated 43 self-storage centers in England and Wales.

- January 2024: Ardian acquired a majority stake in Costockage, the leading self-storage marketplace in France. Costockage operates 10 centers and a digital platform enabling storage rentals from professionals and individuals. This acquisition supports Ardian's strategy to diversify into self-storage, a growing sector in France. Ardian will leverage its expertise to expand Costockage’s footprint, focusing on real estate acquisitions and transforming distressed properties. The deal aims to enhance Costockage’s offerings and capitalize on the growing demand for self-storage in France.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=6270&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145