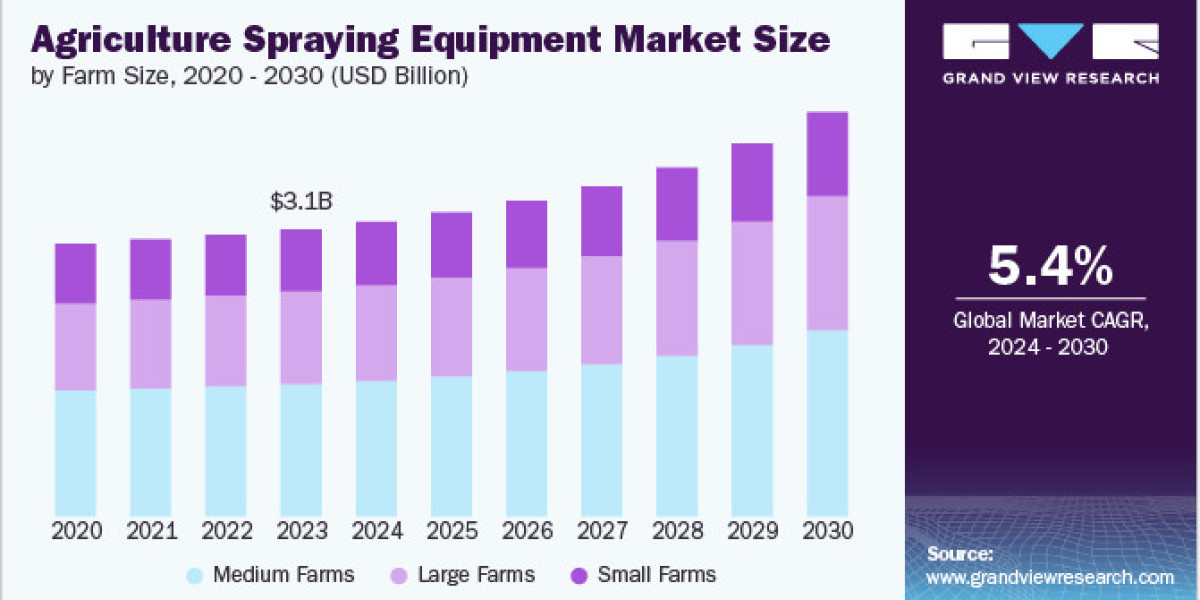

In the year 2023, the global market dedicated to agriculture spraying equipment was valued at approximately USD 3.13 billion. Projections indicate a steady climb, with an anticipated Compound Annual Growth Rate (CAGR) of 5.4% from 2024 through 2030. This upward trajectory is propelled by a confluence of factors: a heightened emphasis on farm efficiency, the trend towards larger agricultural holdings, governmental encouragement of contemporary farming methods, and the continuous integration of machinery into agricultural practices. In today's agriculture, farm efficiency and productivity stand as paramount concerns, where the imperative is to maximize yields while judiciously managing resources.

To achieve these crucial objectives, farmers are increasingly adopting sophisticated spraying equipment. Innovations such as GPS-guided systems and variable rate application technologies enable the precise dispersal of fertilizers, pesticides, and herbicides, targeting specific zones with unparalleled accuracy. This precision not only optimizes crop yields but also curtails waste and lessens environmental impact. As sustainability gains prominence as a critical consideration, agriculture spraying equipment that champions the efficient utilization of resources is rising in importance. Responding to this need, manufacturers are developing sprayers equipped with cutting-edge features like automated calibration and real-time monitoring, empowering farmers to attain unprecedented levels of efficiency and productivity.

Get a preview of the latest developments in the Agriculture Spraying Equipment Market; Download your FREE sample PDF copy today and explore key data and trends

Detailed Segmentation

Farm Size Insights

The medium farms segment dominated the target market and accounted for the largest revenue share of 46.2% in 2023. Medium-sized farms have the resources and scale to invest in advanced spraying equipment, which enhances productivity and efficiency. They often face increasing pressures to maximize yield and quality to remain competitive, driving the adoption of precision spraying technologies. These farms typically have larger areas to cover than small farms, making the efficiency and effectiveness of advanced sprayers more beneficial. Additionally, government subsidies and support programs for agricultural modernization are more accessible to medium farms, encouraging investment in modern spraying equipment.

