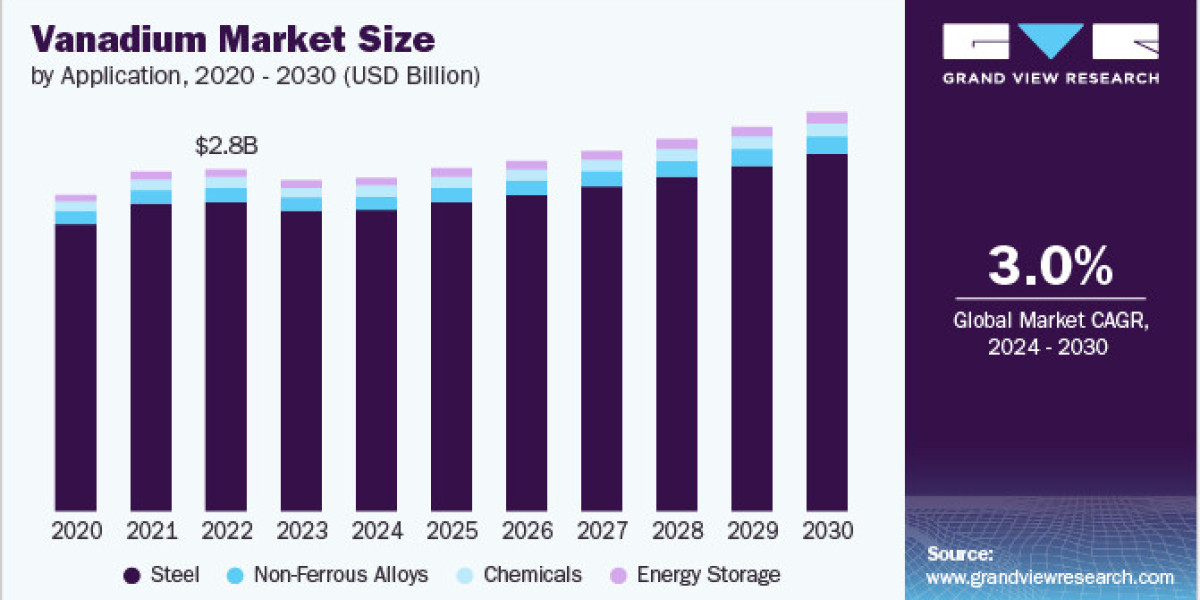

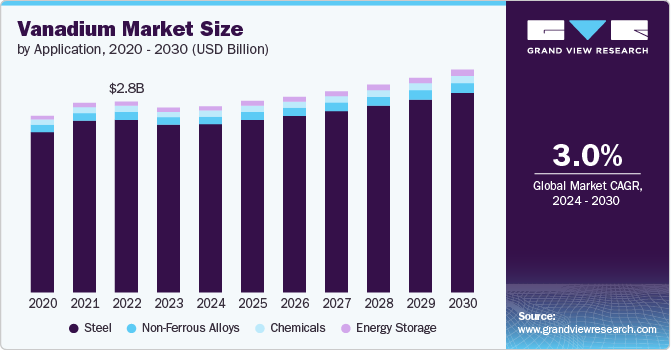

The global vanadium market is set for steady growth. In 2023, the market for this strengthening element was valued at USD 2.73 billion, and it's projected to expand at a consistent 3.0% CAGR from 2024 to 2030. The world's insatiable appetite for crude steel, fueled by the relentless progress of construction, the automotive sector's drive, the hum of machinery, and the movement of transportation, is expected to be the primary engine for vanadium demand in the years to come.

Vanadium's power lies in its ability to fortify steel. As a key alloy, it imbues steel with increased strength, enhanced toughness, and remarkable resistance to wear. The global demand for high-strength steel, a cornerstone of construction, automotive innovation, and aerospace engineering, is on an upward trajectory, directly pulling the demand for vanadium along with it. As nations and corporations invest in building infrastructure and expanding manufacturing capabilities, the demand for this vital element is poised for consistent growth. To illustrate this, the World Steel Association reported that global crude steel production reached a staggering 1,892.6 million tons in 2023, a notable increase from the 1,878.6 million tons recorded in 2019.

Get a preview of the latest developments in the Vanadium Market; Download your FREE sample PDF copy today and explore key data and trends

Detailed Segmentation

Application Insights & Trends

“Steel held the largest revenue share of over 90% in 2023.”

In superconducting magnets, vanadium plays a crucial role, especially in the form of Vanadium Gallium (V3Ga) superconductors. These materials are essential for creating high-field superconducting magnets, which are a critical component in various applications, including magnetic resonance imaging (MRI) machines and particle accelerators. Moreover, superconducting magnets are vital for the research and development of sustainable energy technologies, such as magnetic confinement fusion, which promises an almost limitless source of clean energy.

Regional Insights

“Asia Pacific held over 62% revenue share of the global vanadium market.”

North America vanadium market is primarily driven by a strong focus on the aerospace and defense industry, which requires high-strength steel alloys. The region also shows increasing interest in green energy solutions, including large-scale energy storage systems that leverage vanadium's unique properties.

Key Vanadium Company Insights

Some of the key market participants include EVRAZ plc, HBIS Group., and Bushveld Minerals.

- EVRAZ plc stands is one of the leading steel manufacturing and mining conglomerates. The company excels in producing high-quality, steel products along with vanadium, catering to a diverse range of industrial applications worldwide.

- Glencore is a multinational commodity trading and mining company with a strong presence in the metals, minerals, energy products, and agricultural sectors. In the ferroalloys portfolio, the company produces ferrochrome, chrome ore, and vanadium.

Key Vanadium Companies:

The following are the leading companies in the Vanadium market. These companies collectively hold the largest market share and dictate industry trends.

- AMG

- Aura Energy Ltd

- Australian Vanadium Limited

- Bushveld Minerals

- EVRAZ plc

- Glencore

- HBIS Group

- Largo Inc.

- Pangang Group Vanadium and Titanium Resources Co., Ltd.

- Vanadium Resources Limited

Vanadium Market Segmentation

Grand View Research has segmented the global vanadium market report on the basis of application, and region.

- Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Steel

- Non-Ferrous Alloys

- Chemicals

- Energy Storage

- Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- Russia

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Middle East & Africa

Curious about the Vanadium Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Recent Developments

- In February 2024, AMG Vanadium acquired processing technologies and IP-related business from Transformation Technologies Inc. (TTI), which focuses on green energy and recyclable metals. With this acquisition, the company aims to improve its leadership position in recycling refinery waste. AMG Vanadium recycled vanadium from oil refining residues.

- In February 2024, Australian Vanadium Limited (AVL) completed the merger with Technology Metals Australia. AVL acquired all the shares of Technology Metals Australia. With this strategic move, the company wants to broaden its footprint in primary vanadium production.