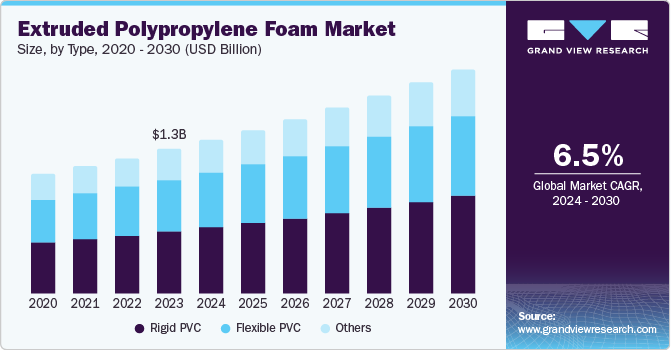

The global extruded polypropylene (XPP) foam market was a hefty USD 1.30 billion in 2023 and is set for impressive expansion, projected to grow at a compound annual growth rate (CAGR) of 6.5% from 2024 to 2030. This buoyant market is primarily buoyed by the surging consumer demand for eco-friendly packaging materials for fast-moving consumer goods (FMCG). Why XPP foam? Because it's a superstar, offering superior shock absorbency and high melt strength, making it the perfect guardian for products on their journey.

But the story doesn't end there! The automotive industry is driving demand for XPP foams into overdrive. As vehicle manufacturers adopt new technologies focused on reducing vehicle weight, and new global emission regulations emphasize lightweight materials, XPP foams are becoming indispensable. Imagine lighter, more fuel-efficient cars, where XPP foams provide crucial cushioning in seats, and find applications in engine sheds, door liners, and roof trunk liners. This growing awareness about lightweight vehicles and improved fuel efficiency is set to accelerate the consumption of these versatile products even further.

Beyond cars, the booming construction sector is also building up demand for XPP foam, primarily for its incredible energy efficiency properties. These foams are the silent protectors in our homes and refrigerators, acting as vital insulating materials. They're helping structures align with stringent building codes by dramatically reducing heating and cooling costs, promoting truly energy-efficient living spaces. And it's not just about energy; these foams are stiff, remarkably noise-resistant, lightweight, and pack a powerful punch with high impact resistance. Plus, they offer critical moisture protection in buildings, actively preventing the formation of harmful molds and mildew.

Get a preview of the latest developments in the Extruded Polypropylene Foam Market; Download your FREE sample PDF copy today and explore key data and trends

Detailed Segmentation

Type Insights

Rigid PVC foams dominated the market with a share of 43.2% in 2023, owing to the growth of the construction industry. Rigid PVC is durable, corrosion-resistant, low maintenance, and has a lower environmental impact than other plastics. This has led to widespread adoption in the construction industry for insulation, piping, and other structural components. These XPP foams are used to build insulating materials, helping improve energy efficiency by reducing heating and cooling costs. The increasing adoption of energy-efficient building codes and the rising focus on sustainable construction practices have boosted the demand for these foams in this sector. In addition, the versatility of these foams in providing moisture resistance and preventing mold growth in buildings has made them a valuable material in the construction industry.

End-use Insights

The automotive segment dominated the market in 2023. The key market drivers of XPP foams in this sector were centered on the material’s lightweight, energy-absorbing, and environment-friendly properties. XPP foam is significantly lighter than traditional materials, including PU and PP, which helps reduce the overall weight of vehicles. This weight reduction translates to better fuel economy and lower carbon emissions, aligning with global regulatory standards and consumer preferences for greener cars. Its excellent energy-absorbing properties make it ideal for use in automotive components such as bumpers, door panels, and interior padding.

Regional Insights

The extruded polypropylene foam market in North America is expected to grow at the significant rate over the forecast period. The significant expansion in the automotive and construction sectors drives this growth. In addition, there is rising demand in the automotive and packaging industries. The shift towards electric and fuel-efficient vehicles drives the need for lightweight, high-performance materials, making XPP foam an attractive option. Furthermore, the packaging industry increasingly utilizes XPP foam for its protective qualities and recyclability, aligning with consumer preferences for sustainable solutions. These factors collectively support robust market growth in North America.

Key Extruded Polypropylene Foam Companies:

The following are the leading companies in the extruded polypropylene foam market. These companies collectively hold the largest market share and dictate industry trends.

- DS Smith

- LyondellBasell Industries Holdings B.V.

- Borealis AG

- Mitsubishi Chemical Group Corporation.

- Formosa Plastics Corporation, U.S.A.

- BASF SE

- Braskem

- Toray Industries Inc

- KURARAY CO., LTD.

Extruded Polypropylene Foam Market Segmentation

Grand View Research has segmented the global extruded polypropylene foam market on the basis of type, end-use and region:

Extruded Polypropylene Foam Type Outlook (Revenue, USD Million, Volume in Kilotons, 2018 - 2030)

- Rigid PVC

- Flexible PVC

- Others

Extruded Polypropylene Foam End Use Outlook (Revenue, USD Million, Volume in Kilotons, 2018 - 2030)

- Automotive

- Packaging

- Building & Construction

- Furniture & Bedding

- Others

Extruded Polypropylene Foam Regional Outlook (Revenue, USD Million, Volume in Kilotons, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Netherlands

- Denmark

- Sweden

- Norway

- Asia Pacific

- China

- India

- Japan

- South Korea

- Thailand

- Indonesia

- Latin America

- Brazil

- Argentina

- Middle East and Africa (MEA)

- Saudi Arabia

- South Africa

- UAE

Curious about the Extruded Polypropylene Foam Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Recent Developments

- In June 2024, LyondellBasell Industries Holdings B.V. announced the start of operations at its Dalian facility under the Advanced Polymer Solutions (APS) business. This new production line manufactures polypropylene compounds for the automotive sector. The expansion enhances the company’s ability to meet the growing market demand.