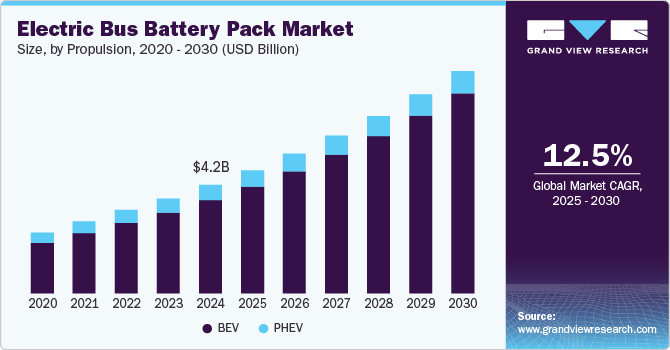

The wheels of urban transit are turning electric, powered by a market surging with potential. In 2024, the global electric bus battery pack market, estimated at USD 4,292.2 million, is charging towards a projected 12.5% CAGR from 2025 to 2030. This electrifying growth is fueled by a worldwide commitment to sustainable transportation and cleaner air in our cities. Across the globe, metropolises are enacting stringent environmental regulations and setting ambitious zero-emission targets, compelling transit authorities to trade their diesel fleets for electric buses.

Government incentives and subsidies are playing a pivotal role in jump-starting this market. Many nations are offering substantial financial support to offset the initial investment in electric buses and their vital battery packs. China's New Energy Vehicle (NEV) subsidies have been instrumental in driving adoption, while the European Union's Clean Vehicles Directive mandates minimum procurement targets for clean buses. In the U.S., the Federal Transit Administration's Low or No Emission Vehicle Program provides crucial funding for state and local governments to electrify their bus fleets and build the necessary infrastructure, further energizing market growth.

Get a preview of the latest developments in the Electric Bus Battery Pack Market; Download your FREE sample PDF copy today and explore key data and trends

Rapid urbanization is amplifying the demand for efficient and eco-conscious alternatives to traditional buses. Cities worldwide are embracing electric buses as a key strategy to combat air pollution and reduce operational expenses. Shenzhen, China, stands as a shining example, having become the first city to fully electrify its bus fleet with over 16,000 electric buses. This transformative shift is driving the demand for high-performance, long-lasting battery packs, as urban transit authorities prioritize vehicles with greater energy density and extended range.

Technological breakthroughs and the declining costs of batteries are also significantly benefiting the electric bus battery pack industry. The price of lithium-ion batteries has plummeted over the last decade, making electric buses a more economically viable option. Advancements in battery chemistry and energy density have also alleviated concerns about range, with contemporary electric buses now capable of operating for entire days on a single charge. For instance, BYD's latest battery packs boast ranges exceeding 300 kilometers, while industry leaders like CATL and LG Energy Solution continue to pioneer advanced battery technologies with faster charging capabilities and longer lifespans. Moreover, innovations in battery thermal management systems have enhanced both performance and safety, particularly in extreme weather conditions, making electric buses a more dependable choice for year-round operation.

Detailed Segmentation

Propulsion Insights

Based on the voltage rating, the electric bus battery pack industry is segmented into BEV and PHEV. BEV segment registered largest revenue market share of over 85.0% in 2024 and is expected to grow at the fastest CAGR of 13.4% during the forecast period. BEV battery packs are designed to power fully electric buses, relying solely on electricity stored in large battery systems without the support of an internal combustion engine. These battery packs typically have high voltage ratings to ensure sufficient energy density and range for commercial operations. BEVs are known for their zero tailpipe emissions, making them a popular choice for urban public transportation and cities aiming to reduce air pollution and achieve sustainability goals.

Battery Chemistry Insights

Based on battery chemistry, the market is segmented into LFP, NCA, NCM, MNC, and others. The LFP (Lithium Iron Phosphate) segment accounted for the highest revenue market share of over 60.0% in 2024. LFP batteries are widely used in electric buses due to their exceptional thermal stability, long cycle life, and high safety profile. These batteries exhibit excellent performance in high-temperature conditions and are known for their robust structural integrity, making them suitable for heavy-duty applications like electric buses.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of over 55.0% in 2024. The region benefits from robust government support and ambitious clean transportation initiatives. China has implemented aggressive policies to promote electric bus adoption, including substantial subsidies and mandates for cities to electrify their public transport fleets. For example, Shenzhen became the first city globally to achieve 100% electrification of its public bus fleet with over 16,000 electric buses. Other countries such as India have launched similar initiatives, with its FAME II (Faster Adoption and Manufacturing of Electric Vehicles) scheme allocating significant funding for electric bus procurement.

Key Electric Bus Battery Pack Company Insights

The market is characterized by intense competition. Key players such as BYD, CATL, LG Energy Solution, and Samsung SDI dominate the market with advanced battery technologies, high energy densities, and robust supply chain networks. The competitive environment is further intensified by the entry of new players, partnerships, and collaborations aimed at enhancing battery efficiency, reducing costs, and increasing energy storage capacities. Regional players are leveraging government incentives and local production capabilities to gain market share, while established companies focus on R&D, vertical integration, and scaling production to maintain their competitive edge.

- In September 2024, CATL, a major Chinese battery manufacturer, launched its new TECTRANS LFP battery range at the IAA Transportation 2024 event in Germany. This innovative battery system is designed specifically for commercial vehicles, including heavy-duty trucks and electric buses, with a focus on enhanced performance and sustainability. The TECTRANS - Bus Edition features an impressive energy density of 175 Wh/kg, which CATL claims is the highest for lithium iron phosphate (LFP) chemistry in bus applications. This model is engineered for long-distance passenger transport, enhancing vehicle layout flexibility and energy efficiency

- In October 2023, Scania unveiled its new battery-electric bus platform at Busworld, showcasing a commitment to sustainable transport solutions. This platform introduces low-entry 4×2 buses equipped with batteries that can store up to 520 kWh of energy, allowing for a range of over 500 km under optimal conditions.

Key Electric Bus Battery Pack Companies:

The following are the leading companies in the Electric Bus Battery Pack market. These companies collectively hold the largest market share and dictate industry trends.

- CATL

- WattEV

- Hitachi

- LG Energy Solution

- SK Innovation

- XALT Energy

- Tesla

- Proterra

- BYD

- Samsung SDI

Electric Bus Battery Pack Market Segmentation

Grand View Research has segmented the Electric Bus Battery Pack marketbased on target group and region:

- Propulsion Outlook (Revenue, USD Million, 2018 - 2030)

- BEV

- PHEV

- Battery Chemistry Outlook (Revenue, USD Million, 2018 - 2030)

- LFP

- NCA

- NCM

- MNC

- Others

- Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Asia Pacific

- China

- India

- Japan

- Australia

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Curious about the Electric Bus Battery Pack Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.