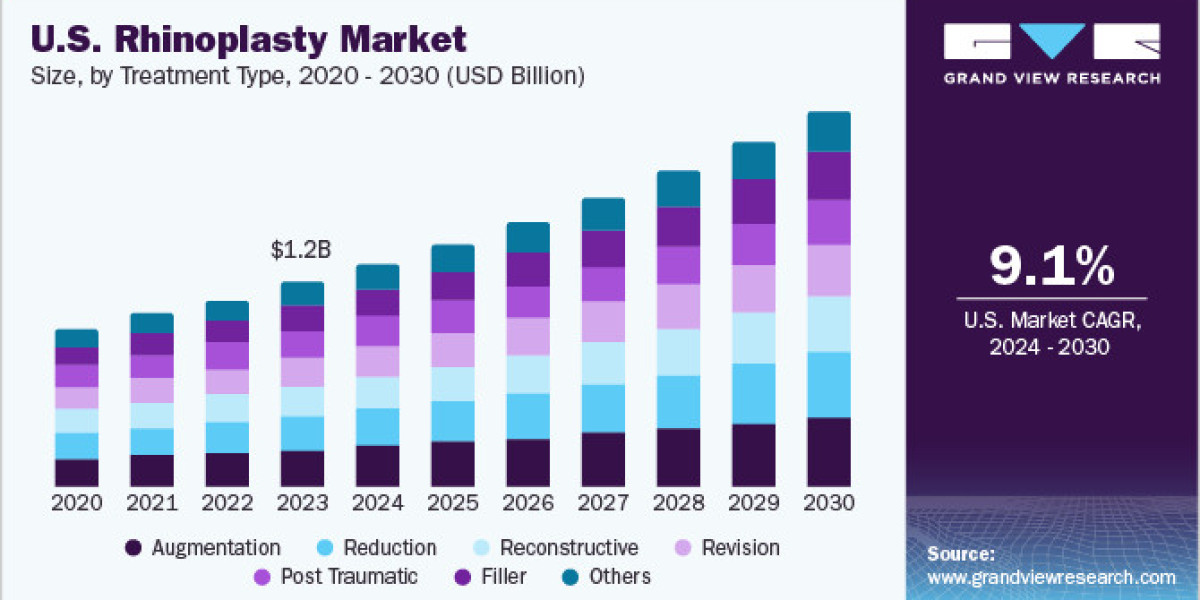

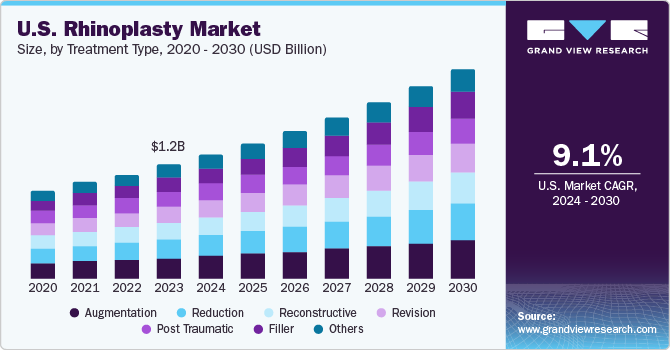

The U.S. rhinoplasty market reached an estimated USD 1.2 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 9.1% from 2024 to 2030. This growth is primarily fueled by the increasing demand for cosmetic procedures and continuous technological advancements in surgical techniques. Rhinoplasty, a surgical procedure designed to enhance both the aesthetic appearance and structural integrity of the nose, helps achieve a more balanced facial profile and can correct deformities resulting from injury or congenital conditions.

According to the National Library of Medicine, an impressive 350,000 nose-reshaping procedures are performed annually in the U.S., firmly establishing rhinoplasty as the most common plastic surgery. A key factor propelling this market expansion is the surging demand for cosmetic procedures across the U.S. The aging population and a heightened focus on health and wellness are motivating more individuals to seek cosmetic interventions to maintain a youthful appearance. Additionally, cultural influences and societal beauty standards contribute to the demand for rhinoplasty across diverse demographic groups. The widespread influence of celebrities and social media influencers showcasing their cosmetic enhancements, coupled with a growing societal acceptance of cosmetic surgery as a means of self-improvement, further drives market growth.

