The North America urinary tract infection testing market size was valued at USD 197.22 million in 2022 and is estimated to grow at a compound annual growth rate (CAGR) of 4.0% from 2023 to 2030. The increasing prevalence of Urinary Tract Infections (UTIs), the aging population, increasing awareness about the importance of early UTI detection, and better access to healthcare facilities are some of the major factors driving the growth of the market in the region. Moreover, engaging in sexual intercourse and using spermicides and diaphragms can increase the risk of developing UTIs. Frequent pelvic exams and anatomical abnormalities of the urinary tract can also make someone more susceptible to UTIs.

Urinary tract infection is becoming a common global concern. According to data published by the National Library of Medicine, Urinary tract infections (UTIs) are common bacterial infections among women in the U.S., typically affecting those between 16 and 35 years of age. About 10% of women experience a UTI each year, and 40-60% will have at least one infection in their lifetime. Recurrences are frequent, with nearly half experiencing a second infection within a year. UTIs are more prevalent in females, occurring at least four times more frequently than males. Moreover, even with appropriate antibiotic treatment, UTI symptoms can persist for several days. For women with recurring UTIs, their quality of life may be negatively affected. Approximately 25% of women experience such recurrences within six months.

The rising incidence of UTIs in the elderly is significantly impacting the market growth in the region. With a substantial portion of the aging population susceptible to UTIs, there is an increasing demand for advanced UTI testing and treatment solutions. As people age, their vulnerability to UTIs increases due to weakened bladder and pelvic floor muscles, which can lead to urine retention or incontinence. When urine remains in the urinary tract, it creates an environment where bacteria, such as E. coli, can multiply and cause infections. Seniors are at higher risk of UTIs due to factors like weakened immune systems, the use of catheters, diabetes, and kidney problems.

Get a preview of the latest developments in the North America Urinary Tract Infection Testing Market; Download your FREE sample PDF copy today and explore key data and trends

In older women, UTIs are more common due to changes in the female anatomy and lower estrogen levels after menopause. This hormonal shift can lead to an imbalance of bacteria in the vagina, increasing the likelihood of an infection. UTIs are less prevalent in older men due to the male anatomy, but uncircumcised men or those with enlarged prostates (BPH) are susceptible. UTIs associated with BPH occur when the bladder is not fully emptied. Proper understanding and management of these risk factors are essential to prevent and address UTIs in older adults.

Furthermore, the increasing prevalence of catheter-associated UTIs (CAUTIs) is driving the growth of the market for UTI testing solutions. Healthcare facilities and providers recognize the urgent need for accurate and timely UTI testing to identify and manage CAUTIs effectively. As the incidence of CAUTIs rises, there is a growing demand for advanced UTI testing instruments to detect and quantify pathogens, including drug-resistant strains. Catheter-associated UTIs (CAUTIs) are the most prevalent healthcare-associated infections in hospitals and long-term health facilities.

Short-term catheter use increases CAUTI risk by 3-7% each day, leading to an up to 80% higher risk of complications during hospitalization. For long-term catheterization, the risk of complications is nearly 100%. CAUTIs are linked to higher morbidity and mortality rates and are a primary cause of secondary bacteremia. The use of urinary catheters bypasses the body's natural immune defense, providing microorganisms from the groin and perineum with direct access to the bladder. The persistent irritation and inflammation caused by catheters in the bladder hinder normal bladder contraction and urination, making the bladder more susceptible to infection.

Increasing R&D for developing advanced UTI testing kits is driving the growth of the market in North America. Companies and research institutions are investing in innovative technologies and improved diagnostic sensors to improve the early detection and accuracy of UTIs. These advancements in UTI testing kits enable quicker and more reliable diagnosis, leading to better patient outcomes and more effective treatments. For instance, in May 2023, The University of Texas at Dallas unveiled a prototype diagnostic sensor that can rapidly confirm urinary tract infections (UTIs), without waiting for 24 to 48 hours for lab test results.

This innovative technology leverages the diagnostic capability of electrochemical biosensors, leading to more accurate therapy and better patient outcomes. Continuous efforts to enhance the performance and efficiency of UTI testing kits are attracting healthcare providers and consumers, driving market growth in the region. Moreover, the rising awareness about the importance of early UTI detection and the potential benefits of advanced testing kits encourage higher adoption rates among healthcare facilities, further contributing to North America's urinary tract infection testing market expansion.

Detailed Segmentation

Type Insights

The cystitis segment accounted for the largest revenue share of 41.41% in 2022 in the North America urinary tract infection testing market. Cystitis is a condition where bacteria from the skin or bowel enter the urethra and bladder, leading to irritation and inflammation of the bladder lining, causing a bladder infection. There are two types of cystitis - acute, which occurs suddenly; and interstitial, a chronic and longer-term condition. The growth of the segment is due to the rising incidence & recurrence rate of cystitis, the increased number of product approvals, and the high number of diabetes patients more prone to cystitis.

Product Insights

The instruments segment accounted for the largest revenue share of 60.36% in 2022 and is expected to witness the fastest CAGR over the forecast period. The rising prevalence of UTIs in North America has led to a greater demand for efficient and reliable testing methods. Instruments are crucial in UTI testing as they are essential for accurate and rapid diagnosis. Advanced diagnostic instruments, such as automated urine analyzers and point-of-care testing devices, have gained traction due to their ability to deliver faster and more precise results. These instruments aid in detecting UTIs early, allowing for prompt treatment and improved patient outcomes.

