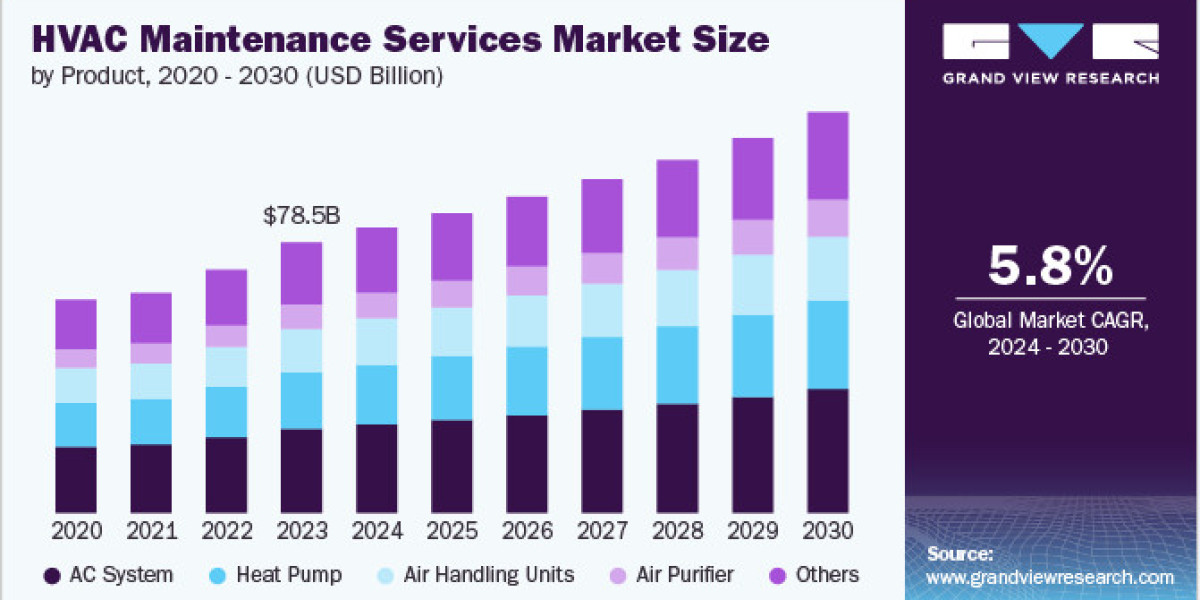

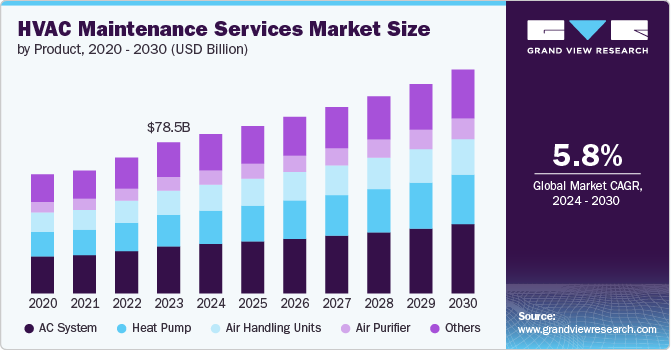

The world's breath, regulated by HVAC systems, requires expert care, and the global HVAC maintenance services market is rising to the occasion. Valued at USD 78.54 billion in 2023, this essential sector is projected to expand at a healthy 5.8% CAGR from 2024 to 2030. Several currents are fueling this robust growth. A growing understanding among both individuals and businesses of the vital role HVAC maintenance plays in energy efficiency, system longevity, and overall well-being is a significant driver. Regular upkeep ensures these systems operate at their peak, translating to leaner energy bills and a reduced risk of costly, unexpected breakdowns.

The increasing prevalence of HVAC systems across residential, commercial, and industrial landscapes is also propelling the maintenance market forward. Rapid urbanization and infrastructure development worldwide have led to a surge in HVAC installations in new constructions. This proliferation of systems naturally creates a greater need for professional maintenance to keep them running smoothly. Furthermore, the advent of smart HVAC technologies has made expert maintenance even more critical, as these sophisticated systems demand specialized knowledge for proper care.

Evolving regulations and government initiatives focused on energy efficiency are also anticipated to boost the demand for professional maintenance services that can ensure compliance with new standards. As this market continues its trajectory, service providers who can offer innovative, cost-effective, and environmentally conscious maintenance solutions are poised to gain a significant advantage

Get a preview of the latest developments in the HVAC Maintenance Services Market; Download your FREE sample PDF copy today and explore key data and trends

Detailed Segmentation

Service Insights

“The demand for repair segment is expected to grow at a CAGR of 6.3% from 2024 to 2030 in terms of revenue”

The repair segment accounted for 41.5% of the global revenue share in 2023. The HVAC maintenance services market's repair segment is a critical component, fueled by the essential need to ensure the uninterrupted operation and efficiency of HVAC systems. This segment thrives on the inevitability of wear and tear, system malfunctions, and the need for replacements of parts over time. The demand for repair services is significantly high, driven by both emergency breakdowns and the regular wear that comes with the aging of HVAC systems. As environments continue to demand optimal indoor air quality and temperature control, the urgency for skilled professionals to address and rectify issues swiftly is paramount.

