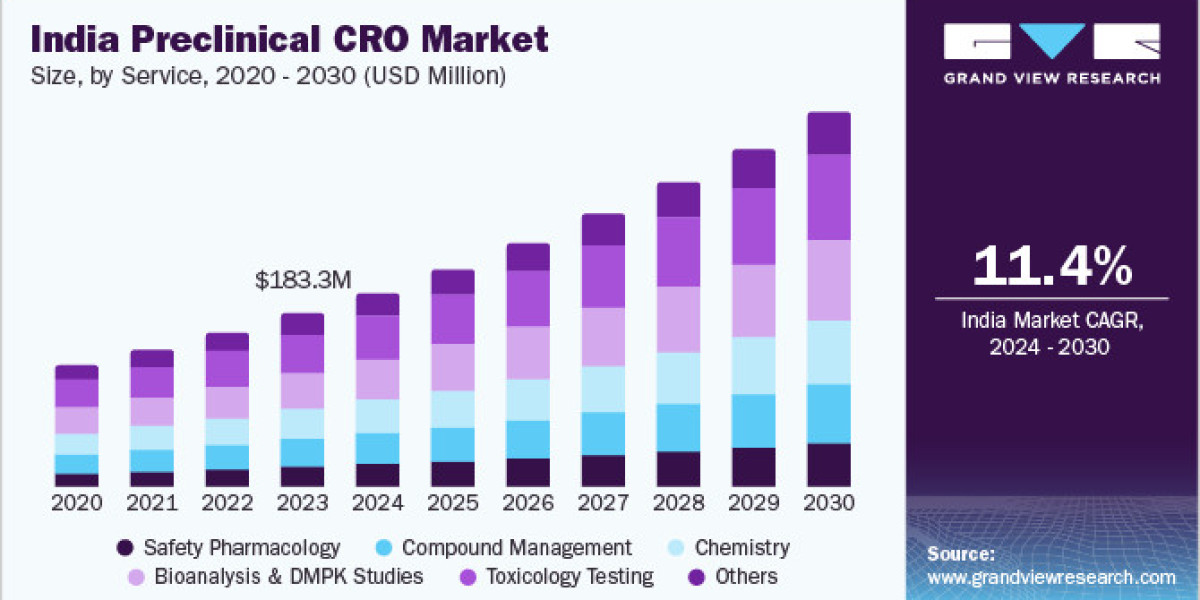

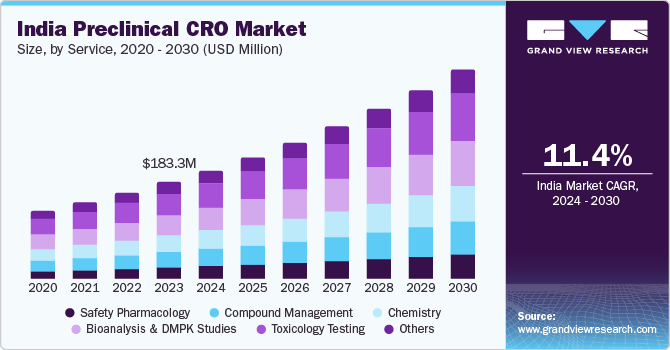

India’s preclinical CRO market was valued at USD 183.3 million in 2023 and is set to expand at a steady compound annual growth rate (CAGR) of 11.4% from 2024 to 2030. This growth trajectory is fueled by the increasing global trend of outsourcing clinical trials and R&D activities, cutting-edge technological advancements, a vast patient population, an extensive hospital network, and cost-effective operations made possible by a well-trained and accessible workforce. According to the World Health Organization, India witnessed 9,954 clinical trials in 2022.

The surge in outsourcing R&D efforts worldwide is a key driver of India's booming preclinical CRO market. Industries spanning pharmaceuticals, biotechnology, medical devices, and agrochemicals are tapping into CRO expertise to conduct preclinical studies, enabling them to delegate specific research components while concentrating on their core strengths. India stands out as an emerging hub in this space, thanks to its skilled talent pool, competitive costs, and supportive regulatory framework.

Get a preview of the latest developments in the India Preclinical CRO Market; Download your FREE sample PDF copy today and explore key data and trends

The increasing R&D expenditure worldwide has further propelled the growth of India's preclinical CRO market, as multinational pharmaceutical and biotechnology firms continue leveraging India's resources and expertise to advance their drug development pipelines. According to a study on the CRO sector in India in August 2023 by the Department of Pharmaceuticals, Ministry of Chemicals & Fertilizers Government of India, the aggregate R&D expenditure of the largest pharmaceutical corporations in 2022 exceeded USD 138 billion, up 1.7% from 2021.

Detailed Segmentation

Service Insights

Based on service, the toxicology testing segment led the market with the largest revenue share of 22.5% in 2023. This can be attributed to the increased use of toxicity testing and the outsourcing of non-core preclinical CRO research. Toxicology tests are one of the key services performed by CROs owing to their improved capabilities is toxicology tests. The rising rate of outsourcing to CROs for non-core preclinical research and the growing capability of CROs to offer additional value-added services are expected to fuel the growth of this segment during the forecast period.

Model Type Insights

Based on model type, the patient derived organoid (PDOs) segment accounted for the largest market revenue share in 2023 and is expected to register the fastest CAGR during the forecast period. PDO models are becoming increasingly crucial in preclinical research since they are highly facile to culture and offer a versatile tool for studying various disorders, including cancer. Moreover, the specimens can be cryopreserved, aiding in tailored healthcare.

