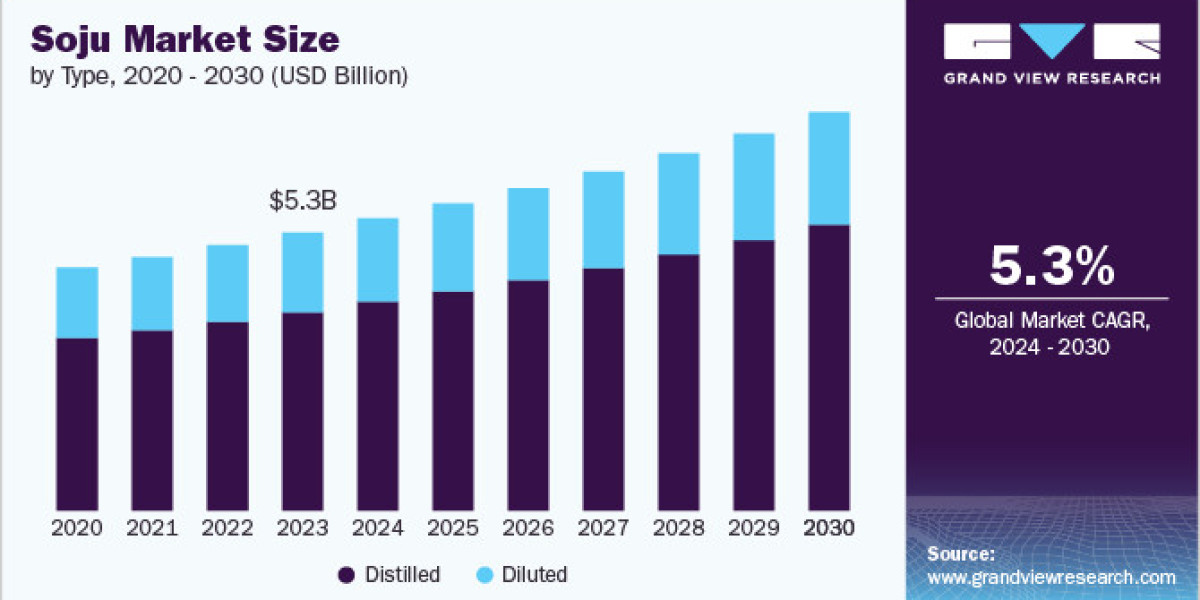

Imagine a spirit as smooth as a K-drama storyline and as vibrant as a K-pop beat, quietly captivating the world. This is soju, the Korean elixir. Global soju market was valued at USD 5.30 billion in 2023 and is now poised for a graceful ascent, projected to grow at an annual rate of 5.3% from 2024 to 2030. What's the secret behind this rising tide? It's a fascinating blend of culture, flavor, and savvy market dynamics.

The "Korean Wave," that irresistible surge of K-dramas and K-pop, has acted as a powerful ambassador, igniting a global curiosity not just for Korean entertainment, but also for its culinary and beverage traditions. Soju, once a regional treasure, is now finding its way into glasses and conversations worldwide, its appeal amplified by this cultural fascination.

But soju's charm isn't solely based on its heritage. Its chameleon-like flavor profile and remarkable versatility make it a delightful discovery. Whether sipped neat, chilled on the rocks, or artfully mixed into a cocktail, it adapts to diverse tastes. Moreover, in an era of mindful consumption, its relatively lighter alcohol content and fewer calories compared to its spirited counterparts make it an alluring choice for those seeking a guilt-free indulgence.

Get a preview of the latest developments in the Soju Market; Download your FREE sample PDF copy today and explore key data and trends

Economic realities also play a significant role in soju's expanding footprint. Often more accessible to the wallet than whiskey or vodka, it resonates with budget-conscious consumers without compromising on experience. Furthermore, its increasing availability – flowing through international distribution channels, appearing on online platforms, and gracing the menus of a growing number of Korean restaurants and bars across the globe – has broadened its reach and accessibility.

