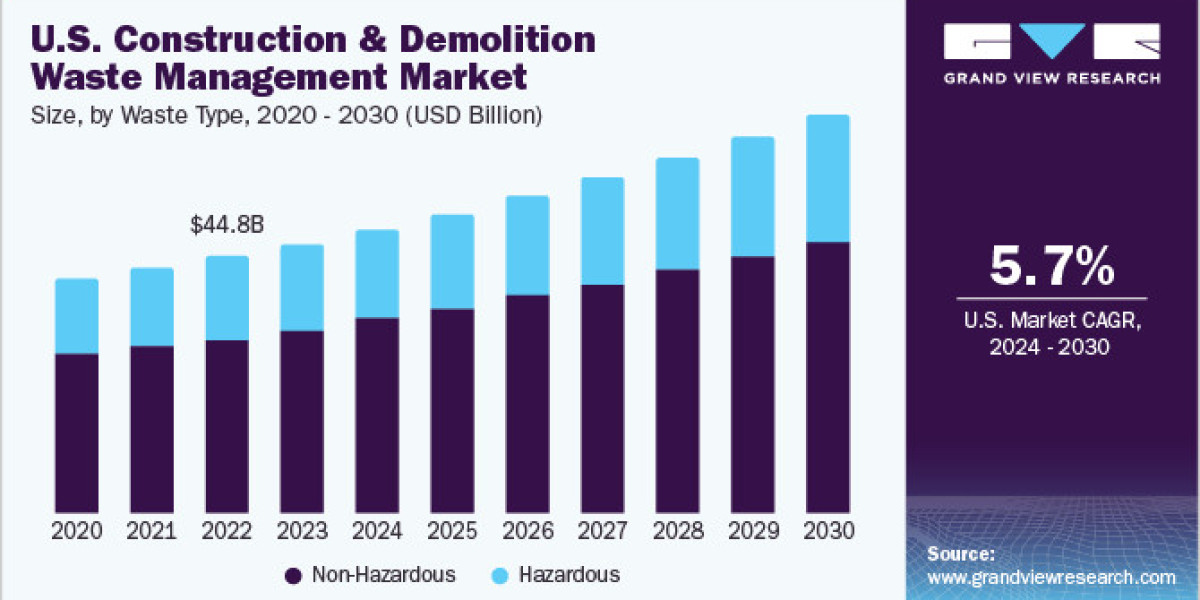

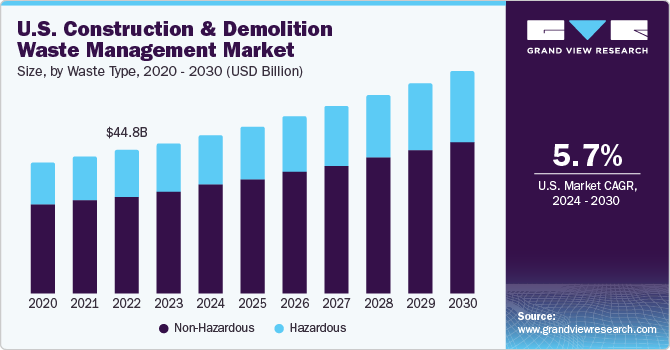

The global construction & demolition waste management market size was estimated at USD 209.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.7% from 2024 to 2030. The market is significantly driven by the growth in construction projects and renovation activities across the world. Construction and demolition activities generate huge amounts of waste material such as wood, metal, concrete, sand, soil, bricks, etc. The rising initiatives by various governments to manage this waste in an environmentally sound way are expected to increase the potential of construction and demolition waste recycling and reuse.

In the U.S., the Environmental Protection Agency (EPA) has established a set of rules and guidelines to efficiently manage construction and demolition waste. EPA promotes a sustainable approach known as Sustainable Materials Management (SMM) that can identify construction and demolition (C&D) debris, which has the potential to be reused in building materials in new construction projects.

Further, new technological advancements in the sustainable recycling of construction and demolition waste are likely to positively impact C&D waste management. For instance, in April 2023, Holcim launched ECOCycle, a proprietary circular technology platform used for recycling construction and demolition waste materials. This platform sustainably processes construction and demolition waste using efficient distribution, grinding, processing, and recycling.

Get a preview of the latest developments in the Construction and Demolition Waste Management Market; Download your FREE sample PDF copy today and explore key data and trends

Construction & demolition waste management market is also propelled by the growth of the construction and demolition projects owing to the increase in the population. According to the U.S. Census Bureau, in December 2023 total of 1.5 million housing permits were granted in the U.S., and 1.6 million housing projects were completed. The total housing permits in December 2023 increased by 1.9% compared to November 2023 and 6.1% growth compared to December 2022. Thus, rising construction projects in the U.S. is expected to increase the demand for C&D waste management over the forecast period.