End-use Insights

Based on end-use, the biopharmaceutical companies segment dominated the market in 2023. The biopharmaceutical industry's growing tendency of outsourcing end-to-end services, particularly for small and mid-sized businesses that lack enough preclinical drug development experience, is predicted to increase demand for preclinical CRO services in the coming years.

Regional Insights

Pune, Maharashtra Preclinical CRO Market Trends

The pharmaceutical industry in Pune, Maharashtra, has been witnessing significant growth over the years as pharmaceutical sector expands, the demand for preclinical (CROs) also increases to support drug discovery and development processes. For instance, in July 2022, TCG Lifesciences Pvt. Ltd. unveiled its new R&D facility in Pune, as part of a strategic expansion initiative.

Hyderabad, Telangana Preclinical CRO Market Trends

The collaborative ecosystem in Hyderabad plays a vital role in driving the market growth. CROs in the region often collaborate with academic institutions, research organizations, and industry partners to leverage expertise, resources, and networks for innovative research projects. For instance, In July 2023, GVRP, a preclinical CRO in Hyderabad, announced a partnership with SenzaGen. This strategic alliance establishes GVRP as the official distributor of SenzaGen's GARD Assay services in India, marking the introduction of innovative safety evaluation methods in the region.

Key India Preclinical CRO Company Insights

Some of the key players operating in the market include Syngene International Limited; Dabur Research; JSS Medical Research, and Jubilant Biosys Ltd.

- Syngene International Limited is based in Bangalore. It offers a wide range of services, including medicinal chemistry, biology, toxicology, and other preclinical research services. Syngene has state-of-the-art facilities and a strong track record of collaborations with global pharmaceutical companies

- Dabur Research Foundation is an Indian contract research organization providing preclinical drug research and development services, from identifying potential lead molecules and drug development to IND-enabling studies. It offers preclinical services to the global fields of biotechnology, medicine, phytopharmaceuticals, cosmetics, and science. Its services are broadly divided into functional areas: in vitro, ex vivo, and in vivo pharmacology, research, GLP toxicology, and DMPK

Sugen Life Sciences; Eurofins Advinus; GVRP and Veeda Clinical Research Limited are some of the other market participants in the India’s market.

- Sugen Life Sciences is a contract research organization focusing on toxicology, efficacy, pre-clinical safety, and clinical research services to research organizations and biopharma industries. International and national regulatory guidelines like EPA, FDA, Schedule Y, and ICH-GCP

- Eurofins Advinus is a preclinical CRO that offers preclinical and development-stage contract research services and drug discovery. Its services include Analytical R&D, CMC services, regulatory Toxicology, discovery services, and DMPK. The company manufactures medicinal products that support clinical and toxicology studies

Key India Preclinical CRO Companies:

The following are the leading companies in the India Preclinical CRO market. These companies collectively hold the largest market share and dictate industry trends.

- Syngene International Limited

- Dabur Research

- JSS Medical Research

- Jubilant Biosys Ltd.

- Sugen Life Sciences

- Eurofins Advinus

- GVRP

- Veeda Clinical Research Limited

- Axis Clinicals

- Syneos Health

- Ethicare-cro

- Liveon Biolabs Pvt.Ltd.

- IQVIA Inc

- Bioneeds

- TheraIndx Lifesciences Pvt. Ltd.

India Preclinical CRO Market Segmentation

Grand View Research has segmented the India preclinical CRO market report based on service, model type, and end-use.

Service Outlook (Revenue, USD Million, 2018 - 2030)

- Bioanalysis and DMPK Studies

- Toxicology testing

- Compound management

- Chemistry

- Safety Pharmacology

- Others

Model Type Outlook (Revenue, USD Million, 2018 - 2030)

- Patient Derived Organoid (PDO) Model

- Patient Derived Xenograft Model

End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Biopharmaceutical Companies

- Government And Academic Institutes

- Medical Device Companies

Curious about the India Preclinical CRO Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Recent Developments

- In October 2023, Roche Products (India) Pvt. Ltd. announced the launch of its Indian clinical trial excellence project to improve public health institutions' capacity to conduct clinical trials and drug research nationwide. As a result, these government hospitals will be able to advance up the value chain and establish themselves as the nation's centers of excellence for clinical research

- In December 2023, Syngene International announced that it had completed the acquisition of a multi-modal biologics manufacturing facility from Selis Biopharma Ltd. The acquisition will boost its biologics drug substance manufacturing capacity by 20,000 liters. The facility is equipped with a commercial-scale fill-finish unit, an essential component for the production of drug products

- In September 2023, Syneos Health announced a strategic alliance with Oracle. The companies aim to decrease the duration required for patient recruitment for clinical studies and enhance the variety of patient populations participating in medical research by utilizing components of Oracle's study startup solutions and the Oracle Cerner Learning Health Network (LHN)

- In May 2023, Aragen Life Sciences Ltd. and Far Biotech announced a partnership to advance preclinical initiatives in the field of neurodegeneration. Aragen will utilize its experimental discovery platform to help FAR Biotech reach an essential milestone in neurodegeneration with its small molecule program

- In April 2023, Medidata announced a partnership with Lambda Therapeutic Research Ltd. to consolidate and automate data management processes to improve clinical trial efficiency. The companies aim to provide advanced data for faster insights safely through the alliance

- In March 2023, Syneos Health announced a strategic partnership with KX. The partnership focuses on providing predictive analytics driven by data, artificial intelligence, and machine learning to help customers make complex healthcare decisions. The collaboration aims to increase the efficiency of clinical trials, reduce costs, and accelerate the time to market for life-changing therapies that benefit patients