Advancements in medical technology have also played a crucial role in shaping the U.S. market. Innovations in surgical techniques, such as minimally invasive procedures and computer-assisted imaging, have made rhinoplasty both safer and more precise. These technological leaps have resulted in reduced recovery times, less scarring, and significantly improved outcomes for patients undergoing rhinoplasty. A notable trend observed in the U.S. market is the shift towards more personalized and natural-looking results. Patients are increasingly seeking subtle enhancements that complement their existing facial features rather than dramatic transformations. This trend has spurred the development of advanced surgical techniques focused on achieving refined outcomes while meticulously preserving each individual's unique facial characteristics.

Get a preview of the latest developments in the U.S. Rhinoplasty Market; Download your FREE sample PDF copy today and explore key data and trends

Detailed Segmentation

Technique Insights

Based on technique, the open rhinoplasty segment led the market with the largest revenue share of 51.35% in 2023 and is expected to grow at the fastest CAGR over the forecast period. This growth is attributable to its versatility and effectiveness in addressing a wide range of nasal deformities. This technique involves making an external incision on the columella (the strip of skin between the nostrils) to access and reshape the nasal structures with precision. Open rhinoplasty allows surgeons better visibility and access to nasal structures, resulting in more precise surgical outcomes compared to closed rhinoplasty techniques. According to the ASPS statistics, nose surgeries are gaining vast popularity and have become the 3rd most popular aesthetic procedure in the U.S. The average cost of the rhinoplasty in the U.S. can vary widely depending on the location, surgeon’s experience, and complexity of the procedure. However, according to a report by ASPS, the average cost of rhinoplasty is USD 6,324.

Treatment Type Insights

Based on treatment type, the market is segmented into augmentation, reconstructive, post-traumatic, revision, reduction, filler, and others. The augmentation segment led the market with the largest revenue share of 17.74% in 2023 and is expected to grow at the fastest CAGR during the forecast period. Augmentation rhinoplasty can be used to treat a variety of respiratory conditions, such as sleep apnea and chronic sinusitis. It involves procedures such as dorsal hump reduction and tip refinement, which have emerged as a dominant force in the rhinoplasty market. As more people become aware of these conditions and their treatment options, the demand for augmentation rhinoplasty is likely to increase.

Key U.S. Rhinoplasty Company Insights

Some of the key players operating in the market include Stryker; Grover Aesthetics; Sunset Cosmetic Surgery; Implantech; and Surgiform Technologies LLC.

- Stryker Corporation is a medical technology company specializing in developing innovative products and services. Stryker provides a wide range of instruments for rhinoplasty procedures, such as osteotomes, rasps, and forceps. These instruments are designed to facilitate precise cuts and shaping of nasal bones, allowing surgeons to achieve the desired aesthetic outcome. It also offers image-guided surgery systems that allow surgeons to visualize patient-specific anatomy in real-time

- Surgiform Technologies LLC is a Columbia-based bio medical company which provides nasal implants made from various materials such as silicone, Gore-Tex, or Medpor. These implants are designed to enhance the shape and structure of the nose during rhinoplasty surgery

Key U.S. Rhinoplasty Companies:

- Stryker

- Grover Aesthetics

- Sunset Cosmetic Surgery

- Implantech

- Surgiform Technologies LLC

U.S. Rhinoplasty Market Segmentation

Grand View Research has segmented the U.S. rhinoplasty market report based on treatment type, technique, and region:

U.S. Rhinoplasty Treatment Type Outlook (Revenue, USD Million, 2018 - 2030)

- Augmentation

- Reduction

- Post traumatic

- Reconstructive

- Revision

- Filler

- Others

U.S. Rhinoplasty Technique Outlook (Revenue, USD Million, 2018 - 2030)

- Open Rhinoplasty

- Closed Rhinoplasty

U.S. Rhinoplasty Regional Outlook (Revenue, USD Million, 2018 - 2030)

- U.S.

Curious about the U.S. Rhinoplasty Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends

Recent Developments

- In February 2023, Acclarent, Inc., which is a subsidiary of Johnson & Johnson, introduced its Balloon Sinuplasty Systems, RELIEVE SPINPLUS. This innovative system utilizes endoscopic techniques to help patients with sinusitis and breathing difficulties by expanding obstructed sinus ostia and passageways with the help of qualified otolaryngologists. In addition, it can be utilized for nasal reshaping procedures.