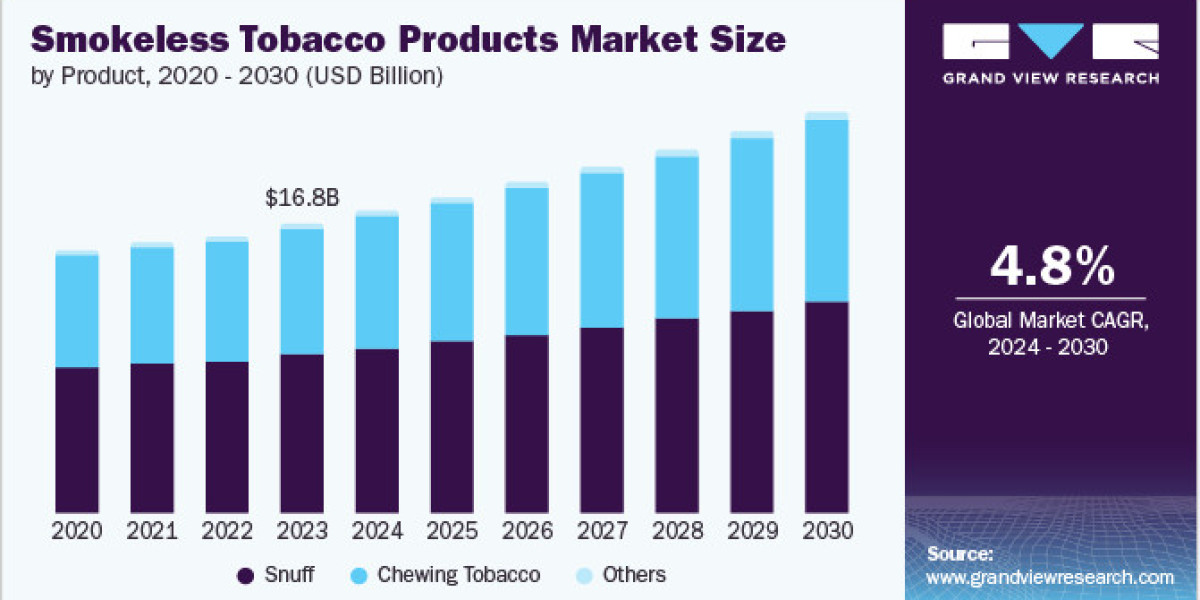

A silent shift is reshaping the tobacco landscape. In 2023, the global smokeless tobacco products market, valued at USD 16.81 billion, is charting a course for a 4.8% CAGR through 2030. This upward trajectory is fueled by a growing awareness of smoking's perils, nudging consumers toward alternatives perceived as gentler. The allure of convenience, tempting flavors, and a lighter price tag further draws in a diverse audience, notably younger individuals. A robust tobacco production ensures the gears of this market keep turning. Moreover, bold marketing and the unveiling of novel product variations act as powerful tailwinds.

Across generations, the world has long turned to tobacco for fleeting solace from stress and anxiety. Yet, a subtle evolution is underway. While smokeless options share the common thread of nicotine, their composition, preparation, and toxicity diverge. Interestingly, a preference for premium smokeless offerings is emerging. Simultaneously, the affordability of single-serving packets is anticipated to be a key growth driver. The smokeless tobacco industry is actively expanding its portfolio of these addictive nicotine products. Globally, a parallel rise in overall tobacco consumption directly correlates with the increasing appetite for readily available and relatively inexpensive smokeless alternatives compared to their smoked counterparts.

Get a preview of the latest developments in the Smokeless Tobacco Products Market; Download your FREE sample PDF copy today and explore key data and trends

Moreover, smokeless tobacco consumption is more because of the greater social acceptance, curiosity, lifestyle, and cultural influence, which are boosting factors for smokeless tobacco product consumption and production across the world. Some other key drivers that lead to market growth are a rise in the adoption of trendy lifestyles among consumers and an elevated intake of tobacco products and their forms in the market. Growth of the market is also attributed to the low cost of smokeless products as compared to smoked tobacco products.

