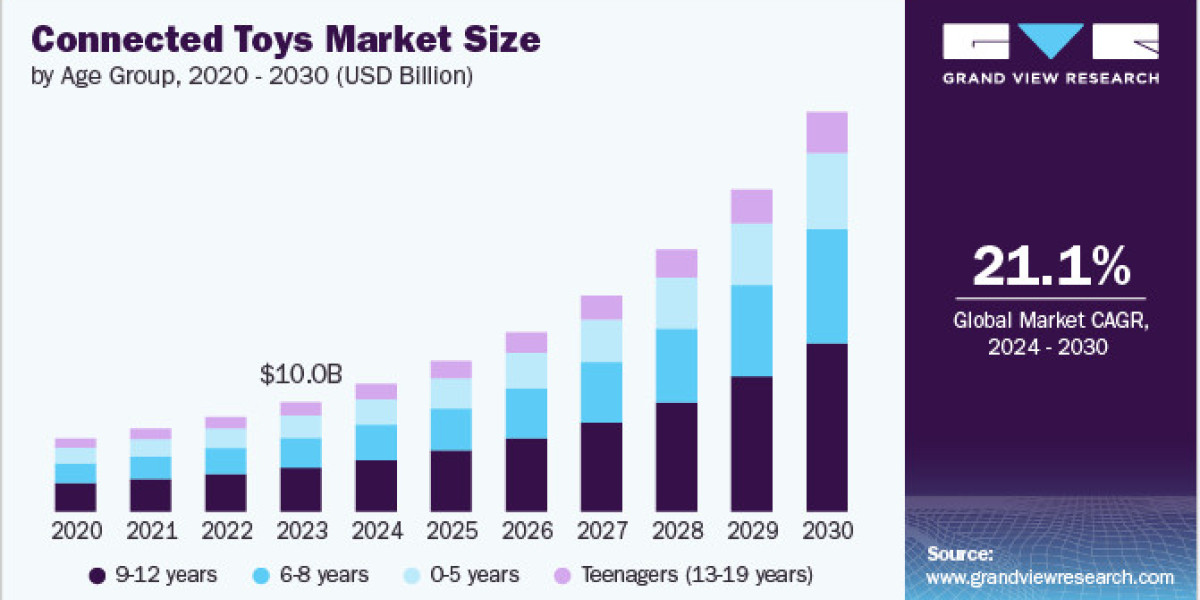

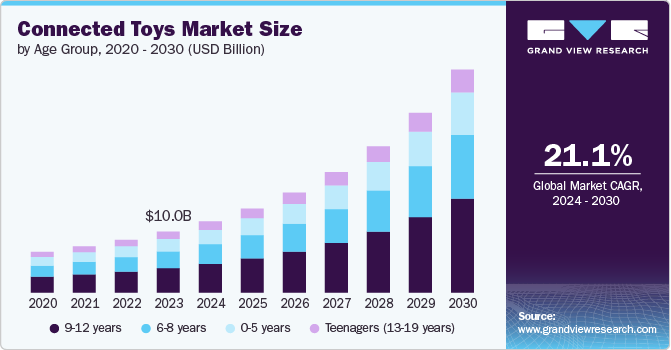

The toy box is getting a digital makeover. In 2023, the global connected toys market, estimated at USD 10.04 billion, is poised for an electrifying expansion, projected to grow at a 21.1% CAGR from 2024 to 2030. This surge is powered by a thirst for toys that do more than entertain – they interact and educate. The growing ubiquity of smart devices and relentless technological advancements are key catalysts, amplified by increasingly savvy consumers. The fusion of connected toys with digital realms – apps and online content – unlocks new dimensions of fun, further fueling market growth. Moreover, the ongoing evolution of technology and design, particularly the immersive experiences offered by AR and VR, are igniting consumer desire.

The rising emphasis on STEM education is fostering a fertile ground for connected toys that nurture these critical skills. The widespread adoption of smart devices acts as a seamless conduit for connectivity and control, broadening the appeal and accessibility of these toys. As connected toys venture into emerging and developing markets, fresh avenues for growth open up, amplifying their global potential. Strategic alliances between toy makers, tech innovators, and content creators are birthing ever more imaginative and captivating connected playthings.

Get a preview of the latest developments in the Connected Toys Market; Download your FREE sample PDF copy today and explore key data and trends

The burgeoning Internet of Things (IoT) and the intelligence of AI are injecting new levels of interactivity and personalization into connected toys, sparking consumer fascination and driving market growth. Parents and educators are increasingly drawn to toys that offer both engagement and educational value, creating a strong preference for connected toys that deliver on this promise. Features that empower parents with monitoring and control capabilities further bolster the adoption of these digitally enhanced toys.

Detailed Segmentation

Age Group Insights

The 9-12 years age group segment led the market in 2023, accounting for over 40.0% share of the global revenue. increasing demand for STEM-based toys, preference for interactive and immersive play, growing interest in social play and collaboration are primarily contributing to the growth of the segment. Children in the 9-12 age group are often more engaged with STEM (Science, Technology, Engineering, and Mathematics) learning. Connected toys that focus on coding, robotics, and problem-solving such as, LEGO Mindstorms, Osmo kits cater to this interest, encouraging skill development while being entertaining.

Interfacing Device Insights

The smartphones segment accounted for the largest market revenue share in 2023. Various factors such as widespread smartphone penetration, increased connectivity options, and cost-effective solution are primarily driving the growth of the segment. With the increasing adoption of smartphones globally, parents and children have easy access to devices that can interface with connected toys. This allows toys to leverage smartphone apps for enhanced interactive experiences. Various connected toys are designed to work with companion smartphone apps, allowing for more dynamic features such as game updates, customizable settings, and real-time interactions. The ability to personalize experiences through smartphone apps enhances user engagement.

