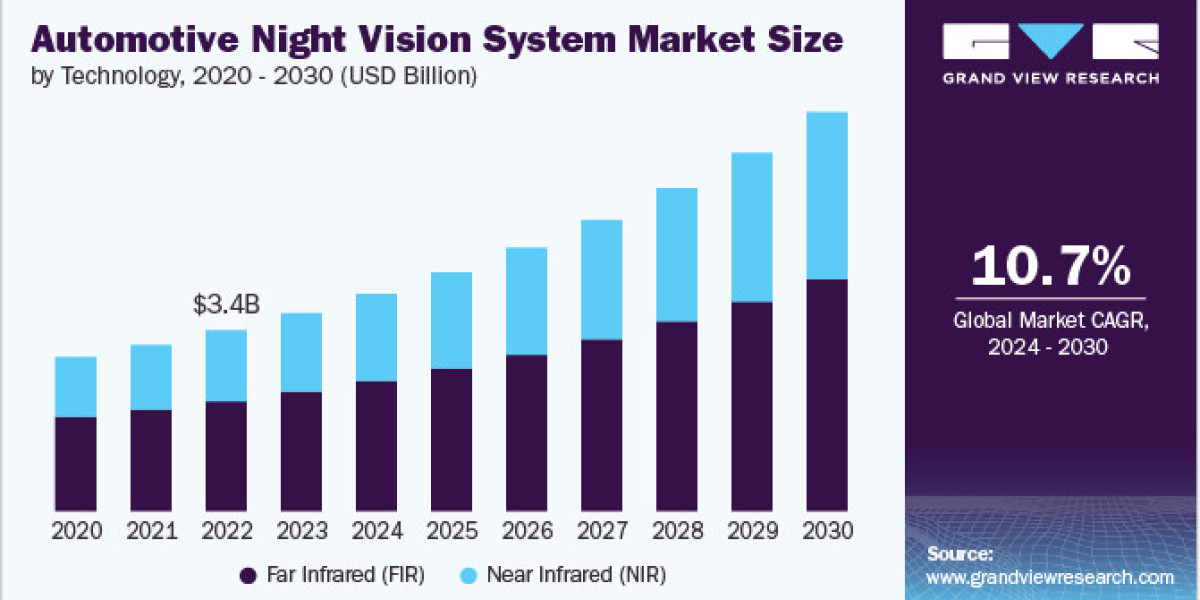

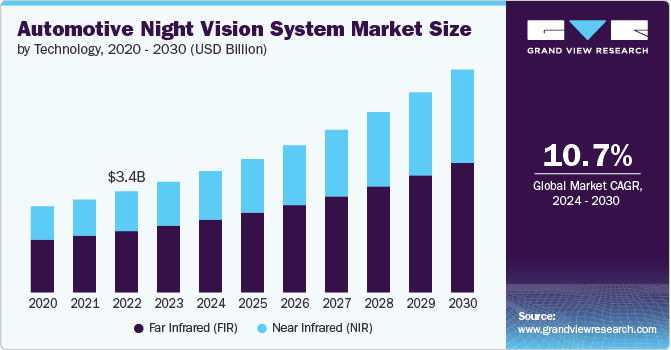

The global automotive night vision systems market valued at an estimated $3.66 billion in 2023, is projected to expand at a compound annual growth rate (CAGR) of 10.7% from 2024 to 2030. A primary catalyst for this growth is the increasing global emphasis on vehicle safety. Night vision systems significantly improve drivers' capacity to identify pedestrians, animals, and other potential hazards in low-illumination conditions, thereby playing a crucial role in mitigating the risk of accidents. As governmental bodies and regulatory agencies worldwide continue to strengthen safety regulations, automotive manufacturers are progressively incorporating advanced safety technologies, including night vision systems, into their vehicles. The collective desire to enhance road safety, particularly in regions characterized by high accident rates, is a substantial driver of market expansion.

Heightened public awareness regarding road safety concerns and the advantages offered by advanced safety features has led to a more informed consumer base willing to invest in vehicles equipped with technologies like night vision systems. The increasing frequency of accidents during nighttime driving has underscored the importance of these systems, encouraging more consumers to choose vehicles that provide enhanced visibility in low-light conditions. Furthermore, marketing initiatives undertaken by automotive manufacturers and their suppliers to educate consumers about the benefits of night vision systems are contributing to increased adoption rates.

Get a preview of the latest developments in the Automotive Night Vision System Market; Download your FREE sample PDF copy today and explore key data and trends

Moreover, the integration of night vision systems aligns with the broader industry trend towards advanced driver assistance systems (ADAS), which are becoming a standard inclusion in contemporary vehicles. Consumers are increasingly seeking vehicles that incorporate the latest technological advancements to enhance both driving convenience and safety. Night vision systems, when integrated with other ADAS technologies such as adaptive headlights and automatic emergency braking, offer a comprehensive suite of safety features that appeals strongly to safety-conscious consumers. This trend is particularly pronounced in the luxury vehicle segment, where manufacturers actively compete to offer cutting-edge technologies.

