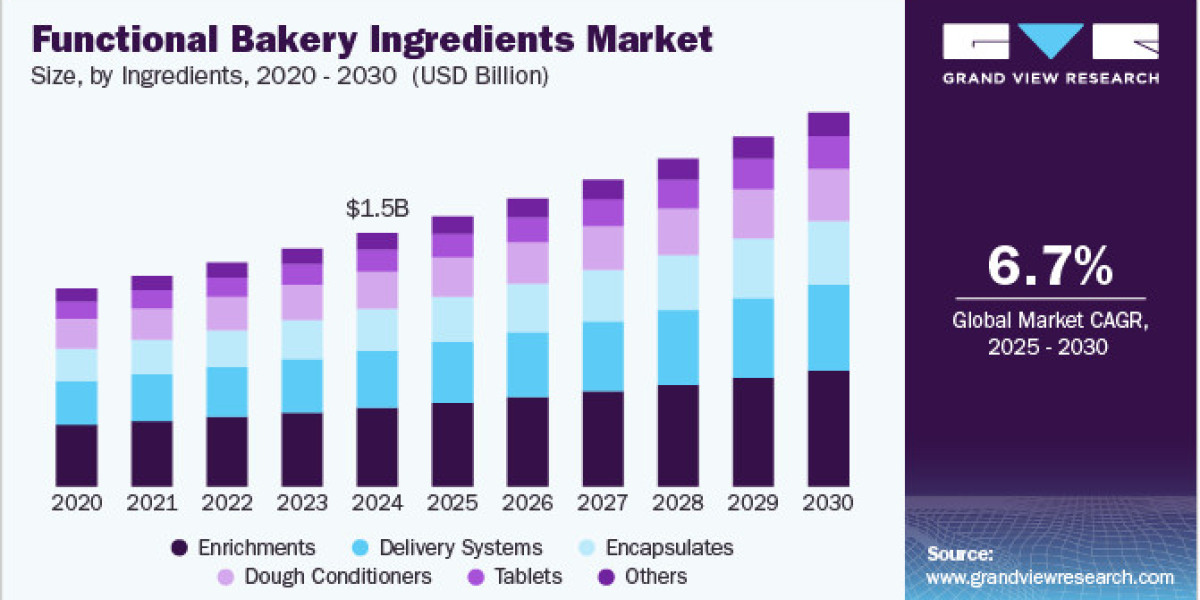

Unlocking the secrets to guilt-free indulgence, the global functional bakery ingredients market is undergoing a delectable transformation! Valued at an estimated USD 1.54 billion in 2024, this vibrant sector is set to rise at a tempting CAGR of 6.7% from 2025 to 2030. This sweet success is largely thanks to a widespread awakening around health and wellness, inspiring a fresh craving for baked goods that don't just taste good, but do good. Think baked delights brimming with extra fiber, a protein punch, or a boost of essential vitamins and minerals – satisfying cravings while nourishing the body. Bakers are now artisans, meticulously blending in whole grains, sprouted grains, prebiotics, and probiotics to craft treats that resonate with the health-conscious consumer.

The rising tide of dietary sensitivities is also shaping this market. With a growing number of individuals navigating food allergies and intolerances, particularly gluten and dairy sensitivities, there's a booming demand for innovative "free-from" bakery creations. This has sparked a revolution in ingredient innovation, bringing forth a delightful array of gluten-free flours like rice, almond, and tapioca, alongside creamy plant-based milk alternatives such as almond, soy, and coconut. Coupled with clever stabilizers and emulsifiers, these ingredients are empowering manufacturers to produce delectable, visually appealing bakery items that cater to specific dietary needs without compromising on flavor or texture. The innovation here is relentless, with new formulations continuously emerging to elevate the sensory experience of these alternative baked goods.

Get a preview of the latest developments in the Functional Bakery Ingredients Market; Download your FREE sample PDF copy today and explore key data and trends

Furthermore, our fast-paced lives and insatiable appetite for convenience are fueling the need for functional ingredients that work magic on shelf life, texture, and overall eating quality in ready-to-eat (RTE) bakery products. Enzymes, emulsifiers, and preservatives are the unsung heroes here, meticulously maintaining the freshness and stability of packaged delights, especially vital in regions with extended distribution networks or warmer climates. This trend is amplified by increasing urbanization and bustling schedules, leading consumers to reach for quick, fortified, and readily available bakery options. Beyond convenience, a powerful shift towards transparency and ethical sourcing is guiding consumer choices. This means a rising demand for plant-based proteins, natural sweeteners, and "clean-label" preservatives derived from sources like fermentation extracts or plant-based oils. Companies are actively investing in R&D to unearth sustainable and natural alternatives, meeting the evolving desires of environmentally and health-aware consumers.

Finally, the globalized food landscape and burgeoning disposable incomes in emerging economies are adding significant zest to this market. As culinary tastes diversify and Western eating patterns become more widespread, the demand for healthier and more convenient bakery products is poised for exponential growth in regions like Asia Pacific and Central & South America. This presents a golden opportunity for multinational food companies and ingredient suppliers to tap into an expanding consumer base and the increasing appreciation for the benefits of functional bakery ingredients.

