The global taste modulators market is set for significant expansion, with its value expected to reach USD 2,363.5 million by 2030. This follows an estimated market size of USD 1,452.7 million in 2023, with a projected compound annual growth rate (CAGR) of 7.2% from 2024 to 2030. This upward trajectory is primarily driven by the escalating demand for convenient and processed food products. Additives play a crucial role in this sector, enhancing flavor, optimizing texture, and extending preservation, all of which contribute to the broader food industry's growth. The reliance of the food industry on these additives stems from their ability to provide longer shelf life and significantly improve taste.

A key factor propelling this market forward is the worldwide consumer interest in health-promoting products. As a result, taste modulators have become indispensable in the functional food and beverage industry. The increased popularity of "ready-to-drink" options and products with reduced sugar or sodium content has particularly boosted the demand for modulators, especially those that enhance sweetness and saltiness. These innovative ingredients are now commonly incorporated into fortified beverages, allowing manufacturers to appeal to health-conscious consumers without compromising on the desired taste and texture experience.

Get a preview of the latest developments in the Taste Modulators Market; Download your FREE sample PDF copy today and explore key data and trends

Detailed Segmentation

Product Insights

“Sweet Modulators emerged as the fastest growing end use with a CAGR of 8.2%”

Sweet modulators segment dominated the market and accounted for a revenue share of 58.1% in 2023. Sweet modulators are compounds designed to enhance or mimic the taste of sugar, enabling the reduction or elimination of added sugars in food and drinks. They help control calorie intake and manage dietary health concerns, such as diabetes, without sacrificing sweetness. These modulators work by interacting with taste receptors on the tongue, either by amplifying the sensation of sweetness or by directly stimulating the sweet taste receptors, thereby requiring smaller quantities of sugar or artificial sweeteners to achieve the desired taste. As a result, they play a crucial role in developing healthier, low-calorie, and sugar-free food products.

End-use Insights

“Food emerged as the fastest growing end use with a CAGR of 6.0%”

Food dominated the market with a market and accounted for a revenue share of 58.9% in 2023. In the food industry, innovative ingredients enhance, block, or modify the taste profile of foods and beverages. These product market compounds help reduce sugar, salt, or fat content without compromising on taste. They are instrumental in creating healthier options for consumers, making products more palatable without the additional calories. Taste modulators interact with taste receptors, either amplifying the desired flavors or suppressing the unfavorable ones, thus playing a crucial role in product development and reformulation within the industry.

Regional Insights

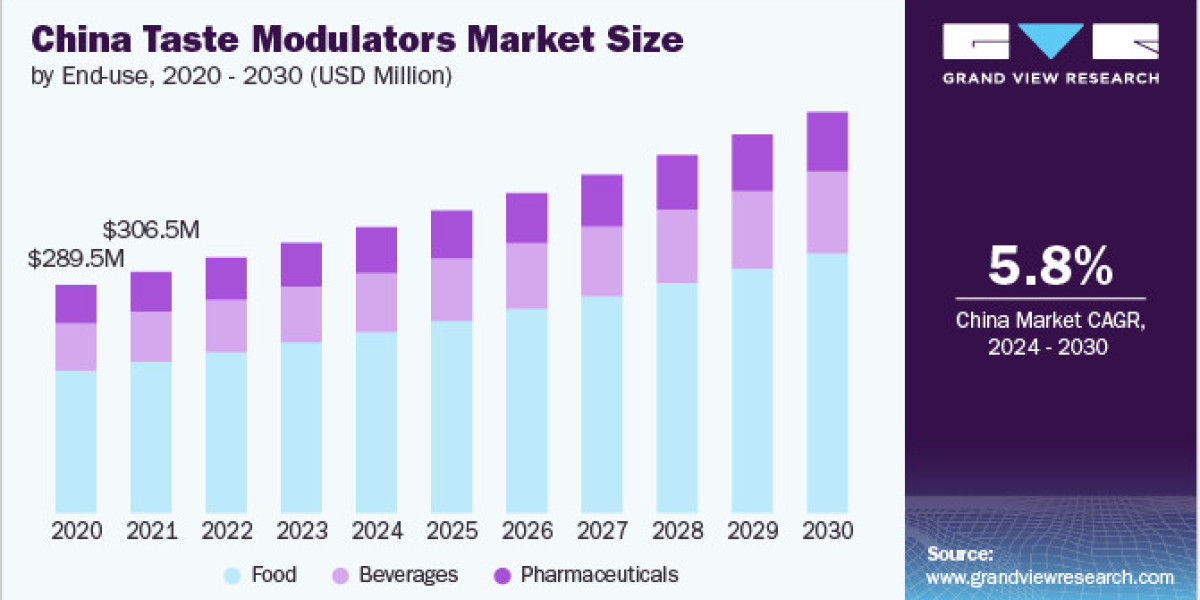

“China is expected to dominate the Asia-Pacific market with a market share of 33.5% in 2030”

Asia Pacific dominated the market and accounted for a 70.5% share in 2023. This growth is attributed to increasing demand and consumption of processed and convenience food in the region. For instance, in February 2023, according to UNICEF, Asia Pacific, known for its vibrant and diverse food cultures, changed quickly. Traditional healthy, fresh foods are being replaced by a growing consumption of highly processed junk food and drinks full of salt, sugar, and unhealthy fats.

Key Taste Modulators Companies:

The following are the leading companies in the taste modulators market. These companies collectively hold the largest market share and dictate industry trends.

- DSM

- Döhler GmbH

- IFF

- Givaudan

- Kerry Group PLC

- Ingredion

- Symrise

- Tate & Lyle

- Corbion

- Takasago International Corporation

- Cargill Incorporated

Taste Modulators Market Segmentation

Grand View Research has segmented the global taste modulators market report based on product, end-use, and region:

- Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Sweet Modulators

- Salt Modulators

- Fat Modulators

- End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Food

- Beverages

- Pharmaceuticals

- Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

Curious about the Taste Modulators Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends

Recent Developments

- In April 2023, Döhler GmbH has announced a collaboration with Ixora Scientific. The partnership aims to enhance natural taste modulation and expand Döhler's expertise in natural ingredients and integrated solutions. This collaboration will be supported by establishing a state-of-the-art hub in North Brunswick to drive rapid flavor innovation and better serve customers' needs in the US.

- In November 2021, Kerry Group PLC introduced Tastesense, the first organically certified sweet modulator. This product launch is aimed at satisfying the increasing need for organic-based sweet modulators that comply with U.S. standards in the beverage industry. These products cater to various preferences, including low- to no-sugar beverages, flavored sparkling water, energy and functional drinks, and high- and low-ABV alcoholic beverages.