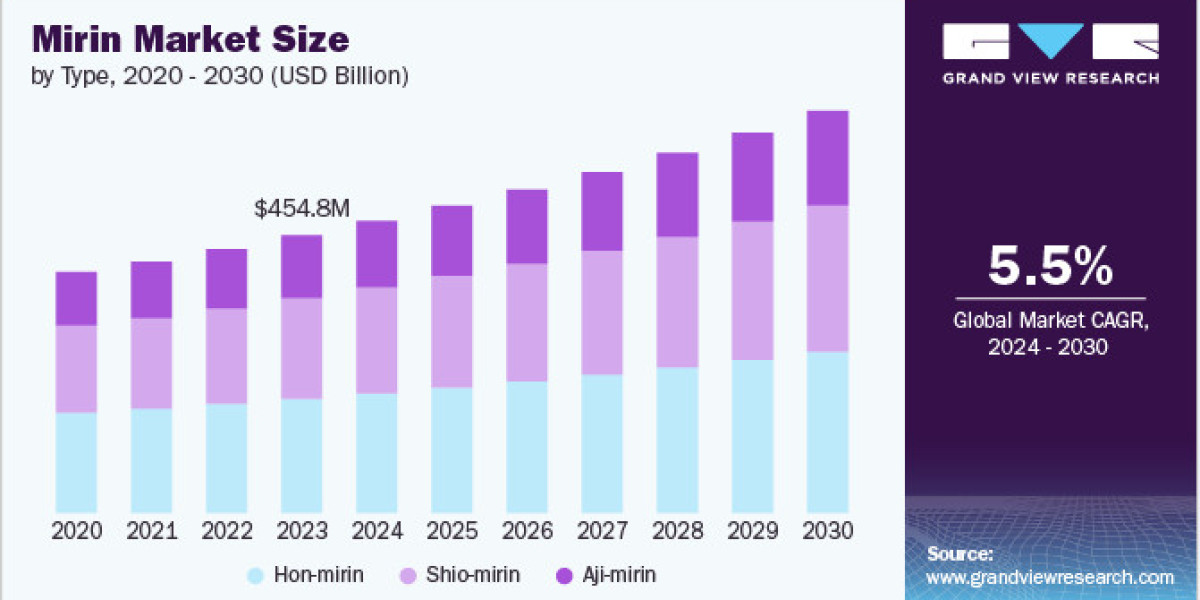

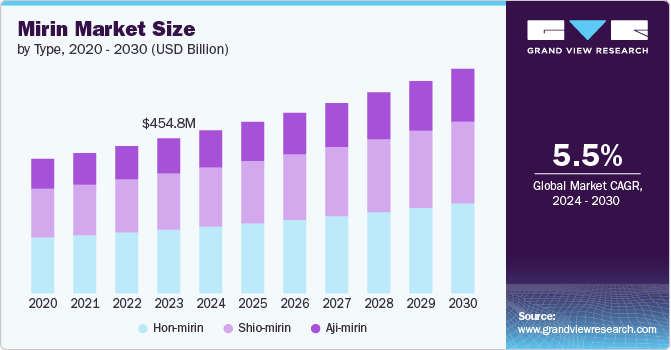

The global mirin market size was estimated at USD 454.8 million in 2023 and is expected to grow at a CAGR of 5.5% from 2024 to 2030. As consumers become more health-conscious, there is a growing preference for natural and traditional ingredients. Mirin, known for its amino acids and antioxidants, is seen as a healthier alternative to artificial sweeteners and additives. Additionally, the global proliferation of Japanese cuisine, including sushi and teriyaki dishes, has led to increased demand for authentic Japanese ingredients like mirin.

The market for mirin, a traditional Japanese sweet rice wine, is experiencing a significant rise due to various factors and trends influencing its consumption in both residential and commercial applications. One major factor is the globalization of cuisine, which has led to an increased demand for authentic Japanese ingredients like mirin. As Japanese dishes such as teriyaki, sukiyaki, and various sauces gain popularity worldwide, mirin becomes a staple in kitchens aiming to replicate these flavors. Additionally, the health consciousness movement has driven consumers to seek healthier alternatives to sugar, and mirin, with its lower glycemic index and additional nutrients from fermented rice, fits this preference well.

Another factor contributing to the increased consumption of mirin is culinary innovation. Both professional chefs and home cooks are experimenting with mirin in unconventional recipes, integrating it into fusion cuisine, dressings, marinades, and even desserts.

