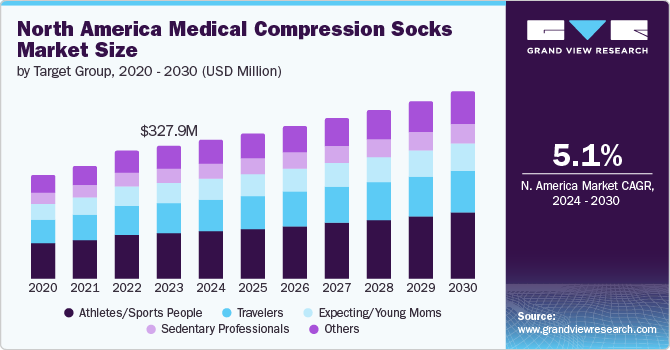

A subtle revolution in leg health is underway. In 2023, the North America medical compression socks market was valued at USD 327.9 million, and it's stepping towards a projected 5.07% CAGR from 2024 to 2030. This steady ascent is powered by a confluence of factors: the rising tide of chronic venous disorders, the knitting together of advanced manufacturing technologies, a growing understanding of available treatments, and the demographic shift towards an aging population. The expanding digital storefront of online retail and supportive reimbursement landscapes are also contributing to this market's overall growth narrative. The increasing occurrence of conditions like deep vein thrombosis, varicose veins, and lymphedema within the region's population is a primary driver, creating a significant demand for these supportive socks. Notably, the Society for Vascular Surgery reports that approximately 40.0% of adults in the U.S. grapple with chronic venous insufficiency.

As North America ages, so too does the prevalence of venous disorders, leading to a greater need for medical compression socks. The U.S. Census Bureau projects that the number of Americans aged 65 and older will reach a substantial 82.0 million by 2050, effectively doubling the current figure. Heightened awareness regarding chronic venous disorders and their treatment options is fostering greater acceptance of medical compression socks among both patients and healthcare professionals. Moreover, proactive awareness campaigns by manufacturers and healthcare organizations are encouraging early diagnosis and intervention, further propelling market growth.

Get a preview of the latest developments in the North America Medical Compression Socks Market; Download your FREE sample PDF copy today and explore key data and trends

The effectiveness of compression socks in preventing blood clots in surgical patients is underscored by studies, as noted by Dr. Joshua Beckman of UT Southwestern Medical Center in Dallas in June 2024. Modern manufacturing techniques are also weaving improvements into the very fabric of medical compression socks, enhancing their quality and comfort. The use of innovative materials and designs is attracting more consumers seeking comfortable relief. Finally, North America's thriving e-commerce sector provides convenient access to these medical aids for consumers across the continent, broadening product availability and reaching a wider audience seeking non-invasive solutions for venous issues.

Detailed Segmentation

Target Group Insights

The athletes/sports people segment dominated this market and accounted for a share of 33.96% in 2023. CEP and 2XU are brands that specialize in producing compression socks for athletes. These socks are designed to improve blood circulation, reduce muscle fatigue, and expedite recovery after physical activities. Both brands utilize graduated compression technology in their products and offer a variety of styles to cater to different preferences and requirements. These socks facilitate faster post-exercise recovery by lessening muscle soreness and inflammation. The popularity of these products among athletes is on the rise due to their efficacy in improving performance and recovery times.

The traveler segment is projected to grow at a significant rate over the forecast period. Extended travel by plane, train, car, or bus involves long periods of sitting, increasing risks of swelling, discomfort, and Deep Vein Thrombosis (DVT), as highlighted by vascular vein centers. Travelers prioritize compression socks that reduce these risks and withstand frequent use and washing without losing effectiveness. In addition, these socks must be easy to put on and take off, catering to the practical needs of travelers during transit.

Regional Insights

Strict regulations, high diabetes and cardiovascular disease rates, and a cultural shift towards proactive health and wellness shape the market. This, combined with an aging population and a focus on innovation showcased at events like Exintex in Mexico, underscores the market's growth and unique challenges. In addition, the economic landscape, with consumers willing to invest in health-related products, further fuels demand. Advancements in fabric technology and design make compression socks more comfortable and appealing and broaden their user base beyond medical needs to include athletes and those in professions requiring extended periods of standing. In 2024, a clinical study with 85 lymphedema patients evaluated JOBST Confidence and compared it to previously used garments. The study indicated that JOBST Confidence received higher ratings in the range of motion, moisture management, wearing comfort, and overall patient satisfaction.

Key North America Medical Compression Socks Company Insights

Some of the key market players operating in the North America medical compression socks market include SIGVARIS GROUP, Medi, and Mölnlycke Health Care AB. They capitalize on strategies, such as innovation, extensive product ranges, and strong brand recognition. Emerging players carve out their niche by focusing on unique products or direct-to-consumer sales via digital platforms. Moreover, strategic partnerships and collaborations with healthcare professionals and institutions are increasingly leveraged to gain market trust and augment product visibility.

Key Military Drone Companies:

The following are the leading companies in the North America Medical Compression Socks market. These companies collectively hold the largest market share and dictate industry trends.

- Julius Zorn, Inc.

- Essity

- SIGVARIS GROUP

- Medi

- Goodhew, LLC

- Cardinal Health

- Medline

- Mölnlycke Health Care AB

- CHARMKING

- Thuasne

- COMRAD

- Enovis (DJO, LLC)

- 3M

- beltwell.com

- Surgical Appliance Industries (SAIBrands)

- Ames Walker

North America Medical Compression Socks Market Segmentation

Grand View Research has segmented the North America medical compression socks marketbased on target group and region:

North America Medical Compression Socks Target Group Outlook (Revenue, USD Million, 2018 - 2030)

- Athletes/Sports People

- Travelers

- Expecting/Young Moms

- Sedentary Professionals

- Others

North America Medical Compression Socks Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

Curious about the North America Medical Compression Socks Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Recent Developments

- In April 2024, SIGVARIS GROUP celebrated its anniversary, promising continued commitment to customer well-being and innovation. The company, which has been evolving since 1961 with the development of the first medical compression stocking, highlights its long-standing dedication to improving venous disorder treatments.

- In October 2023, Sigvaris Group Britain became a British Healthcare Trades Association (BHTA) member. The company is involved in medical compression therapy and offers an extensive range of innovative products for various needs and indications.

- In January 2021, Thuasne bolstered its position in the medical device sector by acquiring Knit-Rite, a U.S.-based specialist in medical textiles. This acquisition enhanced its portfolio with innovative, patented compression therapies known for treating venous disease and lymphedema.