Detailed Segmentation

Product Insights

Snuff dominated the market and accounted for the largest revenue share of 54.9% in 2023. This growth is attributed to an increase in sales due to consumers' adoption of it as a premium segment. In addition, the availability of snuff products in the tobacco market in different flavors such as mint, berry, cinnamon, vanilla, saffron, and apple helps to provide additive opportunities for the smokeless tobacco market. All these aspects contribute to its higher position in the market.

Distribution Channel Insights

Offline channels led the market and accounted for the largest revenue share of 84.9% in 2023. The offline sales sector, which is predominantly influenced by consumers who choose to physically examine a variety of products to gauge their quality and content diversity, drives the segment’s growth. In addition, the ability to browse through different types of products in stores and engage in bargaining with retail sectors is expected to drive the offline segment in the coming years. Furthermore, the expansion of tobacco stores, the introduction of the latest products with diverse flavors, and appealing packaging are all key contributors to the growth of offline product sales in the market.

Regional Insights

The North America smokeless tobacco products market is expected to grow significantly over the forecasted years. Consumers perceive smokeless tobacco as a lower-risk alternative to smoking, fueling demand, especially among millennials and younger generations in the region, which drives the market’s growth. In addition, aggressive marketing and strategic investments by key players, along with the growing prevalence of smokeless tobacco use supported by increased tobacco production globally, contribute to the market's expansion. Furthermore, evolving consumer habits and a shift towards smokeless tobacco for smoking cessation or substitution further propel the market's growth trajectory in North America.

Key Smokeless Tobacco Products Company Insights

Some of the key companies in the smokeless tobacco products market, Altria Group, Inc., British American Tobacco, Imperial Brands Plc., Universal Corporation Ltd., Reynolds Tobacco Company, and Swedish Match AB, in the market, are focusing on the development & to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives.

- Arthrex, Inc. offers surgical products and solutions for arthroscopic and slightly invasive orthopedic surgery. The company also offers related surgical products for hands, knees, shoulders, elbows, feet, and ankles, orthobiologics, imaging, and resection systems.

- Corin Group is a manufacturer of orthopedic systems envisioned to enhance patients' well-being through clinically verified implants associated with technologies and data. The company offers positioning systems, implants, hip and joint replacements, and knee joint fixtures, together with a blend of advanced technologies, allowing surgeons and healthcare professionals to optimize efficiently.

Key Smokeless Tobacco Products Companies:

The following are the leading companies in the Smokeless Tobacco Products market. These companies collectively hold the largest market share and dictate industry trends.

- Medical Device Business Services, Inc.

- Altria Group, Inc.

- British American Tobacco

- Imperial Brands Plc.

- Universal Corporation Ltd.

- Reynolds Tobacco Company

- Swedish Match AB

- Japan Tobacco International S. A.

- Swisher International Group, Inc.

- MacBaren Tobacco Company A/S

Smokeless Tobacco Products Market Segmentation

Grand View Research has segmented the Smokeless Tobacco Products market report based on product, site, application, grade, and distribution channel.

Product Outlook (Revenue, USD Million, 2018 - 2030)

- Chewing Tobacco

- Snuff

- Others

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

- Online

- Offline

Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- Sweden

- Norway

- Asia Pacific

- India

- Latin America

- Middle East and Africa (MEA)

- Algeria

- South Africa

Curious about the Smokeless Tobacco Products Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Recent Developments

- In June 2024, Scandinavian Tobacco Group (STG) announced its acquisition of MacBaren Tobacco Co. for around USD 76.9 million (DKK535 million), financed by cash and debt. Founded in 1826, Mac Baren produces popular pipe tobacco and nicotine pouches with significant sales in the U.S., Denmark, and Germany. STG aims to enhance its smoking tobacco portfolio and expects collaborations from the integration, which will take up to 120 days to complete, according to CEO Niels Frederiksen.

- In June 2023, Imperial Brands acquired different types of nicotine pouches from TJP Labs to enter into the current U.S. market. This acquisition was expected to allow ITG Brands to offer 14 product variants to American consumers, with a relaunch planned for 2024.