Type Insights

The self-propelled segment held the largest revenue share of 36.6% in 2023 due to its high efficiency and versatility in covering large areas quickly. These machines are equipped with advanced technologies, such as variable rate application and GPS, enhancing accuracy and reducing input costs. Their ability to operate in varied terrain and weather conditions makes them highly reliable for large-scale farming operations. Additionally, self-propelled sprayers offer significant labor savings as they require fewer operators compared to traditional equipment. The growing trend towards precision agriculture and the need for increased productivity in farming practices have further driven the demand for self-propelled spraying equipment.

Capacity Insights

The high volume segment held the largest revenue share of 50.1% in 2023 due to its ability to cover extensive areas in a single operation, making it ideal for large-scale farming. These sprayers reduce the frequency of refilling, thereby increasing operational efficiency and minimizing downtime. They are particularly suited for crops requiring substantial amounts of liquid, such as those prone to pest infestations and diseases. The demand for high volume capacity sprayers is driven by the need for more efficient resource utilization and the growing emphasis on maximizing crop yield. Furthermore, advancements in spraying technology have made high volume capacity sprayers more precise and effective, enhancing their appeal to modern farmers.

Regional Insights

North America agriculture spraying equipment market maintained a notable revenue share of 23.9% in 2023, primarily driven by technological advancements and robust adoption of precision agriculture practices. The region's agricultural sector benefits significantly from advanced spraying equipment, which allows farmers to optimize crop yields while minimizing environmental impact. Government initiatives supporting modern agricultural techniques further bolster market growth, fostering innovation and adoption of efficient spraying technologies. North America's strong revenue share underscores its leadership in adopting and integrating cutting-edge agricultural machinery, positioning the region as a key contributor to the global market.

Key Agriculture Spraying Equipment Company Insights

Some key companies operating in the market include Deere & Company, and CNH Industrial N.V., among others.

- Deere & Company, known globally as John Deere, is a leading manufacturer of agricultural and construction equipment. Their core business segments encompass agricultural machinery (tractors, combines, seeding equipment, spraying systems), construction and forestry equipment (excavators, dozers, harvesters), and turf & lawn care equipment (mowers, tractors, zero-turn mowers). The company operates on a global scale, with a significant presence in North and South America, Europe, and Asia.

EcoRobotix SA and DJI are some emerging market companies in the target market.

- EcoRobotix SA is a leading provider of ultra-high precision farming solutions based on artificial intelligence. The company focuses on sustainable agricultural practices, leveraging advanced AI technology to significantly reduce the use of fungicides, herbicides, and insecticides by up to 95%. Their flagship product called the ARA plant protection spraying machine, utilizes AI and machine learning to target and treat specific areas accurately, ensuring environmental benefits and cost savings for farmers.

Key Agriculture Spraying Equipment Companies:

The following are the leading companies in the Agriculture Spraying Equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Deere & Company

- Kubota Corporation

- CNH Industrial N.V.

- AGCO Corporation

- Mahindra & Mahindra Ltd

- ANDREAS STIHL AG & Co. KG

- DJI

- Yamaha Motor Corporation

- EXEL Industries SA

- Buhler Industries Inc.

- EcoRobotix SA

Agriculture Spraying Equipment Market Segmentation

Grand View Research has segmented the global agriculture spraying equipment market report based on farm size, type, capacity, type, and region.

Farm Size Outlook (Revenue, USD Million, 2017 - 2030)

- Large Farms

- Medium Farms

- Small Farms

Type Outlook (Revenue, USD Million, 2017 - 2030)

- Handheld

- Self-propelled

- Tractor-mounted

- Trailed

- Aerial

Capacity Outlook (Revenue, USD Million, 2017 - 2030)

- Ultra-Low Volume

- Low Volume

- High Volume

Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Latin America

- Brazil

- Middle East and Africa (MEA)

- KSA

- UAE

- South Africa

Curious about the Agriculture Spraying Equipment Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Recent Developments

- In July 2023, Deere & Company acquired Smart Apply, a company known for its precision spraying technology that reduces chemical use, airborne drift, and runoff in orchard, vineyard, and tree nursery applications. This acquisition enhances John Deere's portfolio with advanced solutions to improve crop yield efficiency, sustainability, and regulatory compliance for high-value crop growers worldwide.

- In June 2023, Ecorobotix SA, an agriculture equipment manufacturer, announced the launch of a new Ultra-High Precision Sprayer. The new product is highly efficient and is introduced for the North America market. The introduction of a new product is expected to help the company acquire new customers and increase its market share in the North America market.