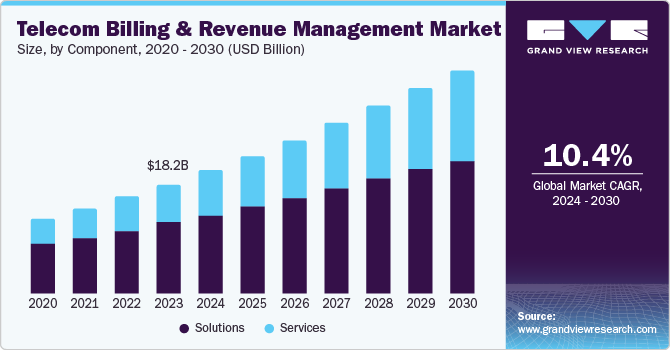

The global telecom billing & revenue management market size was valued at USD 18.22 billion in 2023 and is projected to grow at a CAGR of 10.4% from 2024 to 2030. The growth of this market is primarily driven by factors such as the unceasing growth in cellular network subscribers and smartphone users, rising competition in the industry fuelled by numerous strategies adopted by telecom service providers, the increasing need for effective fraud management solutions, and the inclination towards adopting technology tools to ensure enhanced customer engagements and customer experiences.

With the significant increase in mobile subscribers, telecom service provider companies are seeking effective billing & revenue management solutions that can assist operations. Growing complexities of the business have developed the need for solutions associated with subscriber billing engines, customer/subscriber management, usage monitoring, and more. To ensure a smooth flow of operations, businesses in the telecom industry prefer adopting billing & revenue management solutions or services in areas such as charging or billing, payment management, fraud identification or prevention, and debtor management.

The use of billing & revenue management systems has been helping companies develop opportunities through revenue estimation, process automation, enhanced customer satisfaction and loyalty, effective catalog management, and more. For instance, in March 2024, Hrvatski Telekom, one of the prominent organizations in the telecommunication services industry, announced that the company is willing to continue its lasting partnership with Netcracker by employing Netcracker Revenue Management, which is a part of Netcracker’s digital business support system solution. Through this continued partnership, Hrvatski Telekom aims to improve its IT infrastructure and unify its fixed-line and mobile systems.

Get a preview of the latest developments in the Telecom Billing & Revenue Management Market; Download your FREE sample PDF copy today and explore key data and trends

Detailed Segmentation

Component Insights

Based on components, the solutions segment held the largest revenue share of the global market and accounted for 64.7% in 2023. The growth of this segment is influenced by factors such as flexibility & scalability offered by solutions, seamless collaboration among teams, complete control over managing several business functions, and remote work/monitoring capabilities. Companies adopt billing & revenue management solutions for multiple functions such as billing & charging, revenue assurance, fraud management, and mediation. Automation and software assistance in such business functions help companies in various ways, including understanding customer behaviour, developing business intelligence, and ensuring strategic decision-making.

Deployment Insights

The on-premise deployment segment dominated the billing & revenue management market in 2023. The growth of this segment is mainly driven by the inclination towards on-premise deployments to ensure complete control over IT infrastructure and related business processes. In addition, the growing use of data and its dependability for strategic decision-making have increased the significance of data security, storage, and protection. On-premise deployment of solutions provides businesses with desired control over relevant data sets. Availability of cost structure before implementation, customizations, and infrastructural control are expected to develop the growth of this segment during the forecast period.

Application Insights

Based on application, mobile operators segment held the largest revenue share of the global market. The growing cloud deployments of billing and revenue management solutions are driven by the advanced control offered by the deployment model, which involves remote monitoring, cost-effectiveness, scalability, real-time data processing, business intelligence, and enhanced customer experiences. Complexities in advanced telecom services have encouraged companies to adopt billing & revenue management services associated with billing, charging, payment management, customer assistance, and more. Unceasing growth in smartphone users has influenced this segment in recent years. According to the International Telecommunication Union (ITU), in 2023, 73 % of individuals aged ten and older owned mobile phones.

Regional Insights

North America dominated the global telecom & revenue management market and accounted for the largest revenue share of 35.0% in 2023. This is attributed to factors such as the growing use of mobile phones in the region, increasing dependence on internet-driven technology solutions, a large number of existing customers, and rising complexities of the telecommunication industry. The emergence and implementation of technologies such as 5G and others have driven demand for effective billing & revenue management solutions in North America. In March 2024, the total number of 5G connections in North America was marked at 220 million.

Key Telecom Billing & Revenue Management Companies:

The following are the leading companies in the telecom billing & revenue management market. These companies collectively hold the largest market share and dictate industry trends.

- Amdocs

- Cerillion Technologies Ltd

- Comarch SA

- CSG Systems, Inc.

- Formula Telecom Solutions Ltd

- Huawei Technologies Co., Ltd

- Intracom Telecom

- Comviva

- Netcracker

- Optiva, Inc.

- Oracle

- SAP SE

- STL Tech

- SUBEX

- Telefonaktiebolaget LM Ericsson

Telecom Billing & Revenue Management Market Segmentation

Grand View Research has segmented the global telecom billing & revenue management market on the basis of on component, deployment, application, and region:

Telecom Billing & Revenue Management Component Outlook (Revenue, USD Million, 2018 - 2030)

- Solutions

- Services

Telecom Billing & Revenue Management Deployment Outlook (Revenue, USD Million, 2018 - 2030)

- On–premise

- Cloud

Telecom Billing & Revenue Management Application Outlook (Revenue, USD Million, 2018 - 2030)

- Mobile Operators

- Internet Service Providers

Telecom Billing & Revenue Management Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Middle East and Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

Curious about the Telecom Billing & Revenue Management Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Recent Developments

- In May 2024, Ooredoo, a key multinational telecommunications company from Qatar, and Netcracker, a major market participant in telecom billing & revenue management, extended the existing partnership. The Middle Eastern operator utilizes managed services support and a digital BSS product suite.

- In April 2024, Optiva Inc., one of the major companies in cloud-native billing and revenue management solutions, and GDi Group, a digital technology and software organization, announced a strategic partnership to deliver pre-integrated and tested BSS and OSS software to communication service providers (CSPs).