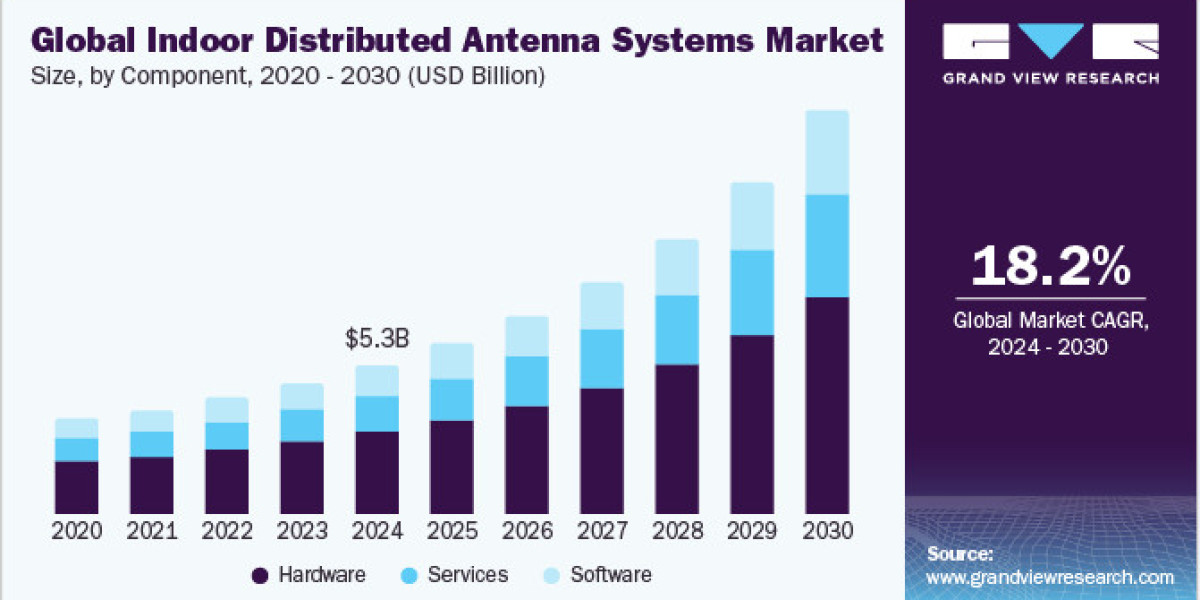

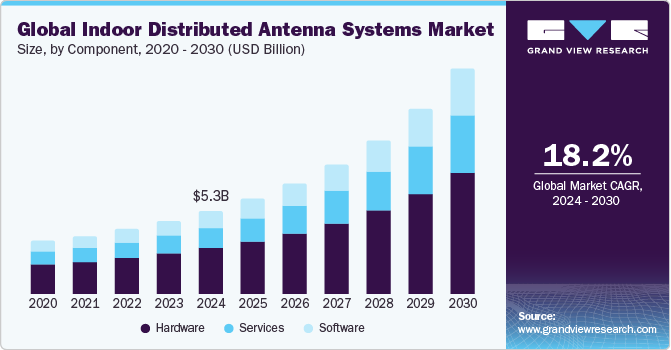

Imagine trying to use your smartphone in a bustling airport, a packed stadium, or even just inside a sprawling office building, only to be met with frustratingly weak signals. This is the challenge that the global indoor distributed antenna system (DAS) market is solving. Valued at USD 5.28 billion in 2023, this crucial market is projected to surge at an impressive CAGR of 18.2% from 2024 to 2030.

The relentless proliferation of smartphones, tablets, and IoT devices, combined with the widespread deployment of 5G networks, has created an insatiable demand for seamless, high-capacity indoor wireless coverage. Beyond personal convenience, there's a vital public safety aspect; regulations like FirstNet in the U.S. are driving DAS adoption in key locations to guarantee reliable connectivity for emergency services. For businesses, uninterrupted connectivity translates directly into enhanced productivity and heightened customer satisfaction, making DAS an indispensable tool for growth.

The Architecture of Seamless Connectivity

At its core, a Distributed Antenna System (DAS) is an intricate web of strategically placed antennas woven throughout a building or indoor space. These antennas are cleverly linked to a central hub, or base station, which acts as the nerve center, efficiently distributing wireless signals for cellular networks, Wi-Fi, and critical public safety communications. The primary goal is simple: to dramatically enhance and extend wireless coverage and capacity within enclosed environments. In our increasingly connected world, where data demands are constantly soaring, and the expectation of uninterrupted access is paramount, DAS ensures individuals and organizations enjoy a consistently reliable indoor wireless experience.

