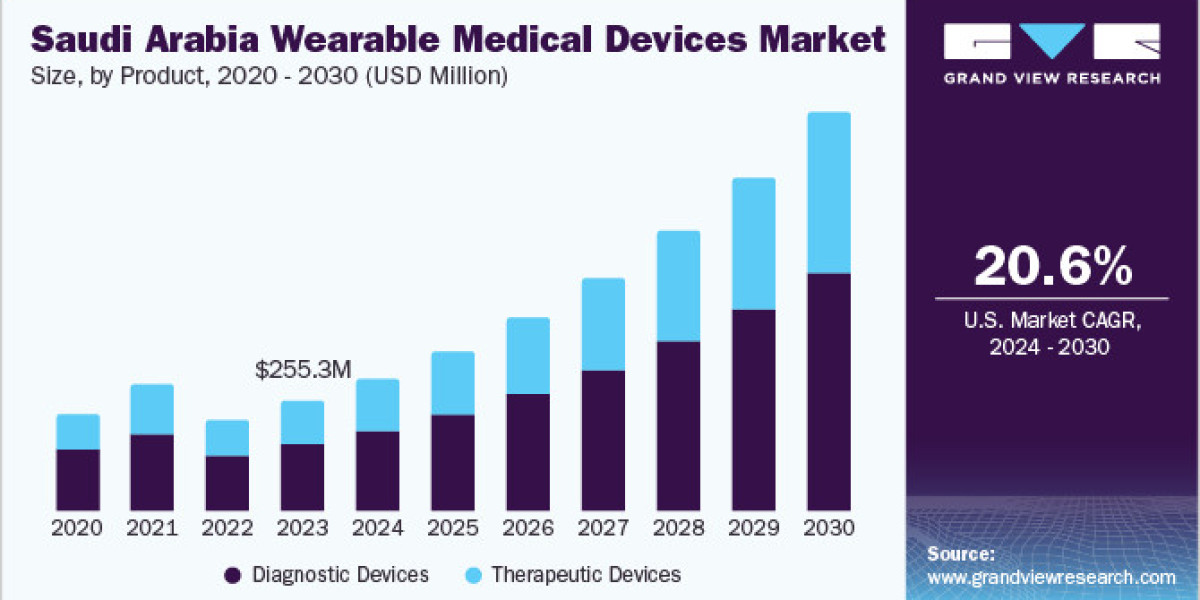

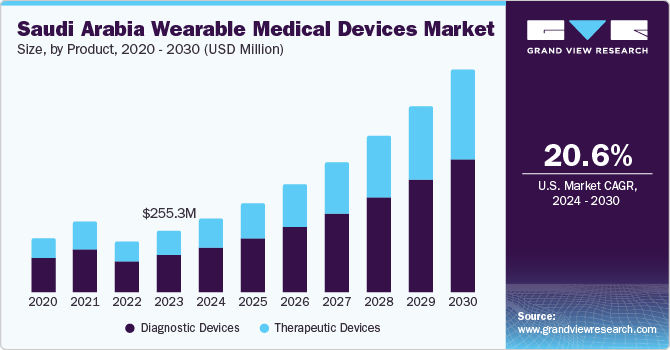

Imagine a future where health dances on your wrist. In Saudi Arabia, this vision is rapidly materializing. Valued at USD 255.34 million in 2023, the Saudi Arabia wearable medical devices market is poised for a dynamic ascent, charting a course at a 20.6% CAGR from 2024 to 2030. Fueling this surge are the expanding horizons of remote patient monitoring and the growing embrace of home healthcare. The pulse of a health-conscious populace, increasingly attuned to fitness, beats strongly in favor of trackers that quantify well-being. Technological leaps, a burgeoning landscape of clinical trials, and a heightened awareness of the power of personal, always-on health surveillance are the winds propelling this market forward.

Yet, a shadow looms – the rising tide of lifestyle-linked ailments threatens the nation's health. Obesity, a stark reflection of compromised healthy habits, casts a long shadow, implicated in a majority of non-communicable diseases – hypertension, type 2 diabetes, dyslipidemia – culminating in serious cardiovascular concerns. Startlingly, in 2020 and 2021, Saudi Arabia held the unenviable distinction of the highest obesity prevalence globally, averaging 35%. This reality underscores the urgent need for vigilant, continuous tracking of vital physiological signs.

