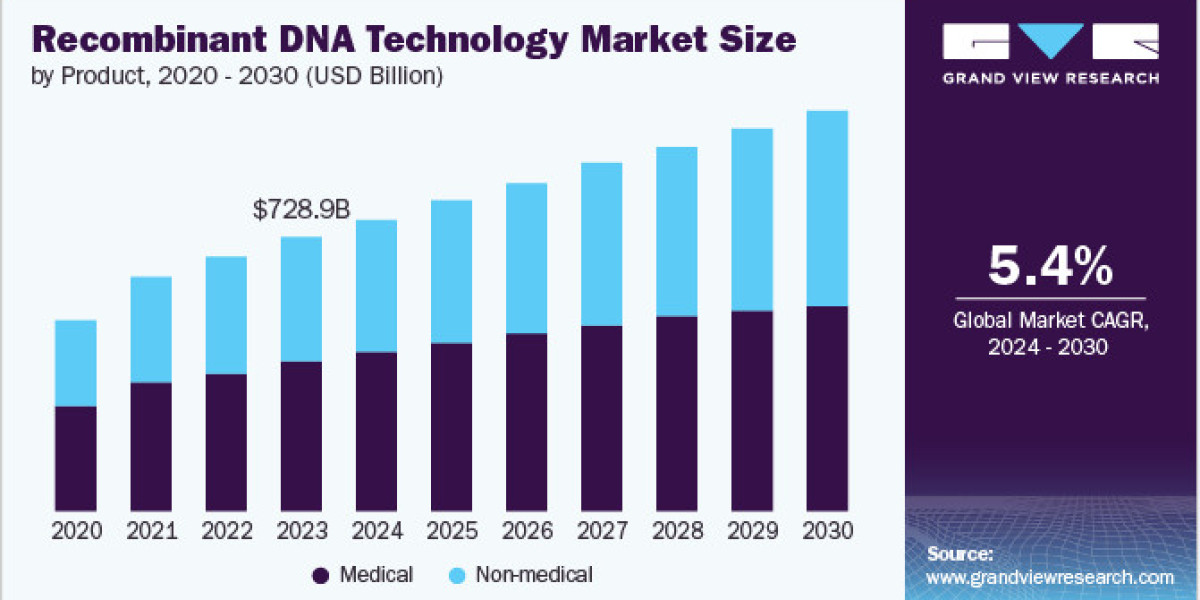

The global market for recombinant DNA technology (RDT) was valued at a substantial USD 728.9 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 5.4% from 2024 to 2030. This impressive growth is largely propelled by the increasing adoption of genetic engineering across vital sectors such as healthcare, agriculture, and industrial biotechnology. RDT is proving indispensable in healthcare, enabling the creation of novel vaccines and groundbreaking drugs, and its demand is further amplified by the escalating need for protein therapeutics and monoclonal antibodies.

RDT has truly revolutionized biological research, becoming an essential tool for enhancing traits in living organisms. Its widespread applications across diverse disciplines—including medicine, agriculture, and various industries—are key drivers of its continued growth. A primary factor fueling this expansion is the surging demand for effective treatments for a myriad of ailments, which has directly led to the development of numerous recombinant DNA-based therapies and vaccines.

Get a preview of the latest developments in the Recombinant DNA Technology Market; Download your FREE sample PDF copy today and explore key data and trends

The technology's remarkable capacity to produce vital proteins, crucial for maintaining nutrition and preventing health issues, has also significantly contributed to its rising demand. For instance, the large-scale production of insulin through RDT has profoundly benefited diabetic patients worldwide. Furthermore, the combined pressures of urbanization, global population growth, shrinking arable land, and persistent food scarcity have spurred the development of genetically modified organisms (GMOs). These GMOs are designed to act as bio-degraders and producers of clean fuel, leading to a surge in research that is expected to propel the market even further.

