Packaging Paper Market Growth & Trends

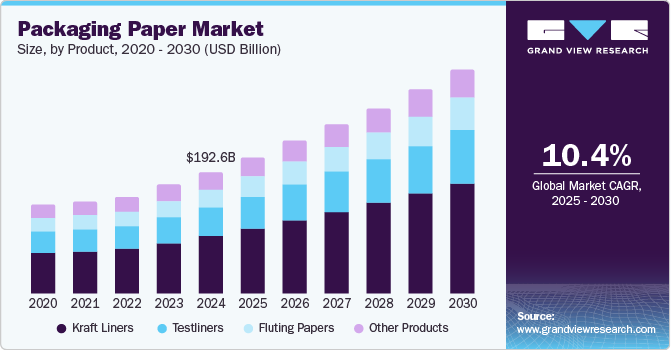

The global packaging paper market size is expected to reach USD 354.53 billion by 2030, as per a new report by Grand View Research Inc. This market is expected to expand at a CAGR of 10.4% from 2025 to 2030 owing to the booming e-commerce industry significantly contributed to the growth of the packaging paper industry. With the rise of online shopping, there is a growing need for protective, lightweight, and sustainable packaging materials. Corrugated boxes and paper-based fillers are widely used in e-commerce shipments, offering durability and cost-effectiveness. As companies like Amazon and Alibaba expand their global logistics networks, the demand for high-quality packaging paper continues to increase.

Governments and private companies are investing heavily in recycling technologies and waste management solutions to support a circular economy. The paper industry is benefiting from improved recycling processes that allow for the production of high-quality recycled paper packaging materials, reducing dependency on virgin pulp.

Advanced paper mills are adopting energy-efficient and water-saving techniques to enhance sustainability while meeting the rising demand. The push for a circular economy is making packaging paper a preferred choice in industries aiming to reduce their carbon footprint and enhance corporate social responsibility initiatives.

Get a preview of the latest developments in the Packaging Paper Market; Download your FREE sample PDF copy today and explore key data and trends

Despite its sustainability benefits, packaging paper has inherent limitations in terms of strength, water resistance, and durability. Unlike plastic or metal packaging, paper-based materials are more prone to damage from moisture, humidity, and rough handling during transit.

This limits its use in certain industries, such as pharmaceuticals and frozen foods, where moisture-proof and airtight packaging is critical. To overcome these limitations, manufacturers are developing coated and laminated paper solutions, but these often come at a higher cost and may reduce recyclability, posing another challenge for widespread adoption.

Innovation in the market is primarily driven by advancements in sustainable materials, barrier coatings, and lightweight yet durable paper solutions. Companies are developing biodegradable and compostable alternatives to plastic-coated papers, using plant-based coatings and water-resistant additives to enhance functionality while maintaining recyclability.

Additionally, digital printing technologies have enabled customization and branding on paper packaging, increasing its appeal to businesses looking for eco-friendly yet visually appealing solutions. While the industry is seeing steady innovation, the challenge remains in balancing cost-effectiveness with sustainability and performance enhancements.

Packaging Paper Market Report Highlights

- Kraft liner dominated the market with 47.4% of revenue in 2024 owing to its high strength, durability, and excellent printability. Moreover, it is primarily used as the outer layer of corrugated boxes, providing structural integrity and protection for goods during transportation and storage. Made from virgin or recycled fibers, kraft liner offers superior resistance to moisture and mechanical stress, making it ideal for heavy-duty packaging applications, especially in industries like e-commerce, food & beverage, and industrial packaging.

- The global market for testliners is expected to experience significant growth with a CAGR of 10.6% from 2025 to 2030. Testliner is a cost-effective alternative to kraft liner, primarily made from recycled fibers and used as an outer or intermediate layer in corrugated board production. While it may not have the same strength as kraft liner, testliner offers good printability and sufficient durability for most packaging applications, making it an ideal choice for industries that require high-volume, lightweight, and budget-friendly solutions.

- In 2024, the Asia Pacific packaging paper market was the largest and fastest growing segment. It was valued at USD 59.67 billion in the global market, fueled by rapid urbanization, expanding e-commerce, and increasing sustainability initiatives. Countries like China, India, and Japan are major contributors, with rising demand for corrugated packaging in consumer goods, electronics, and food industries. Government regulations on plastic reduction and improved recycling capabilities are further propelling the market.

- The North American Packaging Paper market had a 25.3% revenue share in 2024, driven by the rise of e-commerce, sustainability regulations, and increasing demand for recyclable materials. The shift away from plastic packaging, particularly in the food and retail industries, has led to higher adoption of kraft liner, testliner, and specialty paper-based solutions. Large retailers and logistics companies are investing in sustainable packaging, further fueling demand.

Packaging Paper Market Segmentation

Grand View Research has segmented the global packaging paper market based on product and region:

Packaging Paper Product Outlook (Volume, Million Tons; Revenue, USD Million, 2018 - 2030)

- Kraft Liners

- Testliners

- Fluting Papers

- Other Products

Packaging Paper Regional Outlook (Volume, Million Tons; Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- South Korea

- Central & South America

- Brazil

- Middle East & Africa

- Saudi Arabia

Curious about the Packaging Paper Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.