Electronic Shelf Label Market Size & Trends

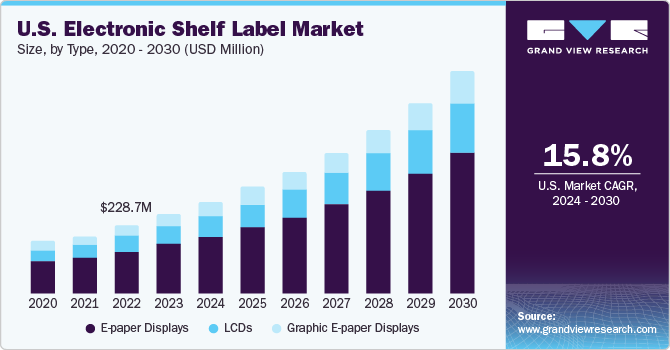

The global electronic shelf label market size was estimated at USD 1,485.10 million in 2023 and is expected to grow at a CAGR of 15.8% from 2024 to 2030. Electronic shelf labels (ESLs) are digital display systems that help retailers manage and update product pricing, information, and promotions in real-time. The growing adoption of digital technology in the retail industry to replace traditional paper labels on store shelves is expected to contribute to market growth. Automation is a growing trend in the U.S. retail sector. Retailers are focusing on improving overall customer experience & operational efficiency and streamlining inventory management. In March 2021, Walmart implemented a full automation solution to its Fulfillment Centers (FCs) and Distribution Centers (DCs) in Walmart DC in Cleburne, Texas.

In April 2023, Walmart announced its plan to make 65% of its stores to be fully automated by the end of 2026. In line with this development in May 2023, Walmart announced plans to adopt ESLs for its 500 stores within the next 18 months, which can support the market growth. According to a research paper released by the United States Postal Service Office of Inspector General in April 2023, the supply of paper products has fluctuated greatly. According to data provided by the Pulp and Paper Products Council (PPPC), North American printing and writing mills ran at 77% capacity in August 2023 compared to the same in 2022. Paper mills' reduction of production capacity resulted in increased prices of paper, which affected its derivate product supply.

Get a preview of the latest developments in the Electronic Shelf Label Market; Download your FREE sample PDF copy today and explore key data and trends

Retailers and grocers significantly depend on paper labels for displaying content and pricing of their products. Electronic shelf labels help eliminate dependency on paper labels and such market dynamics can positively influence the market growth in the U.S. The U.S. is struggling with rising labor costs. According to the U.S. Bureau of Labor Statistics, compensation costs for private workers in the country increased by 5.1% and wages & salaries witnessed a rise of 4.3%. Growing labor costs are driving retailers and industry players to adopt automation, which is further contributing to the demand for ESLs as they eliminate labor requirements to change labels and are updated using cloud-based software.

Electronic Shelf Label Market Report Highlights

- Based on components, the market has been further segmented into displays, batteries, transceivers, microprocessors, and other components.

- Based on types, the market is further segmented into LCDs, E-paper displays, and graphic E-paper displays. E-paper displays emerged as the dominant segment and accounted for the largest revenue share of over 62.0% in 2023.

- On the basis of communication technologies, the global industry has been further categorized into radiofrequency (RF), infrared, near-field communications (NFC), and others.

- Based on size, the market is further categorized into ≤3 inches, 3 to 7 inches, 7 to 10 inches, and ≥10 inches. The ≤3 inches sub-segment dominated the market and accounted for the highest share of over 47.0% in 2023.

- Based on application, the global industry has been further categorized into retail and industrial. The retail application segment dominated the market and accounted for the largest revenue share of over 83.0% in 2023.

- The electronic shelf labels market in North America is characterized by the growing popularity of store automation and fluctuations in paper availability due to the high demand for boxes.

Global Electronic Shelf Label Market Report Segmentation

Grand View Research has segmented the electronic shelf label market report on the basis of component, type, communication technology, size, application, and region:

Component Outlook (Revenue, USD Million, 2018 - 2030)

- Displays

- Batteries

- Transceivers

- Microprocessors

- Others

Type Outlook (Revenue, USD Million, 2018 - 2030)

- LCDs

- E-paper Displays

- Graphic E-paper Displays

Communication Technology Outlook (Revenue, USD Million, 2018 - 2030)

- Radio Frequency

- Infrared

- Near-field Communications

- Others

Size Outlook (Revenue, USD Million, 2018 - 2030)

- ≤ 3 Inches

- 3 to 7 Inches

- 7 to 10 Inches

- ≥ 10 Inches

Application Outlook (Revenue, USD Million, 2018 - 2030)

- Retail

- Industrial

Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Southeast Asia

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Curious about the Electronic Shelf Label Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.