Market growth is additionally being driven by the emergence of innovative diagnostic kits, monitoring devices, and therapeutic approaches. In agriculture, the increasing adoption of RDT has facilitated the creation of high-yielding crops, disease-resistant varieties, and crops with improved nutritional content. Consequently, the demand for recombinant DNA-based products is anticipated to continue its upward trajectory, fueled by the urgent need for sustainable solutions to meet increasing global food demands and address pressing environmental concerns.

Detailed Segmentation

Product Insights

Medical products dominated the market and accounted for a share of 54.9% in 2023. The technology has revolutionized medicine and has significantly impacted patient treatment. It has improved illness treatment by enabling the replacement of diseased or damaged genes with healthy genes. There has been an increase in the need for different genetically engineered products used for healthcare or clinical reasons. For instance, medicines made from GMOs uses genetically modified bacteria to produce insulin.

Component Insights

Cloning vectors accounted for a revenue share of 59.3% in 2023. Segment growth worldwide is attributable to its critical role in cloning and expressing foreign genetic material. Versatile cloning vectors, such as plasmids, viruses, and artificial chromosomes, facilitate the development of genetically modified organisms, therapeutic proteins, and valuable products by inserting, amplifying, and expressing target genes.

Regional Insights

North America recombinant DNA technology market dominated the global recombinant DNA technology market in 2023 with 36.7% of its total revenue share, owing to the large number of manufacturing units in this region. Government agencies and private stakeholders in North America are driving support for biotechnology research, solidifying the region’s leadership in RDT.

Key Recombinant DNA Technology Company Insights

Some key companies in the market include Pfizer Inc., Sanofi, New England Biolabs, GlaxoSmithKline plc, and GenScript. The key players are prioritizing customer acquisition and retention by implementing strategic initiatives such as mergers, acquisitions, and partnerships with other major companies.

- Sanofi is healthcare company that develops, manufactures, and distributes vaccines and medicines. The company engages in the research and development, marketing of pharmacological products, and manufacturing, principally in the prescription market and also develops over-the-counter medications.

- New England Biolabs supplies recombinant and native enzymes for life science research, offering products and services for genome editing, synthetic biology, and next-generation sequencing.

Key Recombinant DNA Technology Companies:

The following are the leading companies in the recombinant DNA technology market. These companies collectively hold the largest market share and dictate industry trends.

- Pfizer Inc.

- Sanofi

- New England Biolabs

- GlaxoSmithKline plc

- GenScript

- Thermo Fisher Scientific Inc.

- Biogen Inc.

- Merck & Co., Inc.

- Amgen Inc.

- Monsanto Company

- F. Hoffmann-La Roche Ltd

- Novartis AG

- Eli Lilly and Company

Recombinant DNA Technology Market Segmentation

Grand View Research has segmented the global recombinant DNA technology market based on product, component, application, end use, and region:

Recombinant DNA Technology Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Medical

- Non-medical

Recombinant DNA Technology Component Outlook (Revenue, USD Billion, 2018 - 2030)

- Expression System

- Cloning Vector

Recombinant DNA Technology Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Food & Agriculture

- Health & Disease

- Environment

- Other Applications

Recombinant DNA Technology End Use Outlook (Revenue, USD Billion, 2018 - 2030)

- Biotechnology and Pharmaceutical Companies

- Academic & Government Research Institutes

- Other End Uses

Recombinant DNA Technology Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Curious about the Recombinant DNA Technology Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends

Recent Developments

- In May 2024, GenScript Biotech Corporation expanded its in vitro transcription RNA synthesis portfolio by introducing self-amplifying RNA (saRNA) synthesis services. This technology enables robust protein expression from a small amount of RNA, enhancing vaccine, immunotherapy, and gene therapy development.

- In March 2024, Eli Lilly and Company announced the presentation of three cancer treatments at the American Association for Cancer Research Annual Meeting. The presentations focused on agents targeting Nectin-4, KRAS G12D, and BRM (SMARCA2), with IND applications planned for 2024.