As a tradesman, managing your finances is crucial for the success and growth of your business. However, it can be a daunting task to keep track of expenses, invoices, taxes, and other financial aspects while focusing on delivering high-quality services to your clients. This is where accountants for tradesmen come in. Hiring an accountants for tradesmen who specializes in working with tradesmen can provide numerous benefits that go beyond basic bookkeeping. In this article, we will explore the importance of accountants for tradesmen and how they can help maximize financial efficiency and success.

Understanding the Role of Accountants for Tradesmen

Accountants are professionals who specialize in managing financial records and providing guidance on various financial matters. When it comes to tradesmen, their role extends beyond traditional accounting tasks. They understand the unique challenges faced by tradespeople and have knowledge about industry-specific regulations and deductions.

How Can Accountants Maximize Financial Efficiency?

1. Managing Bookkeeping Tasks

One of the primary responsibilities of accountants for tradesmen is to handle bookkeeping tasks efficiently. They ensure that all transactions are accurately recorded, invoices are issued promptly, and payments are tracked. By taking care of these administrative tasks, accountants for tradesmen free up your time so you can focus on providing excellent services to your clients.

2. Handling Tax Compliance

Tax compliance is a critical aspect that every business owner must adhere to strictly. However, navigating through complex tax laws can be overwhelming without proper expertise. Accountants specializing in trade businesses have extensive knowledge about tax regulations specific to different types of trade professions such as plumbers or electricians.

They ensure accurate calculations of taxes owed while identifying potential deductions that could minimize tax liabilities legally - ultimately saving you money.

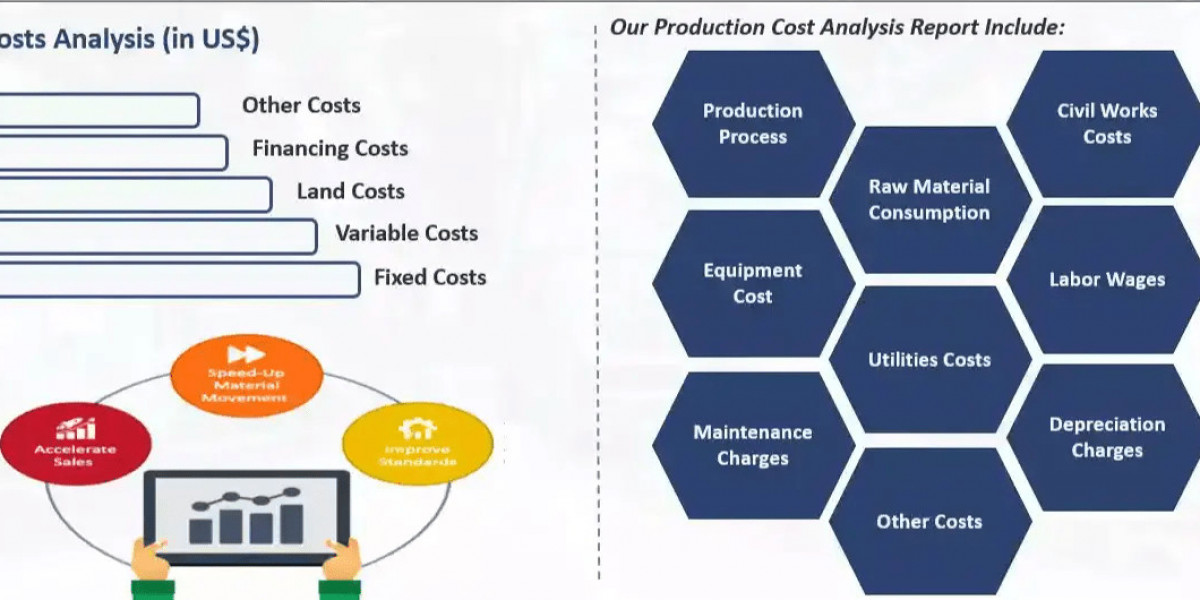

3. Providing Financial Analysis

Understanding the financial health of your business is essential for making informed decisions and planning for the future. Accountants for tradesmen can provide you with detailed financial analysis, including profit and loss statements, cash flow statements, and balance sheets. These reports help you identify areas of improvement, control expenses, and make strategic decisions to maximize profitability.

4. Offering Business Advice

Accountants who specialize in working with tradesmen have a deep understanding of the industry’s dynamics. They can offer valuable insights and advice to help you grow your business efficiently. From pricing strategies to expansion plans, experienced accountants for tradesmen can guide you in making informed decisions that align with your business goals.

Frequently Asked Questions

Q: Do I really need an accountant as a tradesman?

A: While it is not mandatory to hire an accountant as a tradesman, their expertise can significantly benefit your business by ensuring accurate financial records, minimizing tax liabilities, and providing valuable advice.

Q: How do I choose the right accountant for my trade business?

A: When choosing an accountant for your trade business, consider their experience working with similar businesses in the trades industry. Look for certifications such as Certified Public Accountant (CPA) or Chartered Accountant (CA), and check client reviews or testimonials to gauge their reputation.

Q: Can’t I handle my finances on my own?

A: While it is possible to manage your finances independently, hiring an accountant frees up your time so you can focus on delivering high-quality services to your clients while ensuring that all financial aspects are handled accurately by professionals.

Q: Will hiring an accountant be expensive?

A: The cost of hiring an accountant varies depending on various factors such as the complexity of your trade business operations and the level of services required. However, investing in professional accounting services often pays off through minimized tax liabilities and improved financial efficiency.

Q: Can accountants help me with budgeting and forecasting?

A: Yes! Accountants who specialize in working with tradesmen can assist you in creating budgets and forecasts that align with your business goals. They can analyze historical data, industry trends, and market conditions to help you make informed financial decisions.

Conclusion

Managing the financial aspects of your trade business is crucial for long-term success. Accountants for tradesmen specializing in working with tradesmen play a vital role in ensuring financial efficiency by managing bookkeeping tasks, handling tax compliance, providing detailed financial analysis, and offering valuable business advice. By hiring an accountant, you can focus on what you do best while leaving the complexities of finances to professionals who understand the unique needs of your trade business.