Detailed Segmentation

Ingredients Insights

Functional bakery enrichments accounted for a revenue share of 31.0% in 2024, driven by increasing consumer awareness of the health benefits associated with fortified foods. Consumers actively seek products that offer added nutritional value beyond basic sustenance, leading to a greater incorporation of vitamins, minerals, and fiber into baked goods. This trend is fueled by growing concerns about nutrient deficiencies in modern diets, aging populations seeking to maintain health and vitality, and a general interest in preventative healthcare. Key growth areas within enrichments include vitamin D fortification, essential mineral additions like iron and calcium, and increased fiber content through ingredients like beta-glucan and resistant starch. The rise in vegan and vegetarian diets also contributes as individuals look to enriched baked goods to supplement nutrients often found in animal products.

Application Insights

The bread products segment accounted for a revenue share of 38.1% in 2024. Consumers are increasingly seeking bread that offers more than just basic nutrition. They desire products enriched with fiber, whole grains, protein, and prebiotics to support gut health, weight management, and overall well-being. This demand is fueled by growing awareness of the link between diet and health conditions such as diabetes, heart disease, and obesity. Furthermore, innovation in the gluten-free bread market is a significant growth driver, with consumers actively searching for better-tasting and nutritionally superior gluten-free options made with ingredients like ancient grains, tapioca starch, and modified starches that enhance texture and nutritional value. Clean-label ingredients are also paramount, with a growing preference for natural alternatives to synthetic improvers and preservatives.

Functionality Insights

The functional bakery ingredients for nutritional fortifications accounted for a revenue share of 33.2% in 2024, propelled by a growing consumer awareness of the link between diet and health. Consumers increasingly seek bakery products that offer added health benefits beyond basic sustenance, driving manufacturers to incorporate ingredients like vitamins, minerals, fiber, and protein. This trend is further fueled by the rising prevalence of nutrient deficiencies in developing countries and the increasing aging population in developed nations, creating a significant market for fortified bakery goods. Furthermore, specific dietary trends, such as gluten-free, vegan, and keto diets, have opened new avenues for fortification to compensate for potential nutrient gaps associated with these eating patterns, thereby broadening the functional bakery ingredient application.

Regional Insights

The functional bakery ingredients market in North America held over 30.9% of the global revenue in 2024, driven by a growing consumer awareness of health and wellness, leading to increased demand for products with added nutritional benefits. Consumers actively seek bakery items with higher fiber content, reduced sugar, and fortified with vitamins and minerals. Gluten-free options also remain a significant segment, though the focus is expanding beyond just eliminating gluten to incorporating ingredients that improve these products' overall nutritional profile and taste. Furthermore, the rise of vegan and plant-based diets fuels the need for functional ingredients that can replace animal-derived components while maintaining the desired texture and structure of baked goods.

Key Functional Bakery Ingredients Companies:

The following are the leading companies in the functional bakery ingredients market. These companies collectively hold the largest market share and dictate industry trends.

- dsm-firminich

- Kerry Group plc

- Cargill, Incorporated

- Archer Daniels Midland Company (ADM)

- Ingredion

- Corbion N.V.

- Tate & Lyle PLC

- International Flavors & Fragrances Inc.

- Lesaffre Group

- BASF SE

Functional Bakery Ingredients Market Segmentation

Grand View Research has segmented the global functional bakery ingredients market report based on ingredients, application, functionality, and region:

- Ingredients Outlook (Revenue, USD Million, 2018 - 2030)

- Encapsulates

- Dough Conditioners

- Enrichments

- Delivery Systems

- Tablets

- Others

- Application Outlook (Revenue, USD Million, 2018 - 2030)

- Bread Products

- Cakes & Pastries

- Cookies & Biscuits

- Others

- Functionality Outlook (Revenue, USD Million, 2018 - 2030)

- Texture & Dough Improvement

- Nutritional Fortification

- Shelf-Life Extension

- Flavor & Aroma Enhancement

- Color Enhancement

- Others

- Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia & New Zealand

- Central & South America

- Brazil

- Middle East & Africa

- South Africa

Curious about the Functional Bakery Ingredients Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends

Recent Developments

- In October 2024, Crespel & Deiters Group, a functional wheat ingredients expert, announced it had devised an innovative way to enhance the nutritional profile of baked goods, including pizza and pasta. The company introduced Lory Starch Elara, a resistant wheat starch that increases fiber content while reducing carbohydrates in products such as burger buns and cookies. This ingredient, characterized by its low water-binding capacity and few calories, allows manufacturers to create healthier options with optimal taste and texture. In addition, Crespel & Deiters highlighted its Lory Protein range, which provides high-protein content and is suitable for various baking applications.

- In May 2024, ADM launched ADMbuydirect.com, a new online storefront. The website aims to offer enhanced accessibility and convenience to producers across the U.S. food industry while buying essential ingredients. The website provides a streamlined procurement platform and delivery in 48 states across the U.S.

- In April 2024, International Flavors & Fragrances Inc. opened a new co-creation center in Wageningen, Netherlands. This center is expected to improve the company’s capabilities in research and innovation. This center's presence in an area characterized by multi-national organizations from the food industry and an increasing number of new establishments is significant.