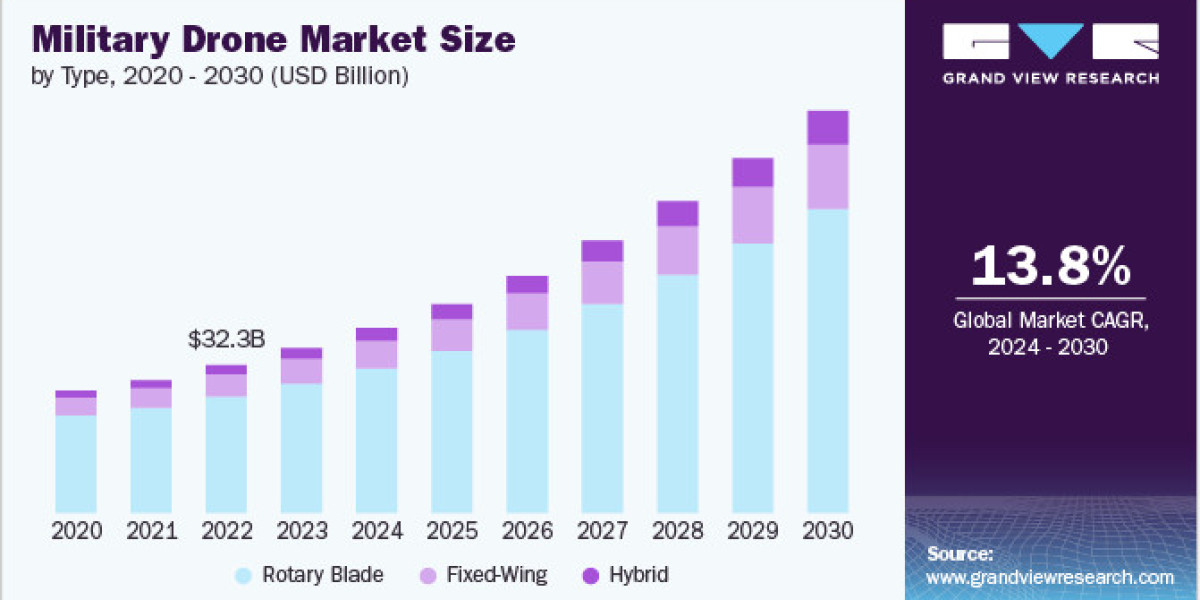

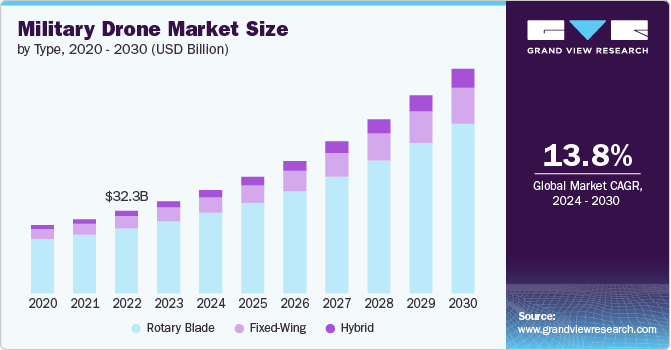

The skies of modern warfare are buzzing with innovation. In 2023, the global military drone market was valued at a formidable USD 36,140.8 million, and it's soaring towards a projected 13.8% CAGR from 2024 to 2030. This ascent is fueled by rapid technological leaps, breathing new life into drone capabilities. Imagine drones with ever-increasing endurance, the muscle to carry heavier payloads, and the stealth of shadows. Breakthroughs in materials science, battery technology, and miniaturization are making this a reality, allowing drones to fly longer, lift more, and evade detection with greater finesse. The integration of advanced sensors and AI-driven analytics is sharpening their operational edge, providing real-time data processing and lightning-fast decision-making. From vigilant surveillance and reconnaissance to decisive combat and logistical support, these advancements are broadening the spectrum of military applications.

Furthermore, the march towards autonomy is transforming military drone operations. Autonomous and semi-autonomous systems are taking flight, capable of executing complex missions with minimal human guidance, reducing risks to personnel and boosting mission success. Sophisticated algorithms for navigation, target recognition, and obstacle avoidance are the brains driving this market's growth.

Get a preview of the latest developments in the Military Drone Market; Download your FREE sample PDF copy today and explore key data and trends

A tactical shift is also underway, with a growing emphasis on smaller, more agile drones designed for short-range missions. These nimble aircraft can be deployed swiftly and discreetly, becoming invaluable assets for intelligence gathering, surveillance, and reconnaissance (ISR), providing ground troops with real-time situational awareness. Their portability and ease of use make them ideal for the complexities of urban warfare and counter-insurgency operations, where adaptability and rapid deployment are paramount.

Military drones are no longer solitary entities; they are increasingly becoming integral components of a unified battlefield ecosystem. Their seamless integration with ground-based radar, manned aircraft, and naval vessels enables fluid data sharing and coordinated operations. The concept of network-centric warfare, where diverse military assets are interconnected through a robust communication web, is a significant engine of market growth.

However, the proliferation of military drones has also ignited a critical need for defense. Counter-drone technologies are rapidly evolving to detect, identify, and neutralize hostile drones, safeguarding critical infrastructure and military assets. Employing a range of methods, including radar, RF jamming, and kinetic interception, these systems aim to mitigate the evolving threat posed by enemy drones. The rise of asymmetric warfare, where non-state actors and insurgent groups are leveraging commercial drones for attacks, has further accelerated the development and deployment of these crucial counter-drone solutions.