Get a preview of the latest developments in the Saudi Arabia Wearable Medical Devices Market; Download your FREE sample PDF copy today and explore key data and trends

Enter Vision 2030, the Saudi government's ambitious blueprint, earmarking USD 65 million for healthcare investment. This strategic infusion promises to cultivate research and development, nurturing a robust healthcare infrastructure that includes the vital arteries of telemedicine and remote patient monitoring. Meanwhile, pioneering wearable medical device companies are orchestrating a market transformation through groundbreaking innovations. The integration of artificial intelligence, the seamlessness of continuous monitoring, and the sophistication of next-generation sensors are rewriting the rules of the game. A testament to this dynamic landscape is Koninklijke Philips N.V.'s November 2023 unveiling of ultra-lightweight and flexible magnetic resonance Smart Fit coils. Powered by Philips’ SmartSpeed AI solution, these coils promise sharper diagnostic insights through enhanced image quality resolution. The future of proactive health in Saudi Arabia is not just being watched; it's being worn.

Detailed Segmentation

Application Insights

The application segment is further categorized into sports and fitness, remote patient monitoring, and home healthcare. Home healthcare held a maximum share of 53.80% in 2023. Increasing prevalence of lifestyle associated diseases, and rising demand for remote patient monitoring are some factors driving market growth.

Product Insights

The diagnostics device segment dominated the market with the largest share 60.92% in 2023. The life expectancy at birth increased from 71 years in 2000 to 76 years in 2021 and with the aging population comes challenges of dealing with chronic illnesses such as cancer, diabetes and cardio vascular diseases (CVDs).

Site Insights

Based on site, the wearable medical devices market is categorized into handheld, headband, strap/clap/bracelet, shoe sensors, and others. The strap/clap/bracelet site segment dominated with the largest revenue share of 51.51% in 2023. Advancements in technology, including ECG tracking features along with pulse rate, and respiratory monitoring featured with Bluetooth and cloud connectivity, smartwatches are further expected to drive the market. For instance, the Polar Electro’s Elixir sensor offers features that measure mechanical parameters along with physiological parameters like body temperature, cardiovascular activity, and autonomic nervous system.

Grade Type Insights

The consumer grade wearable medical devices segment accounted for the largest revenue share of 77.55% in 2023. The user-friendly functionality, affordability, convenience contribute in the market growth. Technological advancements in clinical applications are expected to drive the growth. Use of artificial intelligence (AI), internet of things (IoT), and cloud computing help physicians and healthcare providers in disease diagnosis and treatment. In May 2023, Medtronic’s AccuRhythm AI algorithm technology was awarded as the “Best New Monitoring Solution” at 7th annual MedTech Breakthrough Awards program.

Distribution Channel Insights

The pharmacy segment dominated the market with the largest revenue share in 2023, owing to the availability and widespread accessibility of pharmacies, providing customers with an easy way to buy these devices. The significant revenue share that pharmacies have in the wearable medical device market results from their function as health and wellness centers and their capacity to offer knowledgeable guidance.

Key Saudi Arabia Wearable Medical Devices Companies:

The following are the leading companies in the Saudi Arabia Wearable Medical Devices market. These companies collectively hold the largest market share and dictate industry trends.

- Koninklijke Philips N.V.

- Garmin

- Covidien (Medtronic)

- Omron Corp.

- Polar Electro

- Sotera Wireless

- Huawei Device Co., Ltd.

- Apple Inc.

Saudi Arabia Wearable Medical Devices Market Segmentation

Grand View Research has segmented the Saudi Arabia wearable medical devices market report based on product, site, application, grade, and distribution channel.

Product Outlook (Revenue, USD Million, 2018 - 2030)

- Diagnostic Devices

- Therapeutic Devices

Site Outlook (Revenue, USD Million, 2018 - 2030)

- Handheld

- Headband

- Strap/Clip/Bracelet

- Shoe Sensors

- Others

Application Outlook (Revenue, USD Million, 2018 - 2030)

- Sports and Fitness

- Remote Patient Monitoring

- Home Healthcare

Grade Type Outlook (Revenue, USD Million, 2018 - 2030)

- Consumer-Grade Wearable Medical Devices

- Clinical Wearable Medical Devices

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

- Pharmacies

- Online Channel

- Hypermarkets

Curious about the Saudi Arabia Wearable Medical Devices Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Recent Developments

- The launching of a new project by Saudi Health on February 15th, 2024, provides tele-electroencephalogram (EEG) services through the SEHA Virtual Hospital (SVH), facilitating medical officers to monitor the recordings round-the-clock as the EEG devices are directly connected to the SEHA Virtual Hospital.

- In January 2024, Garmin International, Inc. launched its HRM-Fit, a heart rate monitor for women which captures real-time heart rate and health data.

- In October 2023, Garmin International, Inc. expanded its ECG App to record heart rhythms and signs of atrial fibrillation from their smart watches.

- In September 2023, Huawei Device Co., Ltd. launched its GT4 watch encompassing TruSeen 5.5+ technology for improved health tracking along with the TruSleep 3.0 technology for detection of sleep interruptions and changes in blood oxygen levels.