Get a preview of the latest developments in the Indoor Distributed Antenna Systems Market; Download your FREE sample PDF copy today and explore key data and trends

DAS in Action: Powering Diverse Industries

Indoor DAS plays a pivotal role across a multitude of industries, ensuring robust connectivity where it matters most. In bustling office buildings, DAS facilitates seamless communication and access to critical business applications, boosting productivity and improving the visitor experience. In shopping malls, it enriches the retail journey, supports location-based marketing, and drives customer engagement. For healthcare facilities, DAS is a lifeline, enabling timely communication among medical professionals and providing patients with essential connectivity for comfort. At stadiums and arenas, it effortlessly handles high-density crowds, elevating attendee experiences and streamlining event organization. And in the hospitality sector, these systems cater to the evolving connectivity needs of guests and conferences, enhancing satisfaction and attracting more events. Across all these diverse applications, indoor DAS acts as a powerful enabler, fostering improved experiences, productivity, and safety, making it an integral component of modern indoor infrastructure.

Drivers, Challenges, and Opportunities

The remarkable growth of the indoor DAS market is propelled by several key forces: the ever-increasing demand for enhanced connectivity from mobile and IoT devices, the explosion in data consumption from activities like video streaming, and the critical need for robust network solutions. Furthermore, advancements in technologies like 5G and Wi-Fi 6 necessitate indoor systems capable of supporting higher speeds and lower latency, making DAS essential. Public safety mandates also underscore its importance, ensuring reliable communication for emergency responders.

However, the market isn't without its hurdles. High installation and maintenance costs, coupled with complex deployment processes, can pose barriers, especially for smaller enterprises. Supporting multiple frequency bands and technologies adds to this complexity, challenging system design and integration.

Despite these challenges, opportunities abound. Emerging regions, driven by rapid urbanization and infrastructure development, represent fertile ground for DAS expansion. The integration of DAS with smart building technologies promises enhanced building intelligence and efficiency. Strategic partnerships between DAS providers, telecom operators, and building owners can lead to more cost-effective deployments, while collaborations with technology providers can spark innovative solutions. Yet, navigating varying regulatory and compliance issues across regions, coupled with the need for continuous investment in system upgrades to combat rapid technological obsolescence, remain ongoing challenges. Ensuring optimal performance and mitigating interference in densely populated areas also requires constant vigilance.

Detailed Segmentation

Component Insights

The hardware segment led the market and accounted for more than 55% share of the global revenue in 2023. By component segment, the market is bifurcated into hardware, software, and services. The hardware segment is further categorized as antenna nodes, base stations, and others (radio frequency cables, connectors and splitters, fiber optics. The primary role of DAS hardware components, such as antennas, cabling, and amplifiers, is to extend wireless coverage and capacity within indoor spaces. By strategically placing antennas and using quality cabling, distributed antenna systems ensure that cellular and wireless signals reach every building corner, eliminating dead zones and ensuring a seamless user experience. Indoor DAS hardware is designed to support multiple frequencies and technologies, including cellular, Wi-Fi, and public safety communications. This flexibility ensures that the DAS can adapt to changing wireless standards and evolving user needs, making it a future-proof solution for indoor connectivity.

Type Insights

The active segment led the market and accounted for more than 41.0% share of the global revenue in 2023. By end-user segment, the market is bifurcated into active, passive, and hybrid. Active DAS plays a pivotal role in the indoor DAS market due to their ability to efficiently amplify and distribute wireless signals within buildings. Their significance stems from several key benefits that drive their growth. Active indoor distributed antenna systems offer enhanced coverage, eliminating dead zones and ensuring consistent connectivity, which is especially vital in large venues like stadiums and malls. Secondly, these systems improve network capacity, handling high data traffic during crowded events without compromising service quality. Their scalability supports future expansion and is carrier agnostic, catering to diverse user bases. In addition, active distributed antenna systems optimize network performance, deliver high data rates, and are crucial for public safety communication. Investing in active indoor distributed antenna systems provides businesses and venues with a competitive edge, reliability, and futureproofing in an ever-evolving telecommunications landscape.

Financing Model Insights

The operator funded segment led the market and accounted for more than 49% share of the global revenue in 2023 and is anticipated to grow at a CAGR of 17.0% throughout the forecast period. By financing model, the market is bifurcated into operator funded, build to suit (third party owner), and venue/customer funded. The mobile network operators (MNOs) cover the costs of installing and maintaining DAS infrastructure within a venue. This model's dominance is due to the considerable benefits it provides to both operators and venue owners. Operators are driven to enhance their network coverage and capacity to maintain customer satisfaction and reduce churn. They invest in DAS to deliver high-quality service in high-traffic locations like shopping malls, stadiums, airports, and corporate buildings, where seamless connectivity is essential. For operators, this model presents the opportunity to directly control network performance and quality. By financing the DAS infrastructure, operators can ensure that the systems are optimized for their specific network needs, leading to improved service delivery and higher customer satisfaction.

