India Automotive Lead-Acid Battery Market Overview

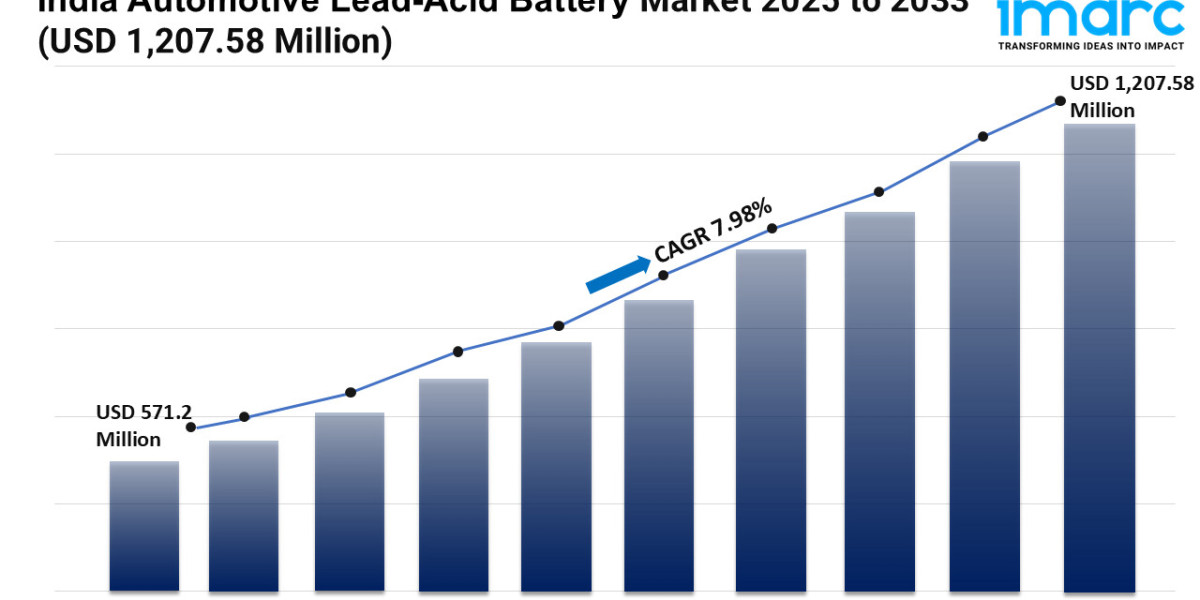

Market Size in 2024: USD 571.2 Million

Market Forecast in 2033: USD 1,207.58 Million

Market Growth Rate: 7.98% (2025-2033)

According to the latest report by IMARC Group, the India automotive lead-acid battery market size was valued at USD 571.2 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,207.58 Million by 2033, exhibiting a CAGR of 7.98% from 2025-2033.

India Automotive Lead-Acid Battery Industry Trends and Drivers:

Driven by several connected elements changing the automotive and energy storage environment, the India automotive lead-acid battery industry is now expanding quickly. Demand for lead-acid batteries is being driven by the growing manufacture of cars, especially two-wheelers and electric rickshaws, which still hold a sizable market share because of their dependability and cheapness. As customers increasingly look for reasonably priced replacements and maintenance solutions for their current cars, the growing aftermarket sector is becoming rather important in keeping sales numbers stable. Government programs fostering battery recycling are helping to create market sustainability by inspiring consumers and producers to actively engage in environmentally friendly disposal and reuse projects. Rising vehicle use and, hence, the growth of lead-acid battery markets across many vehicle categories follow urbanization trends and simultaneous advancement of transport infrastructure. Although lithium-ion technologies are growing in popularity, lead-acid batteries are still chosen for their cost benefits, endurance, and widespread availability particularly in entry-level cars and commercial fleets. Enhanced charge retention and longer service life are among the technical advancements in lead-acid batteries that are further strengthening their market position. Growing customer preferences for reliable and low-maintenance battery solutions in the face of rising vehicle ownership also help to support the growth trajectory. These elements together are causing consistent demand, so setting the India automotive lead-acid battery sector for continued growth over the projected period.