Soju's evolution is also marked by a playful spirit of innovation. Manufacturers are crafting a vibrant spectrum of flavors to entice evolving palates. Imagine the sweet kiss of peach, the refreshing burst of grape, or the zesty tang of citrus, alongside more exotic infusions like the calming notes of green tea or the delicate sweetness of lychee. These flavorful variations are proving particularly popular among younger generations, making soju more approachable and exciting. Simultaneously, a sophisticated undercurrent of premium and craft soju offerings is emerging, attracting discerning consumers willing to invest in elevated quality and unique flavor journeys. These aged or artisanal soju varieties are positioning themselves as refined alternatives to traditional spirits.

In a significant move signaling soju's growing global stature, December 2023 saw Spirit of Gallo, a major player in the beverage industry, embrace soju into its portfolio through a strategic partnership with LOTTE Chilsung Beverage Co., Ltd. This collaboration will introduce three distinct soju brands – Soonhari, Chum Churum, and Saero – to the U.S. market starting in January 2024. This traditional Korean spirit has already captured the attention of American consumers, particularly multicultural audiences and Gen Z, drawn to its lower alcohol content and its adaptable nature in a variety of drinks. This partnership marks a new chapter in soju's global story, promising to bring its unique charm to even wider audiences.

Detailed Segmentation

Type Insights

Distilled soju accounted for a revenue share of 71.30% in 2023. The strong social drinking culture associated with soju, particularly in South Korea, is being embraced and adopted in other countries. This trend is especially notable among Korean expatriates and individuals interested in Korean cuisine and social practices. Furthermore, global mixologists recognize soju's versatility in cocktails, enhancing its presence in bars and restaurants.

Distribution Channel Insights

Off-trade accounted for a revenue share of 69.20% in 2023.Off-trade channels provide consumers easy access to soju at their convenience, whether in physical stores or online. This accessibility allows consumers to purchase soju without the need to visit specialized venues or bars, making it a more convenient option for home consumption. Off trade is further segmented into supermarkets & hypermarkets, convenience stores, online, and others.

Packaging Insights

Bottled soju accounted for a revenue share of 48.50% in 2023. Bottled soju preserves flavor and quality better than other packaging options. The sealed bottle helps maintain the integrity of the soju, ensuring that it remains fresh and enjoyable for a longer period, which can boost consumer confidence and preference for bottled options.

Regional Insights

The soju market in North America accounted for a revenue market share of 20.20% in 2023. Soju's versatility in cocktails and mixed drinks is gaining traction among North American consumers. Bartenders and mixologists are increasingly incorporating soju into innovative and diverse cocktail recipes, enhancing its appeal in bars and restaurants across the region.

Key Soju Company Insights

The soju market is characterized by dynamic competitive dynamics shaped by a combination of factors, including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective, quality products.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the ingredients used while strictly adhering to international regulatory standards.

Key Soju Companies:

The following are the leading companies in the soju market. These companies collectively hold the largest market share and dictate industry trends.

- HiteJinro Co., Ltd.

- Lotte Chilsung Beverage Co., Ltd.

- Korea Alcohol Co., Ltd.

- Hwayo

- The Soju Company

- OB Brewing Co., Ltd.

- Sool Soju

- Tokki Soju

- The Han

- C1 Soju

Soju Market Segmentation

Grand View Research has segmented the global soju market based on type, packaging, distribution channel, and region.

Soju Type Outlook (Revenue, USD Million, 2018 - 2030)

- Distilled

- Diluted

Soju Packaging Outlook (Revenue, USD Million, 2018 - 2030)

- Bottles

- Cans

- Pouches

Soju Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

- On Trade

- Off Trade

Soju Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Central & South America

- Brazil

- Middle East & Africa

- UAE

Curious about the Soju Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Recent Developments

- In March 2024, HiteJinro launched a new soju brand called "Chamisul Fresh" in the U.S. market. This product is designed to appeal to American consumers by offering a smooth and mellow taste profile, which is less intense than traditional soju. The company aims to promote Chamisul Fresh as a versatile beverage suitable for various occasions, including casual gatherings and dining experiences. HiteJinro is focusing on expanding its presence in the U.S. as the demand for soju continues to grow, particularly among younger consumers and those interested in Korean culture.