Technology Insights

Bluetooth segment accounted for the largest market revenue share in 2023. Various factors such as ease of connectivity, cost effectiveness, low power consumption, and interactive play experiences are primarily contributing to the growth of the segment. Bluetooth enables easy pairing with smartphones, tablets, and other devices, allowing children to interact with toys through apps or voice commands. This user-friendly connectivity appeals to both parents and children, encouraging broader adoption of Bluetooth-enabled toys.

Distribution Channel Insights

Online retail segment accounted for the largest market revenue share in 2023. The rise of e-commerce increased digital marketing, subscription and direct-to-consumer models, and technological advancements are primarily contributing to the growth of the segment. Moreover, online retail platforms offer a wider range of connected toys than physical stores, including international brands, niche products, and customized options. This variety attracts consumers who seek unique or hard-to-find toys. Toy manufacturers are leveraging digital marketing strategies, such as social media campaigns and influencer partnerships, to promote connected toys directly to parents and children. This targeted approach has driven sales growth in the online retail space.

Type Insights

App-Connected Toys segment accounted for the largest market revenue share in 2023. Increased smartphone penetration, enhanced user experience, and parental control and monitoring are driving the growth of the segment. The widespread use of smartphones and tablets among parents and children encourages the adoption of app-connected toys.App-connected toys are designed to support learning, helping children develop skills in various areas such as STEM, language, and creativity.Apps often offer parents the ability to monitor playtime, set usage limits, and customize learning paths, appealing to safety-conscious caregivers.

Application Insights

The entertainment segment accounted for the largest market revenue share in 2023. Modern consumers are looking for toys that offer more than traditional play. Connected toys with entertainment applications provide interactive experiences, keeping children engaged for longer periods. This includes features such as games, challenges, and interactive storytelling. The integration of advanced technologies such as augmented reality (AR) and virtual reality (VR) enhances the entertainment value of connected toys. These technologies create immersive experiences that capture children's attention and encourage creative play.

Regional Insights

North America dominated with a revenue share of over 35.0% in 2023. North America has a well-established technological infrastructure, enabling the rapid adoption of connected toys that utilize IoT, AI, AR, and VR. The presence of tech-savvy consumers supports market growth. Furthermore, the region hosts several prominent toy manufacturers contributing to the development and availability of connected toys in the market. These companies continually invest in product innovation, driving the growth of the connected toys market.

Key Connected Toys Company Insights

Key connected toys companies include Hasbro, Mattel, and Sony Corporation. Companies active in the connected toys market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in March 2024, The LEGO Group, collaborated with Hasbro, a toy and game company, to launch LEGO DUPLO PEPPA PIG, a collection of play experiences. LEGO DUPLO collaborated with the popular preschool show to create new sets that feature colorful settings, iconic characters, and imaginative stories to inspire building adventures.

Key Connected Toys Companies:

The following are the leading companies in the Connected Toys market. These companies collectively hold the largest market share and dictate industry trends.

- Hasbro

- Mattel

- Sony Corporation

- Sphero, Inc.

- Spin Master

- The LEGO Group

- UBTECH ROBOTICS CORP LTD

- VTech Electronics North America, LLC

- Wonder Workshop, Inc.

- WowWee Group Limited

Connected Toys Market Segmentation

Grand View Research has segmented the global connected toys market report based on the age group, interfacing device, technology, distribution channel, type, application, and region.

- Age Group Outlook (Revenue, USD Million, 2017 - 2030)

- 0- 5 years

- 6-8 years

- 9-12 years

- Teenagers (13-19 years)

- Interfacing Device Outlook (Revenue, USD Million, 2017 - 2030)

- Smartphones

- Tablets

- Consoles & PCs

- Wearables

- Technology Outlook (Revenue, USD Million, 2017 - 2030)

- Wi-Fi

- Bluetooth

- Radio Frequency Identification (RFID) or Near Field Communication (NFC)

- Artificial Intelligence (AI)

- Augmented Reality (AR) and Virtual Reality (VR)

- Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

- Online Retail

- Offline Retail

- Specialty Stores

- Direct Sales

- Type Outlook (Revenue, USD Million, 2017 - 2030)

- App-Connected Toys

- Voice-Activated Toys

- Screenless Connected Toys

- Smart Toys with Wearable Integration

- Robotics & Programmable Toys

- Smart Action Figures and Dolls

- Application Outlook (Revenue, USD Million, 2017 - 2030)

- Educational

- Entertainment

- Fitness and Health

- Security and Monitoring

- Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- MEA

- UAE

- South Africa

- KSA

Curious about the Connected Toys Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Recent Developments

- In September 2024, GUND, a company of Spin Master, partnered with Disney, to launch a new Disney x GUND collection, a new line featuring iconic Disney characters. Combining GUND's design with Disney's imagery, these plush toys offer a distinct experience for collectors.

- In July 2024, Sony Interactive Entertainment Europe collaborated with Spin Master, connected toys developer, to introduce The Shapes Collection, a new line of collectibles, based on hit PlayStation Studios titles. This collection showcases iconic figures from the God of War Ragnarök, Horizon Forbidden West, and Ghost of Tsushima.

- In April 2024, Hasbro, connected toy company, announced licensing agreement with Playmates Toys Limited, toy designing company, to produce and distribute POWER RANGERS product. Playmates Toys Limited would launch its inaugural POWER RANGERS toy line, focusing on the iconic MIGHTY MORPHIN POWER RANGERS series, designed for children in 2025.