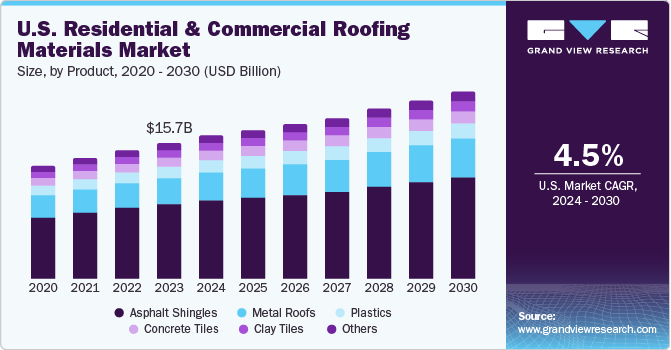

Across the American landscape, the roofs over our heads and businesses form a substantial market. In 2023, the U.S. residential and commercial roofing materials market was valued at USD 15.72 billion, and it's poised for a steady climb, projected to grow at a 4.5% CAGR from 2024 to 2030. This growth narrative is closely tied to the robust global construction sector, fueled by increasing public and private investments shaping both our homes and workplaces across the nation. As severe weather events become more frequent, the demand for roofing materials that can weather the storm is also on the rise, a trend expected to gain momentum in the coming years.

The enduring desire for single-family homes and the expansion of commercial spaces are key drivers, creating a constant need for roofing solutions. Furthermore, a growing emphasis on energy-efficient and sustainable building practices in the U.S. is also contributing to the increased demand for these materials. A strengthening economy, a growing population, increased spending on renovations and redevelopments, and the resilient rebound of the construction sector post-pandemic are all adding layers to this market's growth story.

However, the path isn't entirely smooth. Fluctuations in the cost of raw materials, economic uncertainties, and the expense of installation can cast shadows on potential construction projects, leading to a tempering of overall demand.

Get a preview of the latest developments in the U.S. Residential And Commercial Roofing Materials Market; Download your FREE sample PDF copy today and explore key data and trends

Despite these headwinds, the construction industry remains a significant force, with ongoing residential and commercial ventures continuously generating demand for roofing materials across various applications. Looking ahead, residential construction is anticipated to see a boost, spurred by government initiatives aimed at tackling the nation's housing deficit, which currently exceeds 6 million homes. A tangible example is PulteGroup, Inc.'s January 2023 announcement of Addison Square in Fort Myers. With an investment of approximately USD 2.5 million for the land, the company plans to build around 50 single-family homes on the 17-acre site. This development alone is expected to fuel demand for roofing materials within the project, adding another tile to the market's overall growth

Detailed Segmentation

Product Insights

The asphalt shingles segment held the largest revenue share of over 55% of the market in the year 2023. The segment is projected to register a CAGR of 4.1% in terms of value over the forecast period. Low capital costs and an easy installation process are anticipated to drive the demand for asphalt shingles as roofing materials over the forecast period.

Application Insights

The residential application segment held the largest revenue share of over 58% in 2023. The residential segment is expected to witness growth in the forecast period, driven by factors such as the increasing global population and the growing preference among consumers for single-family housing structures.

Homeowners often choose asphalt shingles for their residential roofs due to the ease of installation and lower maintenance needs compared to metal and concrete options. These shingles come in a diverse range of colors and textures, providing homeowners with the opportunity to achieve a wood, cedar, or slate-like appearance, thereby enhancing the visual appeal of their roofing structures.

Construction Type Insights

The re-roofing segment held for USD 9.45 billion revenue share in 2023 and is anticipated to witness significant growth at a CAGR of 4.4% over the forecast period. The segment demand is majorly driven by aging infrastructure and the need to replace and repair them. The buildings in the U.S. have reached the end of their original roofing lifespan. This trend is followed in most of the states in the U.S. Thus, there is an increased demand from the re-roofing type of segment in 2023 and the trend is expected to remain the same during the forecast period.

Regional Insights

The construction sector in Texas is projected to witness steady growth at a 5.7% CAGR, driven by factors like increasing per capita income, rapid urbanization, and a growing population. Meanwhile, the construction industry in the region is witnessing heightened investments from both local governments and foreign investors. Many companies have established their manufacturing facilities in this region, playing a pivotal role in the expansion of various construction sectors.

Key Companies & Market Share Insights

- GAF Materials Corporation provides all types of roofing materials in the U.S. The company is involved in providing installation and related services in the entire U.S. It provides roofing materials from timber to the Solar grade TPO membranes.

Key U.S. Residential And Commercial Roofing Materials Companies:

The following are the leading companies in the U.S. Residential And Commercial Roofing Materials market. These companies collectively hold the largest market share and dictate industry trends.

- GAF Materials Corporation

- Atlas Roofing Corporation

- Owens Corning

- TAMKO Building Products, Inc.

- CSR Ltd.

- Carlisle Companies Inc.

- Crown Building Products LLC

- Metal Sales Manufacturing Corporation

- Wienerberger AG

- Etex

- CertainTeed Corporation

- Johns Manville

- Fletcher Building Limited

- Eagle Roofing Products

- Boral Roofing. (Ltd.).

U.S. Residential And Commercial Roofing Materials Market Segmentation

Grand View Research has segmented the U.S. residential and commercial roofing materials market based on product, application, construction type, and region:

U.S. Residential & Commercial Roofing Materials Product Outlook (Volume, Million Square Feet; Revenue, USD Million, 2018 - 2030)

- Asphalt Shingles

- Metal Roofs

- Plastics

- Concrete Tiles

- Clay Tiles

- Others

U.S. Residential & Commercial Roofing Materials Application Outlook (Volume, Million Square Feet; Revenue, USD Million, 2018 - 2030)

- Residential

- Commercial

U.S. Residential & Commercial Roofing Materials Construction Type Outlook (Volume, Million Square Feet; Revenue, USD Million, 2018 - 2030)

- New Construction

- Re-roofing

U.S. Residential & Commercial Roofing Materials Regional Outlook (Volume, Million Square Feet; Revenue, USD Million, 2018 - 2030)

- California

- Texas

- Florida

- Arizona

- North Carolina

- South Carolina

- New Jersey

- New York

- Colorado

- Georgia

- Utah

Curious about the U.S. Residential And Commercial Roofing Materials Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

![[Shark-Tank]#1 Nexalyn Anmeldelser - Natural & 100% Safe](https://dostaapkaspace.sgp1.digitaloceanspaces.com/upload/photos/2024/06/GItCeIWDmvgoU1qoslyn_08_25eb794e40c465cabe08685c379a4b6c_image.jpg)