Get a preview of the latest developments in the Mirin Market; Download your FREE sample PDF copy today and explore key data and trends

The improved availability of mirin in supermarkets and online stores has also made it more accessible to a broader audience. Furthermore, the growing influence of Japanese culture through media, such as anime, movies, and culinary shows, has sparked interest in Japanese cooking ingredients, including mirin.

Moreover, there is a clear trend towards premium, artisanal, and organic mirin products, with consumers willing to pay more for high-quality, authentic, and natural options. The demand for convenient, ready-to-use sauces and marinades containing mirin is on the rise, catering to busy consumers looking for quick and easy meal solutions without compromising on flavor. The pandemic has also played a role in increasing home cooking, with more people experimenting with different cuisines, including Japanese, leading to higher residential use of mirin.

Furthermore, Japanese and Asian fusion restaurants globally are driving the demand for mirin as they require authentic ingredients to maintain the quality and authenticity of their dishes. Food manufacturers are also using mirin in sauces, marinades, and ready-to-eat meals to enhance flavor and appeal.

Detailed Segmentation

Type Insights

Hon-mirin dominated the market and accounted for a share of 41.2% in 2023. Hon-mirin, a traditional Japanese sweet rice wine used primarily in cooking, typically contains around 14% alcohol. Hon-mirin is also used to create glazes and marinades for meats, fish, and vegetables, enhancing their flavor and texture. It adds depth to soups and stews, enriches dressings and dipping sauces with its subtle sweetness, and contributes to the light, crispy texture of tempura batter. Its alcohol content not only aids in flavor extraction but also helps in tenderizing ingredients and creating complex, balanced flavors in Japanese cuisine.

Application Insights

Commercial application accounted for a revenue share of 67.9% in 2023. Mirin is predominantly favored in commercial applications due to its consistency, convenience, and cost efficiency. Its ready availability reduces preparation time in busy kitchens, where efficiency is paramount. Moreover, bulk purchasing and standardized production processes make commercial mirin more economical than homemade alternatives, especially in large-scale food production.

Distribution Channel Insights

Sales through hypermarkets & supermarkets accounted for a revenue share of 37.3% in 2023. Supermarkets and hypermarkets offer a one-stop shopping experience where customers can find a wide variety of products, including mirin, alongside other groceries and household items. This convenience saves time and effort for shoppers. These large retail stores typically stock a range of mirin brands and types, giving consumers more options to choose from. Whether looking for a specific brand or a particular type of mirin, shoppers are more likely to find what they need in a well-stocked supermarket or hypermarket.

Regional Insights

The mirin market in North America captured a revenue share of over 20% in the global market. Increased cultural exchange and globalization have led to a greater appreciation for international cuisines, particularly Japanese cuisine, which has unique flavors and health benefits. Additionally, the surge in Japanese restaurants, including sushi bars and ramen shops, has popularized authentic dishes that use mirin, inspiring home cooks to experiment with Japanese recipes. Furthermore, health-conscious consumers in North America are increasingly favoring natural, less processed ingredients.

Key Mirin Companies:

The following are the leading companies in the mirin market. These companies collectively hold the largest market share and dictate industry trends.

- Kikkoman Corporation

- Eden Foods

- Mizkan Holdings

- Sakura Foods Corporation

- Higashimaru Shoyu Co., Ltd.

- Takara Sake

- Yutaka

- Kankyo Shuzo

- Urban Platter

- Soeos

Mirin Market Segmentation

Grand View Research has segmented the global mirin market based on the type, application, distribution channel, and region:

Mirin Type Outlook (Revenue, USD Million, 2018 - 2030)

- Aji-mirin

- Hon-mirin

- Shio mirin

Mirin Application Outlook (Revenue, USD Million, 2018 - 2030)

- Residential

- Commercial

Mirin Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

- Supermarkets & Hypermarkets

- Convenience Stores

- Online

- Others

Mirin Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia & New Zealand

- Central & South America

- Brazil

- Middle East & Africa

- South Africa

Curious about the Mirin Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Recent Developments

- In February 2024, Sung Si-Kyung, a popular South Korean balladeer, launched a new liquor brand called "Kyung" and its first product, makgeolli (Korean rice wine), called "Kyungtakju." The makgeolli has an alcohol content of 12%, higher than the typical 6-9% found in commercially produced makgeolli.