Facility Type Insights

The large buildings (over 500 thousand square feet) segment led the market and accounted for more than 45% share of the global revenue in 2023 and is anticipated to grow at a CAGR of 16.4% throughout the forecast period. Large buildings, such as shopping malls, airports, hospitals, and corporate headquarters, represent the dominant segment in the Indoor DAS market. The sheer size and structural complexity of these buildings often result in poor wireless signal penetration and coverage, necessitating the deployment of robust DAS solutions to ensure reliable connectivity. Growth in this segment is driven by the increasing demand for uninterrupted, high-quality wireless services from both consumers and businesses. The rise of smart building technologies and the Internet of Things (IoT) further amplifies the need for comprehensive indoor wireless coverage to support a growing array of connected devices and applications.

Application Insights

The healthcare segment led the market and accounted for 27.0% share of the global revenue in 2023. By application segment, the market is bifurcated into healthcare, manufacturing, hospitality & commercial, transportation & logistics, others (government, educational institutes, warehouse). This significance of these systems within the healthcare sector arises from seamless and real-time communication, which is essential for medical staff to coordinate patient care and access electronic health records, which distributed antenna systems facilitates, leading to improved patient outcomes. Additionally, augmenting telemedicine services requires robust indoor wireless connectivity, and DAS supports effective virtual consultations and remote patient monitoring. These systems enhance the overall patient experience by enabling patient and family connectivity, particularly during hospital stays.

Regional Insights

North America is estimated to have a market share of 30.0% in 2023. Indoor DAS holds significant importance in North America due to the region's advanced telecommunications landscape and the increasing demand for uninterrupted connectivity. The region's population is highly connected with widespread smartphone and IoT device usage, making indoor DAS crucial for meeting the demands of seamless data access and communication. Additionally, North America prioritizes public safety compliance, where indoor DAS systems support first responders and emergency communication. Furthermore, these systems are integral to the corporate sector, fostering productivity, collaboration, and customer engagement. It also plays a vital role in the advanced healthcare system, retail innovation, transportation hubs, data centers, government facilities, and educational institutions.

Key Indoor Distributed Antenna Systems Companies:

The following are the leading companies in the indoor distributed antenna systems market. These companies collectively hold the largest market share and dictate industry trends.

- CommScope

- Corning Incorporated

- Comba Telecom Systems Holdings Ltd.

- ATC TRS V LLC

- HUBER+SUHNER

- TE Connectivity

- Telefonaktiebolaget LM Ericsson

- Nokia

- ZTE Corporation

- Huawei Technologies Co., Ltd.

- Galtronics

- Boingo Wireless, Inc.

- PBE Group

Indoor Distributed Antenna Systems Market Segmentation

Grand View Research has segregated the global indoor DAS market on the basis of component, type, financing model, facility type, application, and region.

Indoor DAS Component Outlook (Revenue, USD Million, 2017 - 2030)

- Hardware

- Software

- Services

Indoor DAS Type Outlook (Revenue, USD Million, 2017 - 2030)

- Active

- Passive

- Hybrid

Indoor DAS Financing Model Outlook (Revenue, USD Million, 2017 - 2030)

- Operator Funded

- Build to Suit (Third Party Owner)

- Venue/Customer Funded

Indoor DAS Facility Type Outlook (Revenue, USD Million, 2017 - 2030)

- Large Buildings (Over 500 thousand square feet)

- Medium Buildings (50 thousand to 499 thousand square feet)

- Small Buildings (Below 50 thousand square feet)

Indoor DAS Application Outlook (Revenue, USD Million, 2017 - 2030)

- Healthcare

- Commercial Buildings

- Residential Building

- Corporate Spaces

- Educational Institute

- Manufacturing

- Hospitality

- Transportation & Logistics

- Public Sector

- Others

Indoor DAS Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Switzerland

- Netherlands

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Philippines

- Indonesia

- Malaysia

- Bangladesh

- Latin America

- Brazil

- Argentina

- Colombia

- Chile

- Peru

- Middle East

- UAE

- Saudi Arabia

- Qatar

- Oman

- Kuwait

- Africa

- South Africa

- Morocco

- Egypt

- Nigeria

- Kenya

Curious about the Indoor Distributed Antenna Systems Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Recent Developments

- In January 2024, Rosenberger Hochfrequenztechnik GmbH & Co. KG, partnered with TTI, Inc.- Europe, a German-based, distributor of various components, including passive and interconnect components. This agreement ensures the immediate availability of Rosenberger Hochfrequenztechnik GmbH & Co. KG's product portfolio to customers in the Europe, Middle East & Africa (EMEA) region, leveraging TTI, Inc.- Europe's extensive sales network.

- In March 2024, Boldyn Networks announced the acquisition of Apogee, a provider of on-campus connectivity infrastructure in the U.S. The higher education industry is bolstering Boldyn Networks' presence and capabilities in the education sector and fueling its rapid expansion in the U.S. Apogee's clients are expected to benefit from Boldyn Networks' expanded wireless solutions, combining their full range of infrastructure. offerings and substantial investment to enhance connectivity nationwide, especially within the higher education sector.