Detailed Segmentation

Type Insights

The rotary blade segment dominated the market in 2023 with a market share of around 78% due to its superior versatility and operational capabilities. Rotary blade drones offer vertical takeoff and landing (VTOL) abilities, making them highly suitable for a wide range of missions, including reconnaissance, surveillance, and tactical operations in confined or rugged environments. Their ability to hover in place provides better situational awareness and precision targeting compared to fixed-wing drones. This flexibility and adaptability to diverse mission requirements have driven significant demand for rotary blade drones.

Operation Mode Insights

The remotely piloted segment held the largest revenue share in 2023 due to its established reliability and widespread adoption in military operations. Remotely piloted drones offer real-time human control, allowing for precise maneuvering, decision-making, and adaptability in dynamic combat situations. The continued preference for remotely piloted systems, driven by their operational flexibility and mission success rates, has solidified the segment's growth.

Application Insights

The intelligence, surveillance, and reconnaissance (ISR) segment accounted for the highest market share in 2023, driven by drones' critical role in gathering real-time data and enhancing situational awareness on the battlefield. Military drones’ ability to operate in diverse environments, gather high-resolution imagery, and relay information back to command centers has made them essential tools for modern military operations, driving significant demand and leading to their dominant market share.

Range Insights

The visual line of sight (VLOS) segment held the largest revenue share in 2023 due to its simplicity, reliability, and ease of use in various operational scenarios. VLOS drones are often employed for short-range missions where direct visual control is feasible, providing real-time feedback and reducing the complexity of communication systems.

Regional Insights

The military drone market in North America accounted for a significant revenue share of over 40% in 2023, owing to the region's advanced defense infrastructure, substantial military budgets, and ongoing investments in cutting-edge technology. The region's focus on technological innovation, strategic defense initiatives, and the modernization of military assets have driven high demand and market growth for military drones.

Key Military Drone Company Insights

Some of the key players operating in the market are SZ DJI Technologies Co. Ltd. and Lockheed Martin Corporation, among others.

- SZ DJI Technologies Co. Ltd. manufactures and supplies a range of commercial drones along with accessories and payloads. The company’s product portfolio includes drone series, such as the Phantom, Inspire, Ronin, and Spreading Winds. The company also provides attachments, such as aerial gimbals, flight controllers, flame wheels, and propulsion systems.

- Lockheed Martin Corporation specializes in defense technology, solving complex challenges, advancing scientific discovery, and delivering innovative solutions. The company’s business areas include aeronautics, missile and fire control, rotary and mission systems, and space. It serves the U.S. government and commercial customers.

Shield AI and Teal Drones, Inc. are some of the emerging market participants in the market.

- Shield AI is a technology firm at the forefront of AI and robotics innovation, focusing on developing autonomous systems for defense and civilian applications. The company's flagship product, the AI-driven autonomous drone, is designed to operate in challenging environments, enhancing situational awareness and safety for the military and first responders.

- Teal Drones, Inc., is an innovative tech company specializing in the design and manufacture of advanced UAVs for both commercial and military markets. The company aims to revolutionize aerial technology's utilization across various industries by delivering high-performance, rugged, and intelligent drone solutions.

Key Military Drone Companies:

The following are the leading companies in the Military Drone market. These companies collectively hold the largest market share and dictate industry trends.

- AeroVironment, Inc.

- Elbit Systems Ltd.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- RTX Corporation

- Shield AI

- SZ DJI Technologies Co. Ltd.

- Teal Drones, Inc.

- Thales Group

- The Boeing Company

Military Drone Market Segmentation

Grand View Research has further segmented the global military drone market report based on type, operation mode, range, application, and region.

- Type Outlook (Revenue, USD Million, 2018 - 2030)

- Fixed-Wing

- Rotary Blade

- Hybrid

- Operation Mode Outlook (Revenue, USD Million, 2018 - 2030)

- Remotely Piloted

- Partially Autonomous

- Fully Autonomous

- Range Outlook (Revenue, USD Million, 2018 - 2030)

- Visual Line of Sight (VLOS)

- Extended Visual Line of Sight (EVLOS)

- Beyond Visual Line of Sight (BVLOS)

- Application Outlook (Revenue, USD Million, 2018 - 2030)

- Intelligence, Surveillance and Reconnaissance (ISR)

- Logistics & Supply

- Others

- Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Latin America

- Brazil

- Middle East and Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

Curious about the Military Drone Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Recent Developments

- In June 2024, Thales Group introduced OpenDRobotics, an innovative solution to enhance collaborative combat by integrating robotics technologies into unmanned air and ground vehicles. The solution was designed to leverage Artificial Intelligence (AI) to provide armed forces with a human-in-the-loop mission capability and improve the autonomy of drones and robotic systems while reducing the cognitive load on operators.

- In May 2024, SZ DJI Technology Co. Ltd. launched the Zenmuse H30 Series of multi-sensor aerial payloads tailored for public safety and energy inspection applications. The Zenmuse H30 Series features four modules, namely a wide-angle camera, NIR light auxiliary light, a zoom camera, and a laser rangefinder. Compatible with DJI Matrice 300 RTK and Matrice 350 RTK drones, these payloads utilize advanced algorithms for enhanced daytime clarity and improved night vision capabilities, ensuring extended operational visibility and detail retrieval.

- In April 2024, Shield AI has entered into a definitive agreement to acquire Australia’s Sentient Vision Systems, a leading company in real-time situational awareness powered by AI. The acquisition was aimed at enhancing ISR features to address the evolving needs of the defense and security markets.