End-use Insights

The reference laboratories segment held the largest revenue share of 26.11% in 2022. Reference laboratories offer a wide range of comprehensive testing services, including UTI testing, to healthcare providers. These laboratories have advanced instruments and technologies to perform various diagnostic tests with high accuracy and efficiency. Moreover, many reference laboratories have multiple locations and wide geographic coverage, enabling them to serve a large population across different states and regions in North America. In addition, reference labs can handle large volumes of diagnostic tests at an expedited rate and provide better results at comparatively lower prices, which is anticipated to offer economies of scale to service providers.

Country Insights

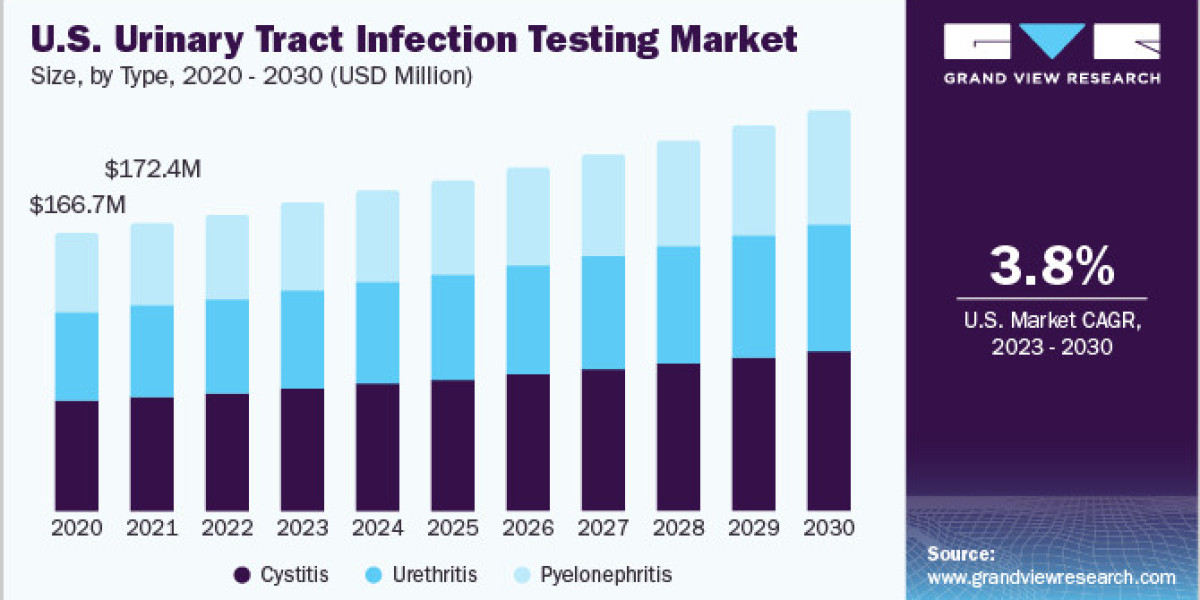

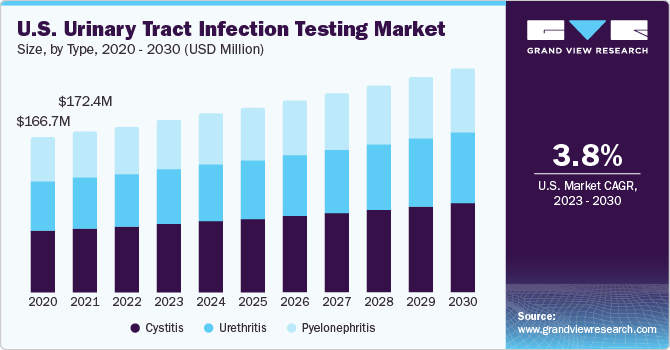

The U.S. dominated the North American market for urinary tract infection testing in 2022 with 90.47% of the revenue share. The presence of key players such as Abbott, BIOMERIEUX, BD, Siemens Healthineers AG, QIAGEN, Accelerate Diagnostics, Inc., Bio-Rad Laboratories, Inc., and Quest Diagnostics is positively influencing market growth. Moreover, increasing R&D initiatives by the key players in the region is expected to drive market growth further.

Key Companies & Market Share Insights

Major companies operating in the regional urinary tract infection testing market are attempting to enhance their product portfolio by upgrading their products and exploring acquisitions and government authorizations to increase their client base and obtain a larger market share. For instance, in May 2023, PathogenDx, a manufacturer and provider of diagnostic solutions, announced that it is preparing to launch an advanced microarray-based test designed specifically for urinary tract infections (UTIs). The UTI assay will be able to identify 26 pathogens and 20 associated antimicrobial resistance genes simultaneously in one comprehensive test. Some of the prominent players in the North America urinary tract infection testing market include:

- QIAGEN

- Accelerate Diagnostics, Inc.

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche Ltd.

- Danaher Corporation

- Siemens Healthcare GmbH

- Randox Laboratories Ltd.

- Thermo Fisher Scientific, Inc.

- bioMérieux SA

- T2 Biosystems, Inc.

North America Urinary Tract Infection Testing Market Segmentation

Grand View Research has segmented the North America urinary tract infection testing market based on type, product, end-use, and region:

North America Urinary Tract Infection Testing Type Outlook (Revenue, USD Million, 2018 - 2030)

- Urethritis

- Cystitis

- Pyelonephritis

North America Urinary Tract Infection Testing Product Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

- Instruments

- Consumables

North America Urinary Tract Infection Testing End-use Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

- General practitioners

- Urologists

- Urogynecologists

- Hospital Laboratories

- Reference Laboratories

- Hospital Emergency Departments

- Urgent Care

- Others

North America Urinary Tract Infection Testing Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

Curious about the North America Urinary Tract Infection Testing Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.