Further, strategies and initiatives by the leading key players and authorities in the market are expected to facilitate the efficient management of construction and demolition waste over the forecast period. For instance, in Lancaster, New Hampshire, U.S., a pilot program was conducted from May 30 to July 2023 to divert C&D waste from landfill to residential reuse. The program was conducted with technical assistance from the Northeast Resource Recovery Association. Such initiatives are expected to drive the growth of the C&D waste management market over the forecast period.

Detailed Segmentation

Service Insights

The collection service segment is estimated to dominate the global construction & demolition waste management market with a 61.7% market share on the basis of revenue share in 2023. The collection of construction & demolition waste from the origin to the transport stations requires a proper vessel and vehicle. It requires door-to-door collection or site-to-site collection, which marks it as one of the largest contributors to total waste management in terms of expenditure.

Waste Type Insights

The non-hazardous waste type segment dominated the market in 2023 owing to the large number of waste generated. The C&D debris consists of various non-hazardous waste materials according to the industry classification, such as concrete, bricks, tiles, ceramics, wood, glass, plastic, etc. Certain metallic wastes, such as iron, steel, tin, aluminum, etc., are considered non-hazardous waste types. The growing construction and demolition waste are driving the growth of the segment over the forecast period.

Material Insights

The soil, sand, & gravel segment dominated the market on the basis of revenue in 2023. Construction activities require a large amount of soil, sand, & gravel used as a filling material in the construction of various different parts such as ground, foundation, underfloor filling, trenches, etc. The leftover materials from construction activities and waste generated from the demolition activities lead to a large amount of such waste materials, which are mostly recovered and reused.

Source Insights

The industrial source segment held the largest market revenue share in 2023 in the global construction & demolition waste management market. The rising manufacturing output and increasing expansion of the industrial facilities across the developing economies are likely to significantly boost the growth of the industrial segment over the forecast period.

Regional Insights

North America construction & demolition waste management market is anticipated to grow during the forecast period. The expanding population and rise in construction activities across the region have led to an increase in the volume of construction waste. With an increase in awareness around sustainability and resource management, countries in North America have started to look for options to minimize the impact of construction.

Key Construction & Demolition Waste Management Company Insights

The industry is extremely competitive due to the presence of various large numbers of waste management companies across the verticals. Waste collection, waste transportation, and waste disposal comprise various shareholders focusing on different activities. Some of the key players are integrated across the value chain and provide services from collection to disposal. Construction & demolition waste management companies use various strategies to increase their service offerings, such as expansions, mergers & acquisitions, research & development, and joint collaborations.

For instance, in February 2024, Capital Waste Services LLC, a South Carolina-based company, announced the acquisition of Herrington Industries LLC, based in Florida. Herrington Industries LLC is a provider of roll-off dumpster and landfill services, and it is one of the prominent service providers for construction and demolition materials.

Key Construction & Demolition Waste Management Companies:

The following are the leading companies in the construction & demolition waste management market. These companies collectively hold the largest market share and dictate industry trends.

- Veolia Environment S.A.

- Waste Connections

- Clean Harbors, Inc.

- Remondis

- Republic Services

- FCC Environment Limited

- WM Intellectual Property Holdings, LLC

- Kiverco

- Daiseki Co., Ltd.

- Windsor Waste

- Casella Waste Systems, Inc.

- Renewi plc

- GFL Environmental Inc.

- Metso Corporation

- Cleanaway Waster Management Limited

Construction & Demolition Waste Management Market Segmentation

Grand View Research has segmented the construction and demolition waste management market based on material, waste type, service, source, and region:

Construction & Demolition Waste Management Waste Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Hazardous

- Non-Hazardous

Construction & Demolition Waste Management Material Outlook (Revenue, USD Billion, 2018 - 2030)

- Soil, Sand & Gravel

- Concrete

- Bricks & Masonry

- Wood

- Metal

- Others

Construction & Demolition Waste Management Source Outlook (Revenue, USD Billion, 2018 - 2030)

- Collection

- Transportation

- Disposal

Construction & Demolition Waste Management Service Outlook (Revenue, USD Billion, 2018 - 2030)

- Residential

- Commercial

- Industrial

Construction & Demolition Waste Management Region Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Curious about the Construction and Demolition Waste Management Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Recent Developments

- In February 2024, Vermeer Corp., an Iowa-based company, launched the LS3600TX low-speed shredder. The new shredder offers excellent processing capabilities for processing light construction and demolition waste.

- In April 2022, CRH subsidiary Eqiom announced the successful commissioning of the construction waste recycling pilot plant in Gennevilliers, France. The plant aimed to process 50,000 tons of construction waste in 2022.