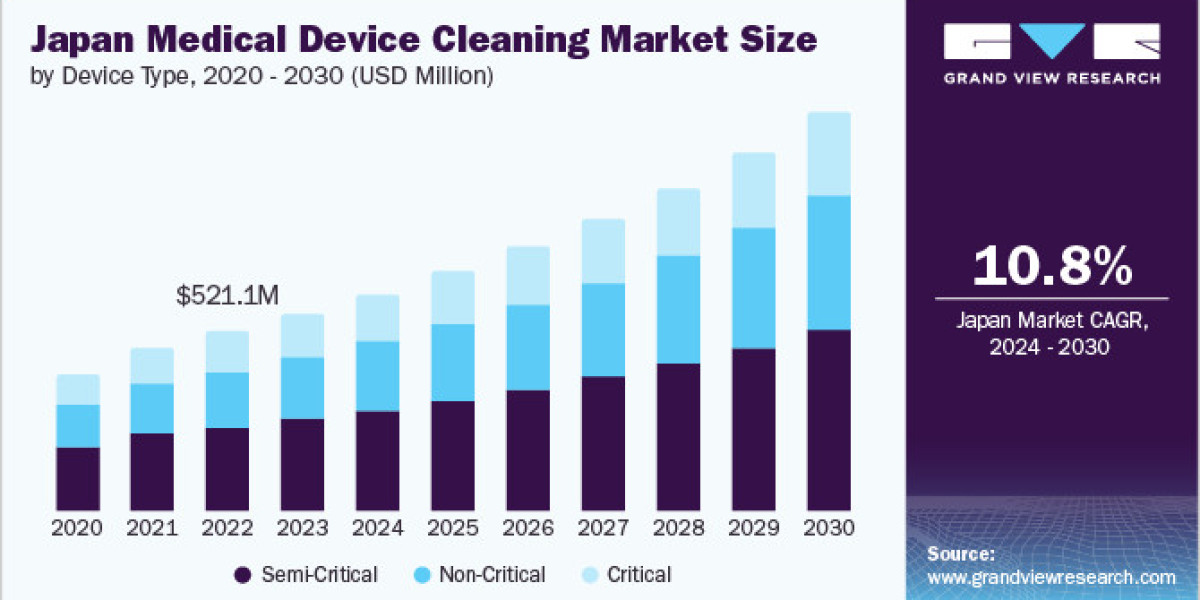

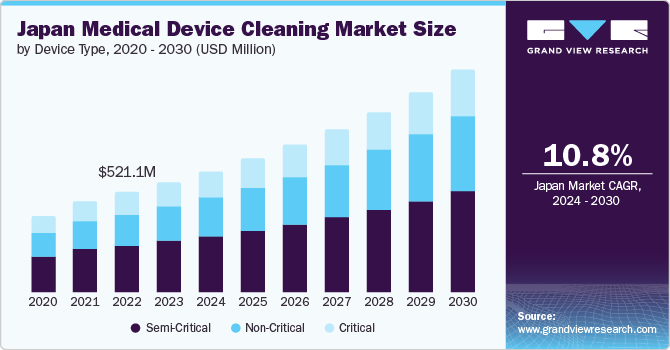

Imagine a nation where health and longevity are paramount, and the tools that heal are meticulously cared for. This is the story of the Japan medical device cleaning market, a vital sector valued at USD 572.95 million in 2023 and set to expand with a robust CAGR of 10.83% from 2024 to 2030. This growth is a direct reflection of Japan's evolving demographics and healthcare landscape.

A significant driver is the nation's remarkable longevity. As of September 2023, a staggering 33% of Japan's population is over 65, with more than 10% surpassing the age of 80, as highlighted by the World Economic Forum. This growing elderly population, coupled with a rising prevalence of chronic diseases, naturally leads to an increased demand for medical interventions and, consequently, for the stringent cleaning and disinfection of medical devices. For instance, cancer prevalence in Japan is projected to reach 3,665,900 cases by 2050, a 13.1% rise from 2020, further emphasizing the need for robust device reprocessing.

Another critical factor fueling this market's expansion is the relentless battle against hospital-acquired infections (HAIs). These infections pose a serious threat to patient safety, with data from May 2023 revealing that one in 14 hospital patients in Japan contracts an active HAI. This stark reality underscores the urgent need for impeccable medical device hygiene. The heightened emphasis on preventing HAIs, supported by ongoing research and published studies – such as the December 2022 study proposing techniques to prevent surgical site infections in thyroid surgery – is expected to propel the demand for advanced cleaning products in the years to come.