Environmental factors, including fog, heavy rainfall, and snowfall, can severely compromise visibility during nighttime driving. Night vision systems offer a significant advantage in such conditions by detecting objects that are not easily discernible with standard headlights. The adoption of night vision systems to bolster driving safety is becoming increasingly prevalent in regions experiencing harsh climatic conditions. This is particularly beneficial in areas with extended winters and frequent adverse weather. The imperative for safer driving solutions in challenging environments is a key driver for the demand for night vision systems.

However, the substantial cost associated with automotive night vision systems acts as a constraint on the market's growth. These systems necessitate sophisticated technology, such as thermal imaging cameras and infrared sensors, which are expensive to develop and manufacture. Consequently, night vision systems are typically limited to high-end or luxury vehicle models, restricting their accessibility to a wider range of consumers. This high price point can deter both consumers and automakers from investing in these systems, especially in price-sensitive markets where intense competition exists, thus leading to a slower rate of penetration of night vision systems into the mass market.

Detailed Segmentation

Technology Insights

The Far Infrared (FIR) segment dominated the market in 2023 and accounted for a 60.45% share of global revenue. Far Infrared technology offers superior detection capabilities, particularly in low-light or no-light conditions. Unlike near-infrared or visible light cameras, FIR sensors can detect thermal radiation emitted by objects, making them highly effective in identifying living beings like pedestrians, animals, and cyclists, even in complete darkness. This ability to "see" heat signatures, regardless of lighting conditions, provides a significant safety advantage, especially when traditional headlights and cameras fall short.

Component Insights

The night vision camera segment dominated the market in 2023. Rapid advancements in camera technology drive the market's growth. Modern night vision cameras have become more sophisticated, offering higher resolution, greater sensitivity to low light, and enhanced image processing capabilities. These improvements allow more precise and accurate detection of objects, pedestrians, and animals in low-light or nighttime driving conditions.

Vehicle Insights

The passenger vehicles segment dominated the market in 2023. Adding advanced features such as night vision systems can enhance the resale value of passenger cars. Buyers often perceive vehicles with safety technologies as more valuable and desirable, which can lead to higher resale prices. For consumers and automotive manufacturers alike, night vision systems can be seen as an investment in the vehicle’s long-term value. This perception of added value encourages more automakers to offer night vision systems as a feature in their passenger cars, contributing to market growth.

Regional Insights

The North America automotive night vision system market dominated the global market and accounted for a revenue share of 33.86% in 2023. This market has a significant segment dedicated to premium and luxury vehicles, where advanced safety features are highly sought after. Night vision systems are often included in the option packages for these high-end vehicles, catering to consumers willing to invest in the latest technology for enhanced safety and comfort.

Key Automotive Night Vision System Company Insights

Companies focus on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Automotive Night Vision System Companies:

The following are the leading companies in the automotive night vision system market. These companies collectively hold the largest market share and dictate industry trends.

- Robert Bosch GmbH

- Valeo

- OmniVision

- Lanmodo

- InfiRay

- Teledyne Technologies Incorporated

- Teledyne FLIR LLC

- Continental AG

- HUDWAY

- Autoliv Inc.

Automotive Night Vision System Market Segmentation

Grand View Research has segmented the global automotive night vision system market based on technology, component, vehicle, and region:

- Technology Outlook (Revenue, USD Million, 2018 - 2030)

- Far Infrared (FIR)

- Near Infrared (NIR)

- Component Outlook (Revenue, USD Million, 2018 - 2030)

- Night Vision Camera

- Controlling Unit

- Display Unit

- Sensor

- Others

- Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

- Passenger Vehicles

- Commercial Vehicles

- Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Middle East & Africa

- UAE

- Kingdom of Saudi Arabia

- South Africa

Curious about the Automotive Night Vision System Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends

Recent Developments

- In January 2024, Valeo, an automotive technology company, collaborated with Teledyne FLIR, a thermal imaging solutions provider, to bring thermal imaging technology to the automotive industry for enhanced road user safety. The collaboration will introduce Automotive Safety Integrity Level (ASIL) B-rated thermal imaging technology for night vision in Advanced Driver Assistance Systems (ADAS). The system will enhance Valeo's broad array of sensors and leverage its ADAS software stack to enable features like automatic emergency braking (AEB) during nighttime for both commercial and passenger vehicles and autonomous cars.

- In October 2023, Koito Manufacturing Co., Ltd. and Denso Corporation announced a collaboration to enhance the object recognition capabilities of vehicle image sensors. By integrating their advancements in lamps and image sensors, the two companies seek to boost nighttime driving safety. Their joint efforts are part of a broader commitment to enhancing vehicle safety and striving towards a future with zero traffic accident fatalities, addressing one of the automotive industry's most pressing challenges. Improving safety during night driving is a key focus of this development.