Product Insights

“The demand for heat pump segment is expected to grow at a CAGR of 6.6% from 2024 to 2030 in terms of revenue”

The AC system segment led the market and accounted for 31.1% of the global revenue share in 2023. This segment is witnessing substantial growth, propelled by the escalating global demand for cooling solutions due to rising temperatures and increasing urbanization. This segment is crucial for ensuring the efficiency, reliability, and longevity of AC units across residential, commercial, and industrial sectors. The demand for AC system maintenance services is spurred by the need to optimize energy consumption, reduce operational costs, and enhance indoor air quality. Furthermore, the swift adoption of eco-friendly and energy-efficient AC systems, driven by stringent environmental regulations and the desire for green certifications for buildings, is fostering opportunities for maintenance service providers.

Application Insights

“The demand from the industrial application segment is expected to grow at a significant CAGR of 6.0% from 2024 to 2030 in terms of revenue”

The commercial segment accounted for 33.9% of the global revenue share in 2023. This segment is experiencing robust growth, driven by the increasing demand for efficient, reliable HVAC systems in office buildings, retail spaces, hotels, and other commercial establishments. This sector requires specialized HVAC maintenance services to ensure optimal operating conditions, given the complex and large-scale nature of commercial HVAC systems

Regional Insights

“China to witness fastest market growth at 6.9% CAGR”

The Asia Pacific HVAC maintenance services market holds a significant share in the global HVAC market, primarily due to its expanding construction sector, increasing urbanization, and the rising demand for energy-efficient buildings. Rapid economic growth across countries like China, India, and Japan further fuels the need for sophisticated HVAC systems to ensure optimal working and living conditions, thus driving the demand for maintenance services to ensure these systems operate efficiently and effectively. This region's distinct climate variations also necessitate regular HVAC maintenance to address the wear and tear caused by extreme weather conditions, making it a significant market for these services.

Key HVAC Maintenance Services Company Insights

Some key players operating in the market include Carrier Corporation, Toshiba, and Mitsubishi Group among others.

- Carrier Corporation is a globally recognized leader in the development and manufacture of advanced heating, ventilation, and air conditioning (HVAC) systems. As a pioneering company in the HVAC service market, Carrier has solidified its reputation by offering a wide range of innovative and energy-efficient products designed to meet the needs of both residential and commercial customers.

- Toshiba Corporation, a venerable player in the global electronics and electrical equipment industry, has carved out a significant niche within the HVAC service market through its innovative and energy-efficient solutions. Specializing in a wide array of climate control systems, Toshiba offers a rich portfolio of products, including air conditioners, heat pumps, and VRF (Variable Refrigerant Flow) systems designed for both residential and commercial applications.

Key HVAC Maintenance Services Companies:

The following are the leading companies in the HVAC Maintenance Services market. These companies collectively hold the largest market share and dictate industry trends.

- Carrier Corporation

- Toshiba

- Mitsubishi Group

- Johnson Controls

- Daikin

- Electromechanical Maintenance Services

- Bradbury Brothers Cooling, Heating, Plumbing & Electrical

- AAA Filter Service

- MG Cooling Solutions

- Carolina Filters, Inc.

- LG Service & Maintenance

HVAC Maintenance Services Market Segmentation

Grand View Research has segmented the global HVAC maintenance services market based on the service, product, application and region:

- Service Outlook (Revenue, USD Billion; 2018 - 2030)

- Repair

- Upgrade/Replacement

- Product Outlook (Revenue, USD Billion; 2018 - 2030)

- Air Handling Units

- AC System

- Air purifier

- Heat Pump

- Others

- Application Outlook (Revenue, USD Billion; 2018 - 2030)

- Residential

- Commercial

- Industrial

- Regional Outlook (Revenue, USD Billion; 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Curious about the HVAC Maintenance Services Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Recent Developments

- In June 2023, American Residential Services LLC. expanded its national footprint in California with the acquisition of Tarpy Plumbing, Heating & Air, which is a company based in California. Throughout Southern California, the Tarpy Plumbing, Heating & Air offers home heating, cooling, and plumbing services. It has 40 installations, service, and sales vehicles on the road.

- In November 2022, Carolina Filters, Inc. collaborated with Mann+Hummel (Tri-Dim and Pamlico Air) to enhance its indoor air quality business in Georgia and Florida. As such, the company opened its Southeastern Distribution Center and provided a wide choice of basic air filters to customers, thereby enhancing its inventory and offering customized kits to them.