Get a preview of the latest developments in the Japan Medical Device Cleaning Market; Download your FREE sample PDF copy today and explore key data and trends

The innovative spirit within Japan's medical device industry is also opening lucrative avenues for the cleaning market. With key stakeholders actively promoting the development and manufacturing of medical devices, the demand for specialized cleaning solutions will inevitably surge. A prime example is Kobe University's plan to establish a Department of Medical Device Engineering in April 2025. As more medical device manufacturing and engineering facilities come online, they will require sophisticated solutions for reprocessing, sterilization, and cleaning, thereby significantly boosting the market's growth.

Detailed Segmentation

Device Type Insights

The semi-critical segment dominated the market, accounting for 46.02% of the revenue in 2023 due to the increasing number of therapeutic and diagnostic procedures. Semi-critical devices include endoscopes that come in contact with mucous membranes but do not penetrate sterile tissue. These devices need high-level disinfection to control the transmission of infections. Moreover, the growing prevalence of HAIs is anticipated to support the segment growth over the forecast period.

Technique Insights

The disinfection segment dominated the market in 2023, accounting for 49.53% of the revenue share. The segment's growth can be attributed to the stringent regulations and standards that need to be followed for healthcare facilities. Furthermore, the growing demand for surgical procedures that require intricate and delicate medical instruments is anticipated to propel the demand for disinfection processes.

EPA Classification Insights

The intermediate-level segment dominated the market and accounted for the largest revenue share, at 48.84% in 2023. These disinfectants are easy to integrate into routine cleaning protocols and provide the necessary level of microbial control, making them the preferred choice. In addition, they are cost-effective. Thus, the cost-effectiveness and ease of use associated with these disinfectants are anticipated to propel the segment's growth in the coming years.

Growing Aging Population

The graph shows the increasing elderly population in different prefectures throughout Japan. The highest percentage of individuals aged 65 and above was found in Akita-ken, while the lowest was in Tokyo-to. This age group witnessed an increase in 44 prefectures. As of October 2023, around 29.1% of Japan's population was aged 65 and over, representing approximately 36,227 thousand individuals. In addition, the European Parliament projects that by 2036, approximately 33.33% of Japan's population will be 65 years and older. The older population is more susceptible to chronic diseases that can lead to increased hospitalizations. As a result, the increasing burden of the older population and the rising number of hospitalizations are anticipated to boost the demand for medical device cleaning products in the coming years.

Key Japan Medical Device Cleaning Company Insights

ASP (Fortive Corporation), Getinge, Syntegon Technology GmbH, Udono Limited, Yoshida Pharmaceutical, AMTEC CO., LTD., and Clean Chemical Co., Ltd. are some of the major players in the market. The industry players are undertaking several strategic initiatives such as acquisitions, partnerships, and collaborations. Moreover, the launch of novel products is anticipated to boost the competitive rivalry in the Japanese market.

Key Japan Medical Device Cleaning Companies:

- ASP (Fortive Corporation)

- Getinge

- Syntegon Technology GmbH

- Udono Limited

- Yoshida Pharmaceutical

- AMTEC CO., LTD.

- Clean Chemical Co., Ltd.

Japan Medical Device Cleaning Market Segmentation

Grand View Research has segmented the Japan Medical device cleaning market based on the device type, technique, and EPA classification:

Japan Medical Device Cleaning Device Type Outlook (Revenue, USD Million, 2018 - 2030)

- Non-Critical

- Semi-Critical

- Critical

Japan Medical Device Cleaning Technique Outlook (Revenue, USD Million, 2018 - 2030)

- Cleaning

- Disinfection

- Sterilization

Japan Medical Device Cleaning EPA Classification Outlook (Revenue, USD Million, 2018 - 2030)

- High Level

- Intermediate Level

- Low Level

Curious about the Japan Medical Device Cleaning Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Recent Developments

- In July 2024, Getinge collaborated with Medical Bear to incorporate Getinge's T-DOC sterile supply management solution into Medical Bear's operations. With this integration, the company adopted the digitalization of sterile supply flows, which highlights the increasing focus of companies on digitalizing sterile workflows.

- In July 2024, Innovative Health, Inc. partnered with MC Healthcare to develop a single-use medical device reprocessing program in Japan.