Supported by concentrated vehicle manufacturing facilities and rising urban mobility needs, major metropolitan and industrial hubs such as Maharashtra, Tamil Nadu, Uttar Pradesh, and Karnataka are leading the growth of the India automotive lead-acid battery market regionally. Strong local supply chains and established distribution networks are helping these areas to enjoy effective delivery and after-sales assistance. Automobile clusters and industrial corridors are helping vehicle makers and battery companies to work together, therefore fostering innovation and cost efficiency. Growing electric rickshaw use in cities like Delhi and Kolkata is giving more market momentum since these cars frequently utilize lead-acid batteries because of their cost-effectiveness and simplicity of replacement. Rising demand for batteries is also being driven by government programs intended to promote electric mobility and improve infrastructure in these areas. In metropolitan areas, consumer awareness of battery care and recycling is growing as well, therefore promoting market acceptance and responsible usage behavior. Together with infrastructural improvements, the regional emphasis on increasing transportation efficiency is spurring more general use of lead-acid battery systems in passenger cars, business fleets, and two-wheelers. These dynamics are creating a resilient and geographically varied market environment ready to fit the changing needs of India's automobile ecosystem.

Looking ahead, the India automotive lead-acid battery industry is embracing innovation and sustainability programs that fit into more general environmental and economic objectives. To meet rigorous quality standards requested by modern vehicles, battery makers are investing in R&D concentrating on increasing energy density, charge cycles, and general durability. Cost cuts made possible by developments in manufacturing techniques are essential for keeping the competitive edge of lead-acid batteries in light of rising lithium-ion use. The market is also benefiting from increased governmental support for sustainable battery lifecycle management, including expanded recycling infrastructure and regulatory frameworks that promote circular economy principles. Enhanced partnerships between automakers, battery suppliers, and recycling companies are fostering an integrated approach to supply chain management, minimizing waste, and maximizing resource utilization. Furthermore fueling diversification inside the battery market is growing consumer preference for electric mobility solutions, which is also influencing lead-acid batteries for hybrid vehicles and specialized uses including backup power systems. To provide end-users better accessibility and convenience, distribution networks are growing past conventional automobile parts stores to encompass e-commerce sites. With urban growth and electrification initiatives driving India's automobile vehicle population to rise in tandem, the automotive lead-acid battery sector is set for sustained growth and makes a major contribution to the country's changing transportation and energy storage sectors.

Download sample copy of the Report: https://www.imarcgroup.com/India-Automotive-Lead-Acid-Battery-Market/requestsample

India Automotive Lead-Acid Battery Industry Segmentation:

The report has segmented the market into the following categories:

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

- HEV Cars

Product Insights:

- SLI Batteries

- Micro Hybrid Batteries

Type Insights:

- Flooded Batteries

- Enhanced Flooded Batteries

- VRLA Batteries

Customer Segment Insights:

- OEM

- Replacement

Regional Insights:

- North India

- South India

- East India

- West India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

India Automotive Lead-Acid Battery Market News:

- In December 2024, Amara Raja Energy & Mobility Limited partnered with Hyundai Motor India Limited (HMIL) to supply domestically manufactured absorbent glass mat (AGM) lead-acid batteries, enhancing advanced battery technology localization. These AGM batteries, surpassing conventional complete maintenance free (CMF) batteries by around 150% in durability tests, would be incorporated into Hyundai's Indian product lineup by Q4FY25.

- In March 2024, Exide Industries announced its plans to introduce premium absorbent glass mat (AGM) lead-acid batteries for fossil-fuel vehicles in India. Already exporting these batteries, Exide received a request for quotation from a major original equipment manufacturer and anticipates further interest. AGM batteries, though pricier, offer nearly double the shelf-life due to low discharge rates and are spill-proof.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=30117&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145