The global cenospheres market is on a significant upward trajectory, with its value anticipated to reach USD 1,269.35 million by 2030. This expansion follows an estimated market size of USD 592.32 million in 2023, with a projected compound annual growth rate (CAGR) of 12.1% from 2024 to 2030.

This impressive growth is primarily driven by the diverse and critical applications of cenospheres, particularly within the oil and gas industry. Here, these lightweight, inert particles are incorporated into drilling fluids to significantly enhance their performance. They play a vital role in controlling and reducing friction, optimizing fluid density, and crucially, preventing blowouts during drilling operations. As a result, the increasing global gas and oil exploration activities are directly fueling the demand for these drilling fluids and their essential additives, including cenospheres.

Get a preview of the latest developments in the Cenospheres Market; Download your FREE sample PDF copy today and explore key data and trends

Detailed Segmentation

Product Insights & Trends

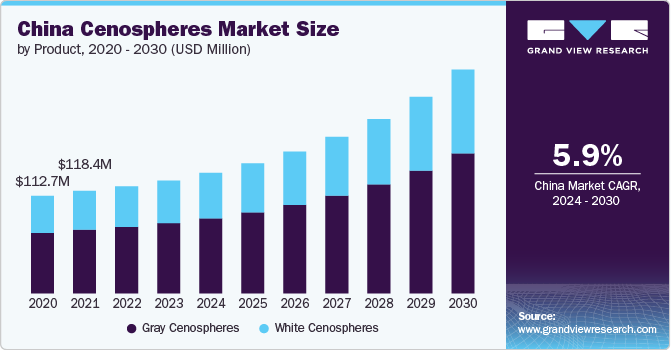

“Gray Cenospheres emerged as the fastest growing product with a CAGR of 12.2%”

The gray cenospheres segment dominated the market and accounted for a revenue share of 62.3% in 2023. The segment's growth is fueled by high demand from Europe and North America. The increasing oil & gas and construction industries in countries like India, China, and Japan are expected to further bolster the segment's growth. Gray cenospheres are a byproduct of coal combustion in thermal power plants. These are lightweight, inert, hollow spheres composed primarily of silica and alumina and filled with air or inert gas. Typically, their color ranges from gray to light gray. These spheres are used in various applications due to their low density, thermal insulation, and fire resistance properties, making them valuable in the construction, oil and gas, and automotive industries, among others.

End-use Insights & Trends

“Automotive emerged as the fastest growing end use with a CAGR of 12.8%”

The construction segment dominated the market with a market and accounted for a revenue share of 24.8% in 2023. Cenospheres, particularly the gray variety produced from coal combustion, are increasingly incorporated into the construction industry due to their unique properties. Their low density makes them an ideal additive for lightweight concrete, reducing the overall weight of structures while maintaining strength. The intrinsic thermal insulation and fire resistance of cenospheres enhance buildings' energy efficiency and safety. Moreover, their use in cement and concrete improves workability and durability and contributes to more environmentally friendly construction practices by recycling a byproduct of industrial processes.

Regional Insights & Trends

“U.S. emerged as the fastest growing region in North America with a CAGR of 10.9% in 2030”

North America dominated the market and accounted for a 34.19% share in 2023. This growth is attributed to the increasing usage of the product market for construction purposes. North American construction activities are also increasing due to the growing number of construction activities in Canada, Mexico, and the U.S.

Key Cenospheres Companies:

The following are the leading companies in the cenospheres market. These companies collectively hold the largest market share and dictate industry trends.

- PRIMA CHEM INTERNATIONAL CO., LIMITED

- Gimpex

- CAMEX GmbH

- Wolkem

- Xingtai Kehui Trading Co., Ltd.

- China Beihai Fiberglass Co., Ltd.

- Frilite SA

- Ashtec India

- Cenosphere India Pvt. Ltd.

Cenospheres Market Segmentation

Grand View Research has segmented the global cenospheres market report based on product, end-use, and region.

- Product Outlook (Volume, Kiloton; Revenue, USD Million, 2018 - 2030)

- Gray Cenosphere

- White Cenosphere

- End-use Outlook (Volume, Kiloton; Revenue, USD Million, 2018 - 2030)

- Oil & Gas

- Construction

- Automotive

- Refractory

- Aerospace

- Other End-uses

- Regional Outlook (Volume, Kiloton; Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

Curious about the Cenospheres Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends

Recent Developments

- In March 2022, Omya AG announced the acquisition of Prima Inter-Chem, a specialty chemical distributor in Malaysia. This acquisition is part of Omya's strategy to expand its presence in Southeast Asia, enhancing its regional distribution network and product offerings. Prima Inter-Chem's established market position and customer base will complement Omya's existing operations, allowing for a broader range of services and products to be offered to customers in various industries. The integration aims to strengthen Omya's footprint in the Southeast Asian market.

- In May 2021, Omya International AG, a significant company in cenosphere manufacturing, introduced a new line of functionalized calcium carbonate products for PET applications. This cost-effective opacifier is primarily used to produce white opaque PET bottles. The innovation is designed to enhance product appeal and efficiency, which is expected to drive demand and create new opportunities for market growth.